- Unhosted Newsletter

- Posts

- Unhosted Weekly #43: August 4th

Unhosted Weekly #43: August 4th

🔁 Buy the Dip or Wait for Further Correction?

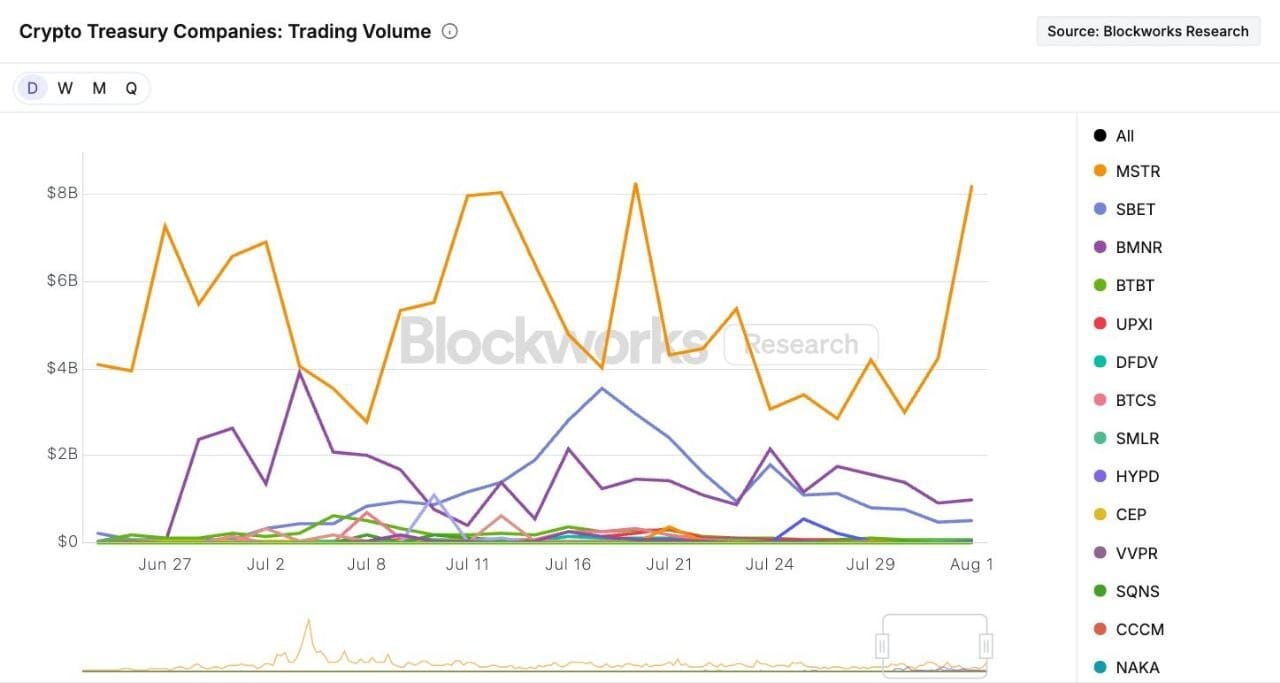

📈 Strategy takes the crown in the crypto treasury game—outshining trad stocks

📊 Markets are now pricing in an 82.1% chance the Fed will slash rates by 25bps at the September 17 meeting.

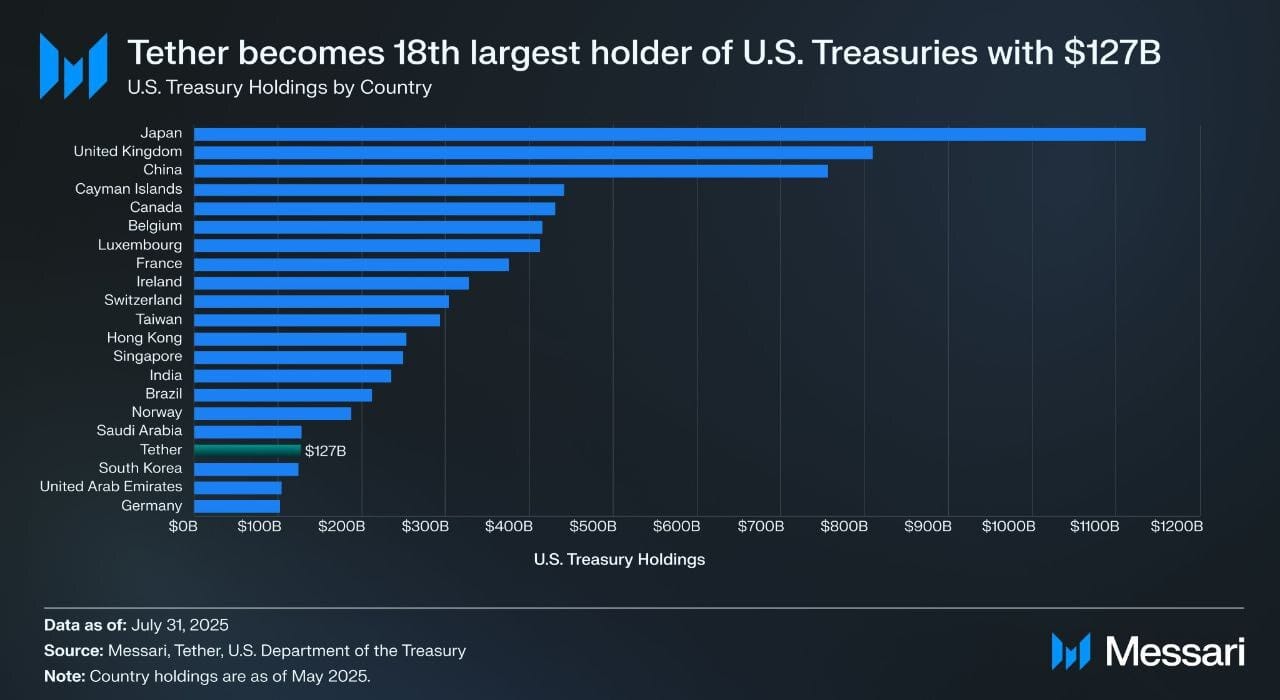

💵 Tether just leapfrogged South Korea to become the 18th largest holder of US Treasury bonds

📉 Kiyosaki’s loving the “Bitcoin August Curse” — says he’ll double down if $BTC drops below $90K

💸 “Get-rich-quick” = you funding someone else’s Lambo

Time to change compliance forever.

We’re thrilled to announce our $32M Series A at a $300M valuation, led by Insight Partners!

Delve is shaping the future of GRC with an AI-native approach that cuts busywork and saves teams hundreds of hours. Startups like Lovable, Bland, and Browser trust our AI to get compliant—fast.

To celebrate, we’re giving back with 3 limited-time offers:

$15,000 referral bonus if you refer a founding engineer we hire

$2,000 off compliance setup for new customers – claim here

A custom Delve doormat for anyone who reposts + comments on our LinkedIn post (while supplies last!)

Thank you for your support—this is just the beginning.

👉️ Get started with Delve

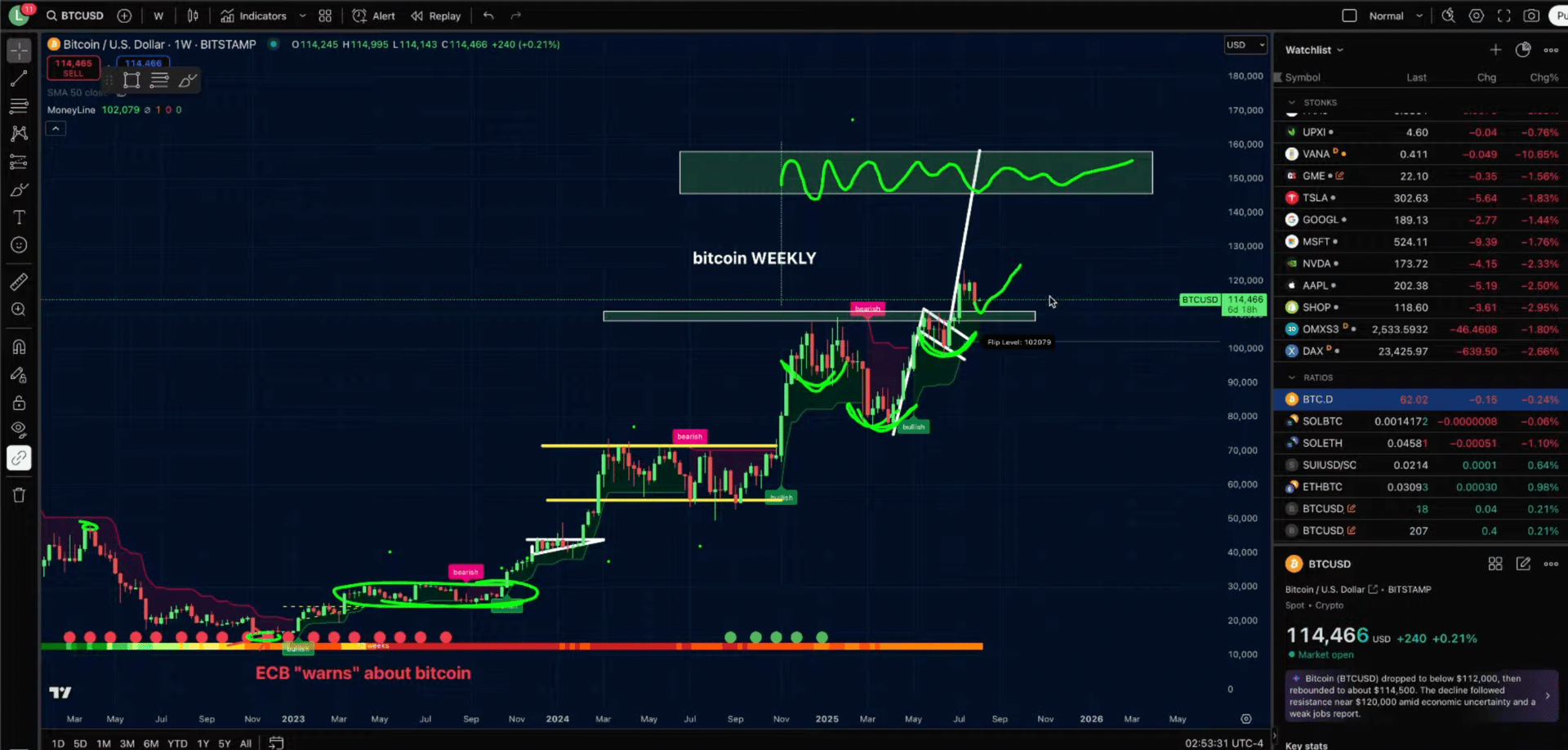

Bitcoin’s “Boring” Retest Is Just What a 150 K Break-Out Needs

How to convert the current wobble into a high-conviction playbook for the next leg up.

TL;DR — The Trade in One Screen-Grab

What’s happening now | Why it matters | Actionable move |

|---|---|---|

BTC retesting 110 K-118 K (prior neckline / inverse H&S) | Text-book “previous resistance ➜ new support.” | Ladder bids from 112 K-110 K. Size for core swing (weeks), not intraday. |

CME gap from July just closed | Gaps act as magnets; once filled, price often resumes trend. | Treat 110 K as invalid-if-lost. Hard stop below 108 K daily close. |

$18-20 B/day of new U.S. debt (Trump fiscal push) | Expanding M2 = more liquidity chasing scarce assets. | Maintain ≥ 50 % of crypto stack in BTC until money-supply slope turns down. |

Fear & PTSD all over CT | No new retail = cycle not topped. | Accumulate while “veterans” panic; unload when Uber driver asks about NFTs. |

1 The Retest No One Wanted—But Bulls Needed

Bitcoin ripped out of a 5-month inverse head-and-shoulders, tagged 118 K, then bled to the exact breakout line.

That’s constructive, not bearish:

Liquidity check: shake weak hands, reload whale bids.

Technical confirmation: trend resumption odds jump once the level holds 2–3 daily closes.

Trade idea:

Stagger entries every $1 000 from 112 K-110 K; ⅓ position size each.

Stop daily close < 108 K. Initial TP 138 K; stretch TP 150 K.

2 Macro Tail-Wind: The $18 B-Per-Day Printer

Trump’s fiscal package implies ~$18–20 B of net new Treasuries every day through mid-2025.

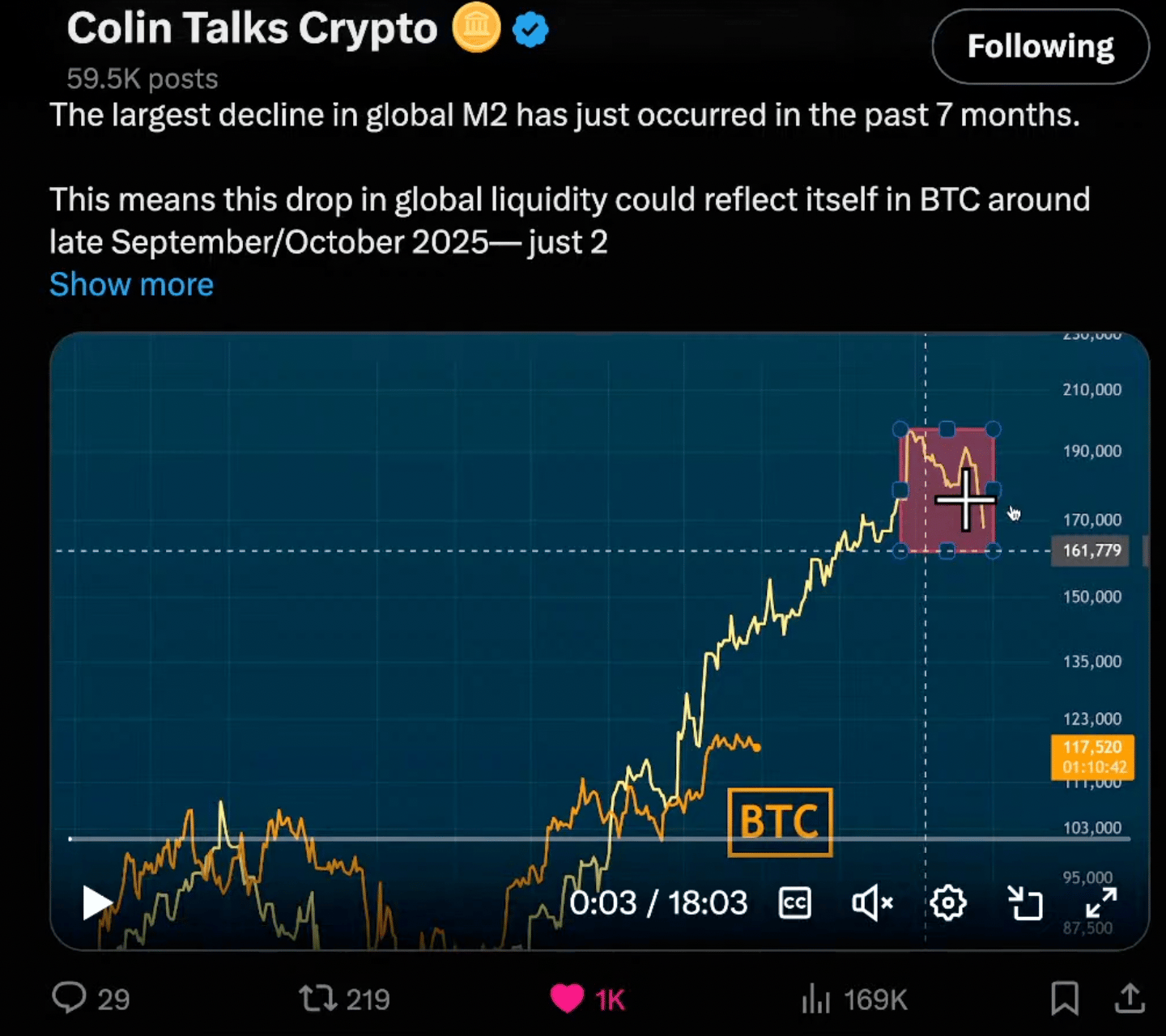

90-day-lagged M2 continues to rise; BTC historically lags that curve by ~3 months.

Bitcoin will catch up with M2 bringing its price to 150k, If it follows it to a T, excpect a correction/hesitation in October.

What to do:

Keep a “liquidity core”: 50 % BTC, 10 % ETH, 10 % SOL/L1 beta, 30 % tactical cash.

Rotate only when the slope of smoothed M2 turns down two months in a row.

3 Portfolio Hygiene: Don’t Let Alts Wreck You

Mini dips in BTC = 20-30 % slaps in small caps.

Rule-of-thumb guard-rails:

≥ 50 % BTC

20 % majors (ETH, SOL, AVAX)

10 % venture/memes

≤ 20 % yield or trading bots (grid-style, delta-hedged)

Grid-Bot Hack

After a red week, redeploy fresh grids (Bonk, Fart, COOKIE) at lower bands.

They buy the dip with leverage while you sleep—but always watch liquidation distance.

4 Why Solana Metrics Still Matter

Active addresses up 7× YoY (from 10 M → 70 M)

Throughput target: double every two years per Moore’s-Law mandate.

If SOL keeps absorbing new use-cases (DePIN, true-on-chain order books) while ETH soaks up TradFi, you want exposure to both.

Stack strategy:

Add SOL on sub-$160 wicks.

Restake via Jito / Marinade; airdrop season isn’t over.

Keep ETH in liquid-staking derivatives (LS-ETH) to capture yield while spot grinds.

5 Institutional Bid: MicroStrategy, MetaPlanet & Friends

MicroStrategy keeps refinancing to buy.

MetaPlanet (Japan’s “micro-micro-strategy”) used Friday’s dip to add.

Marker to watch ➜ failed capital raises. When Sailor stops being able to sell converts, liquidity may be drying.

6 CME Gaps & Sentiment Gauges

November ’23 CME gap closed → +70 % rally followed.

July ’25 gap now closed.

Twitter sentiment index (0-100): sitting at 38—fearful, not euphoric.

Translation

No blow-off yet. Blow-offs end cycles; fear rarely does.

7 Security PSA—Revoke Old Approvals

A year-old phishing approval just drained a whale.

If you use Metamask or any EVM wallet:

Visit revoke.cash

Clear stale token approvals

Hardware-sign large transfers

Five minutes; saves a portfolio.

8 Playbook Cheat-Sheet

Time-Frame | Trigger | Trade | Risk Control |

|---|---|---|---|

Swing (3-8 wks) | Daily close 110-112 K support | Long BTC → 138 K/150 K | Hard stop 108 K close |

Position (2-6 mths) | ETH/BTC weekly > 0.06 | Rotate 15-25 % BTC → ETH | Hedge w/ 0.05 puts |

Event-Driven | MSTR convert fails / auction weak | De-risk ⅓ alt book to cash | N/A |

Macro Hedge | M2 2-month slope turns down | Raise cash to 40 % | Tight trailing on winners |

Bottom Line

Ignore the PTSD chatter. A vanilla breakout-retest is setting the stage for a thrust toward 145-150 K. Size rationally, automate exits, and double-check those old token approvals—so you can enjoy the next leg up instead of fighting your own wallet.

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply