- Unhosted Newsletter

- Posts

- Unhosted Weekly #46 - August 25th

Unhosted Weekly #46 - August 25th

Healthy Correction 💊

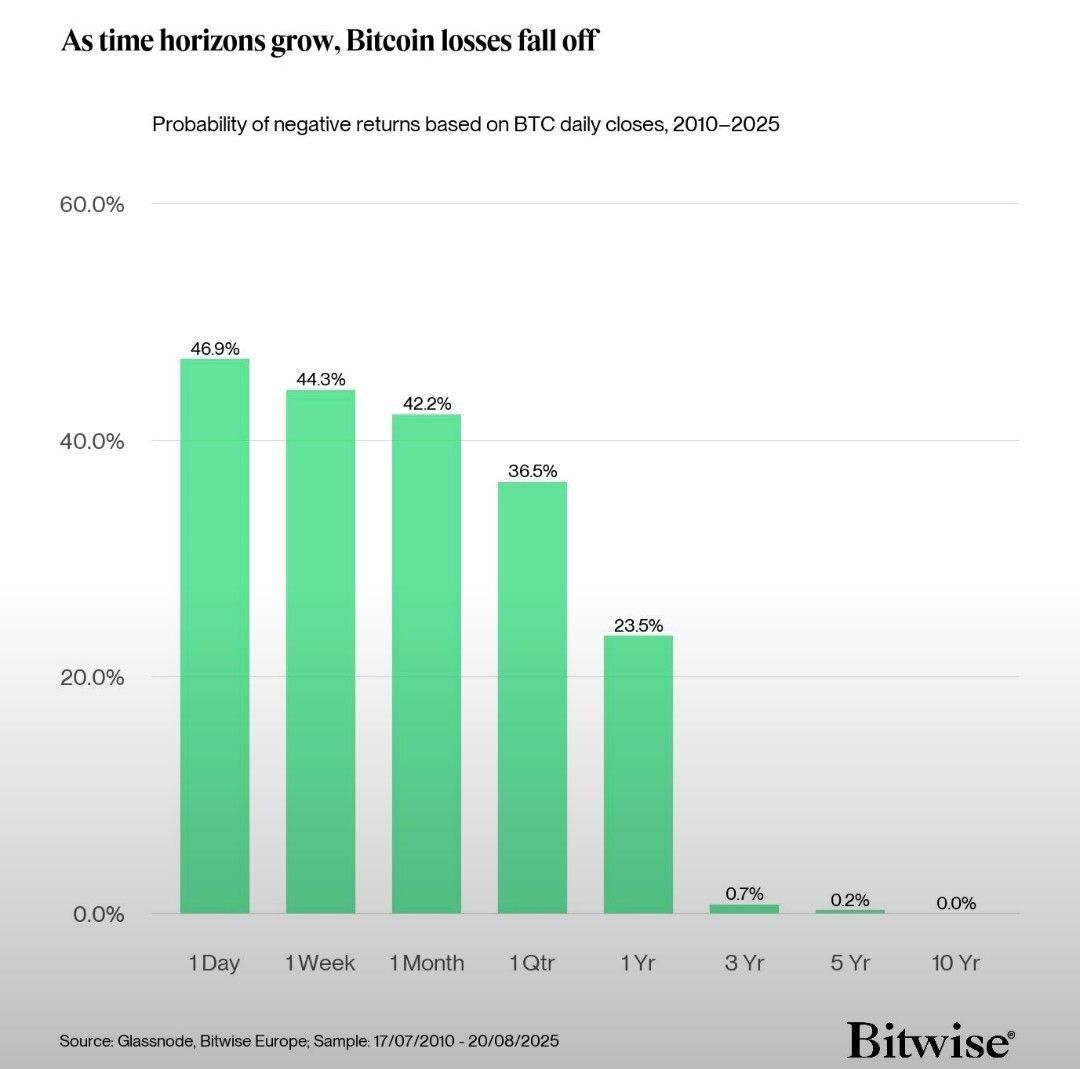

📉 BTC Risk Check → Chance your Bitcoin bags go red depends on how long you hold

💎 Ethereum just flipped Mastercard — now sitting as the 22nd most valuable asset on Earth

🐳 MicroStrategy flex: holding 12× more BTC than the next closest corporate bagholder

🔒 Long-term bullish vibes locked in

Probably pumping his own bags :)

🟧 Bitcoin’s door is always open — step in

Bitcoin’s “Boring Retest” Sets the Stage for $150K

How to turn panic dips into conviction plays.

What’s happening now

BTC retesting $110K–$118K breakout zone

Weekend whale unloaded 24K BTC (classic Sunday dump)

Why it matters

Textbook retest: old resistance ➜ new support

Fear everywhere = not a cycle top

Global liquidity (M2) ticking higher = firepower for Q4

Actionable move

Ladder bids: $112K–$110K

Hard stop: daily close < $108K

TP zones: $138K ➜ $150K

1. The Retest No One Wanted—But Bulls Needed

Bitcoin ripped to $118K, then bled back to its breakout neckline.

Liquidity check: shakeouts, weak hands flushed

Sunday whale dump: 24K BTC dropped in low-liquidity hours

Outcome: Market already reabsorbing — constructive, not bearish

Trade idea: Scale in from $112K down to $110K.

Stop: < $108K daily close.

Target: $138K–$150K.

2. Macro Tailwind: The $18B-Per-Day Printer 🖨️

Trump’s fiscal plan = ~$18–20B daily Treasury issuance.

Expanding M2 = more liquidity chasing scarce assets

BTC historically lags M2 by ~3 months

Play: Keep ≥50% of crypto stack in BTC until M2 slope turns down 2 months straight.

3. Sentiment Check: PTSD Everywhere

Fear index ≈ 47 (not euphoric, far from cycle top)

CT screaming “bear market” = actually bullish contrarian

Veterans panicking while new retail isn’t even here yet

Translation: Tops form on euphoria. We’re nowhere near.

4. September FUD ≠ End of Cycle

Historically September = weak for BTC

But this is the final phase of the 4-year cycle → silly season

Bob Lucas: best rallies come when most are skeptical

So while mid-curvers hedge themselves to death, dumb bulls (buy every dip) will likely win this phase.

5. Whale Watch 🐋

MicroStrategy keeps refinancing to stack sats

MetaPlanet (Japan’s “mini-Sailor”) adding dips

Grant Cardone shook by his first Sunday dump — welcome to Bitcoin, Grant

Playbook Cheat-Sheet

Swing (3–8 wks): Long BTC from $110K → $150K, stop $108K

Position (2–6 mths): Hold ≥50% BTC core, rotate later into ETH/SOL

Event-driven: Watch MSTR raises — failed convert = warning sign

Macro hedge: Cash up only when M2 slope flips negative

Bottom Line

Ignore the noise. BTC’s “boring” retest is fuel, not failure.

$150K is still on the table — size smart, automate exits, and clean your wallet approvals before the next leg up. 🚀

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply