- Unhosted Newsletter

- Posts

- Unhosted Weekly #45 - August 18th

Unhosted Weekly #45 - August 18th

🎯 Bitcoin’s Big Week

🤔 What’s the next move, Bitcoin… ?

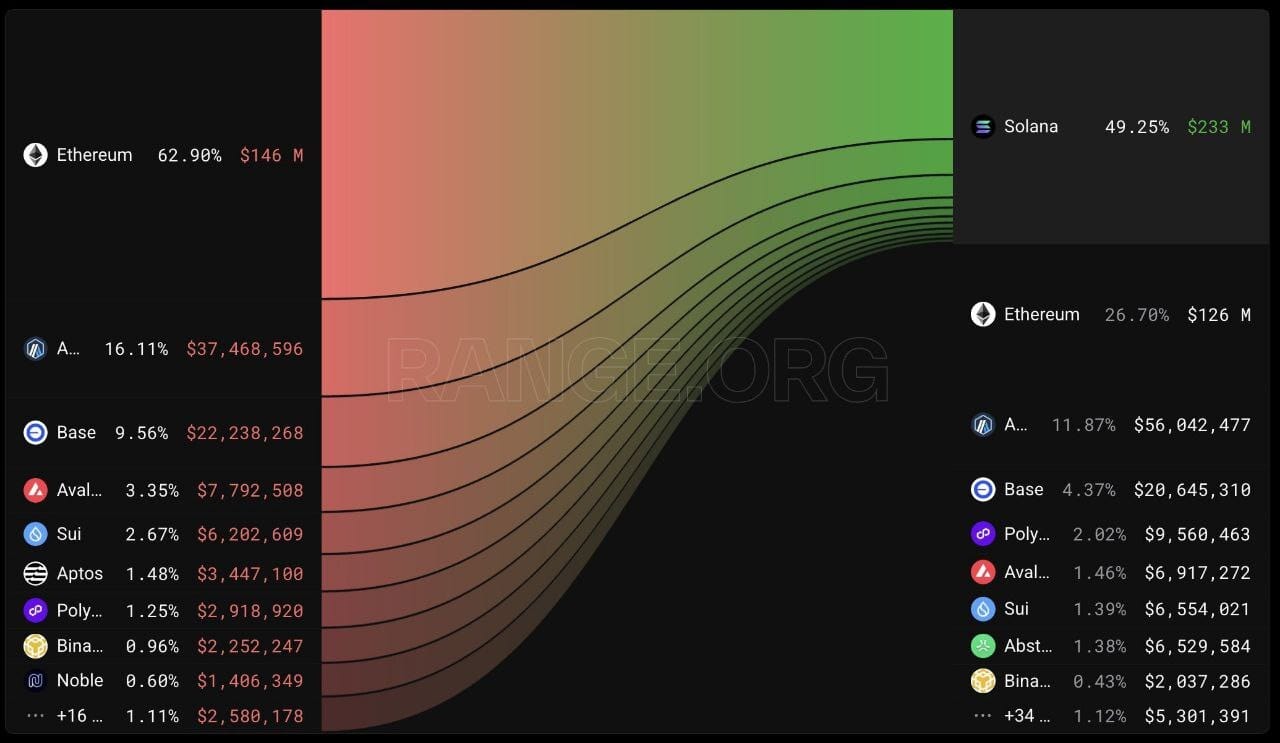

🌊 Solana soaked up $230M inflows in 7d — with $146M bridging from Ethereum alone

🚀 What if you stacked $10 of BTC daily for the last 10 years?

🇹🇭 Thailand just went full degen-friendly

🚀 Metaplanet bags more BTC

💸 Digital asset funds pulled in $3.75B last week

Crypto Dump, Cleaned Up: Two-Day Recap & Next-Week Trader Playbook

TL;DR

Bias: Neutral → cautious until BTC reclaims $118k and ETH reclaims $4,350–4,450 with momentum.

BTC levels: Support $112k → $110k → $100k. Resistance $117–118k → $120–121k → $128k.

ETH levels: Support $4,200 → $4,000 → $3,950–3,800. Resistance $4,350 → $4,450–4,480 → $4,600–4,800.

Positioning: Leverage flushed; funding/froth cooled. Expect whipsaws; trade the levels, not the headlines.

Strategy: Scale in at supports with tight invalidations; fade first test of resistance; keep hedges/live stops into data & Fed speak.

What Just Happened (digestible drivers)

Macro wobble: Hotter inflation prints and tougher rate-cut odds hit risk assets. Liquidity expectations cooled → crypto corrected.

Profit-taking: After the run-up, spot ETF flows/whales took chips off the table. Overhang created at recent highs.

Leverage washout: Long liquidations accelerated selling; OI/funding reset = cleaner field but near-term choppy tape.

Tech fatigue: BTC failed above ~120–124k; ETH rejected sub-4.5k. Broken short-term structures now act as resistance.

Bitcoin (BTC) — Tactical Map

Structure right now: Post-dump range between $112k–$118k; air-pocket below $116k still sticky.

Supports to buy (with tight risk):

$112k (polarity level). Invalidation: sustained < $111.5k.

$110k (edge of low-liquidity gap). Invalidation: clean 4h close below.

$100k (psychological; last-ditch higher-timeframe support).

Resistances to sell/fade:

$117–118k (recent breakdown area + short-term MA cluster).

$120–121k (range high / fib confluence).

$128k+ (only on strong momentum reclaim).

Actionable setups:

Range trade: Buy $112k–$110k, stop 0.8–1.2% below, first take-profit $117–118k, leave a runner for $120–121k.

Break-retest-go: Long only on 4h/daily close > $118k, retest holds → target $120–121k, then $128k.

If $112k fails: Stand down; look for absorption near $110k or capitulation wick toward $100–105k for a reaction long.

Ethereum (ETH) — Tactical Map

Structure right now: Key line in the sand is $4,200; losing it opens $4,000 quickly.

Supports to buy (with tight risk):

$4,200 (liquidity cluster). Invalidation: clean daily close below.

$4,000 (round number + prior demand).

$3,950–3,800 (HTF demand / MA stack).

Resistances to sell/fade:

$4,350 (20-day EMA/VWAP region).

$4,450–4,480 (recent swing high supply).

$4,600–4,800 (momentum extension only).

Actionable setups:

Defense of $4,200: Probe long with 1–1.5% stop; take profit into $4,350, keep runner to $4,450.

Squeeze trigger: 4h/daily close > $4,450 → shorts can unwind quickly; target $4,600–4,800; trail stops tight.

If $4,200 breaks: Don’t knife-catch; wait for 1) reclaim of $4,200 or 2) reaction long at $4,000 / 3,950–3,800.

Derivatives & Sentiment Snapshot (what to do with it)

Funding: Normalized/turned negative in spots → less froth, easier for bounces to stick.

Open Interest: Down from highs → cleaner tape; but also less fuel unless fresh longs arrive.

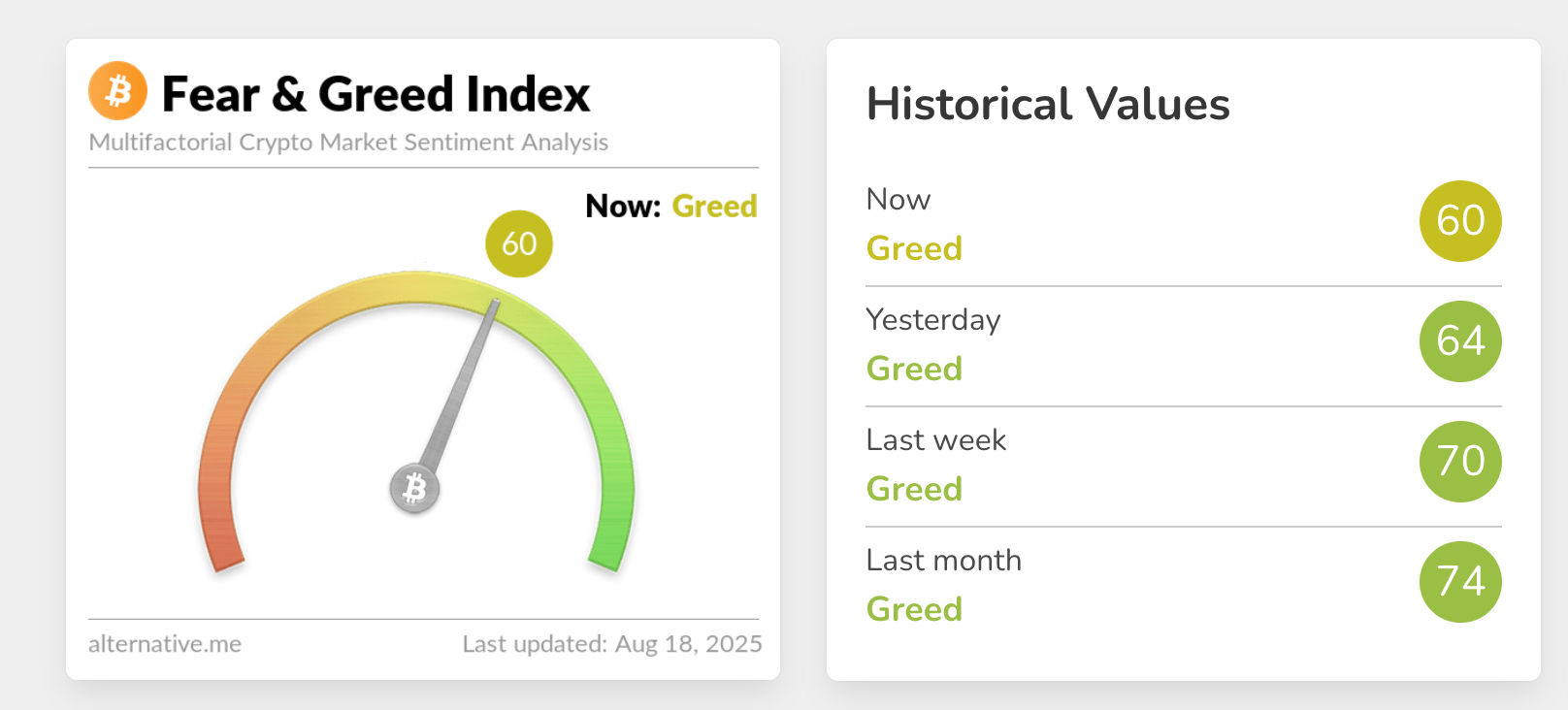

Greed/Fear: Off euphoric highs → neutral/greed. Not capitulation, but better than peak greed.

Trader use: Favor mean-reversion edges (support buys / resistance fades). Demand confirmation before momentum longs.

Week-Ahead Playbook (how to prep)

Catalyst calendar: Track inflation, jobs, and any Fed speak. Into events: trim leverage, hedge, or lighten.

Validation signals for risk-on:

BTC daily close > $118k and ETH > $4,350 (ideally both).

Funding stays flat-to-negative while price grinds up = constructive.

Exchange outflows persist; whale accumulation on dips.

Risk triggers to respect:

BTC < $112k daily close or ETH < $4,200 daily close → tighten risk, expect lower supports to test.

Liquidity vacuums (fast moves through $116–112k BTC / $4.3–4.2k ETH) → don’t fight the tape; wait for wicks/absorption.

Bottom Line

The dump cleaned up leverage but didn’t break the higher-timeframe bull trend.

Until BTC > $118k and ETH > $4,350–4,450, assume chop and play the range.

Keep positions smaller, stops tighter, and let levels (not opinions) lead your next trade.

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply