- Unhosted Newsletter

- Posts

- Unhosted Weekly #51 - September 29th

Unhosted Weekly #51 - September 29th

🔄 October Outlook

🐳 Saylor did it again: 196 BTC scooped for $22.1M at ~$113K each

🎯 In 2025, 5 solo BTC miners each hit a full block and bagged $350K+

🐱 Hyperliquid just airdropped 4,600 Hypurr NFTs to users: Floor price? 1,479 $HYPE (~$68K) per token

🚨 SEC told issuers of $LTC, $XRP, $SOL, $ADA & $DOGE ETFs to pull their 19b-4 filings

📊 TODAY: Fear & Greed Index climbed from 😨 37 (fear) → 😐 50 (neutral)

Pumptober Playbook: How to Trade Bitcoin’s Best Month Without Getting Wrecked

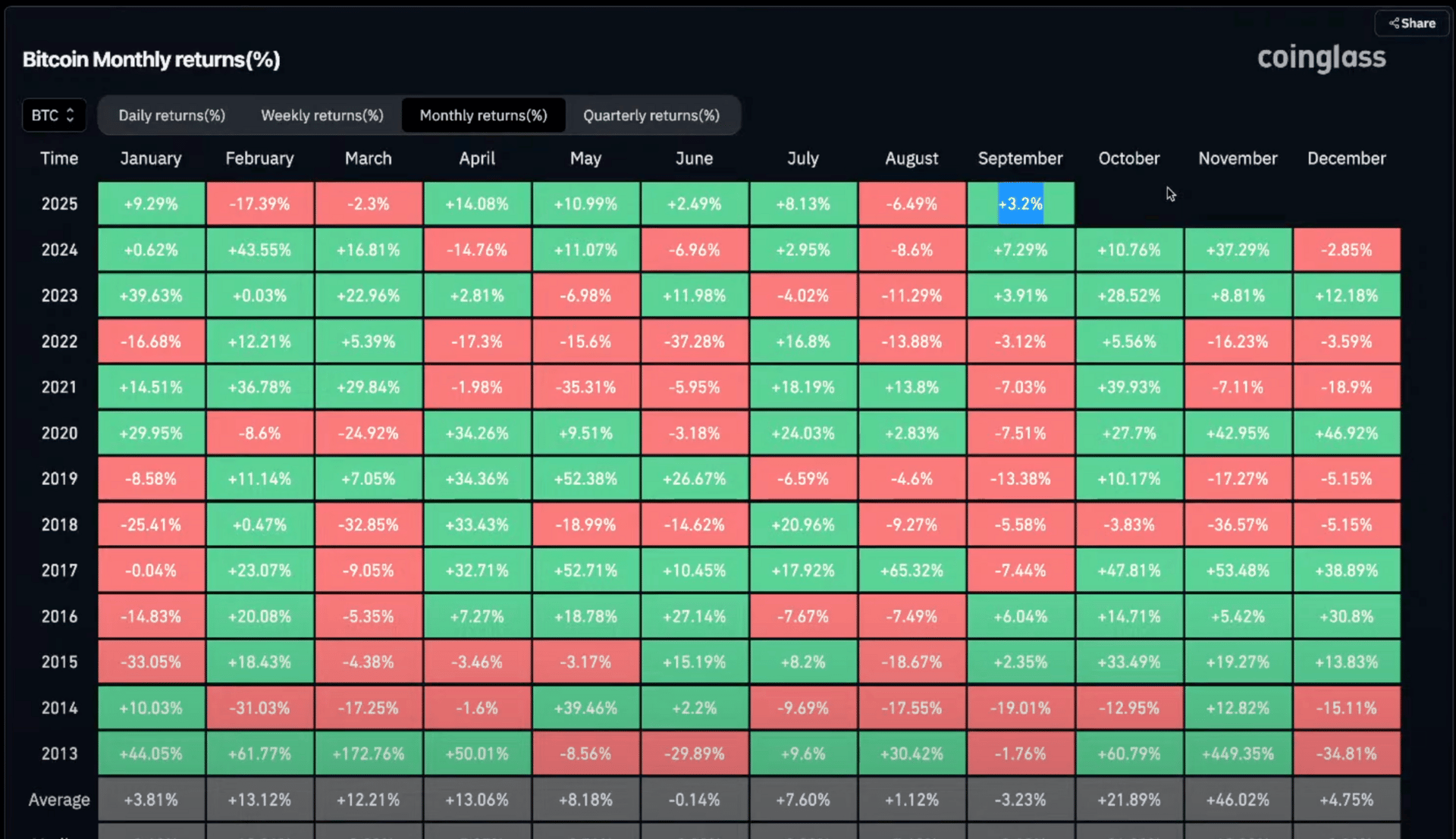

October (“Uptober” / “Pumptober”) has a strong track record—especially in the final year of the four-year cycle. But most traders still get chopped up. Why? Impatience, over-leverage, and ignoring how October usually unfolds.

Here’s a crisp game plan to capture the move without blowing up in the first two weeks.

TL;DR

Expect a slow start. The big October move often arrives mid → late month, not on Oct 1.

Plan for a shakeout. Early-October dips of –8% to –15% have happened (e.g., 2023).

Base case: Chop/range early → breakout later. Position gradually, don’t 100x FOMO.

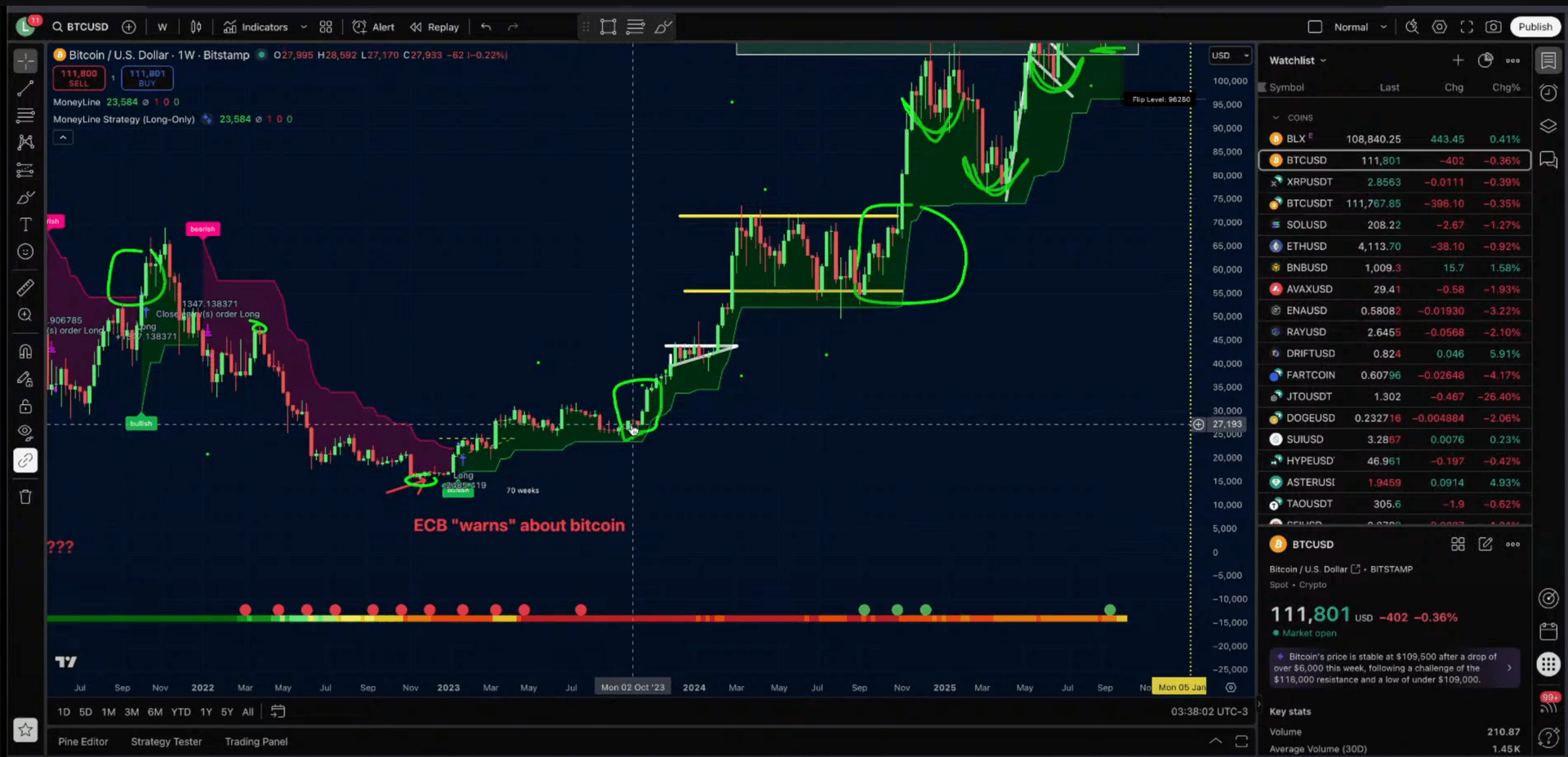

Invalidation: If BTC loses the 104k weekly trend threshold (your “bear flip”), de-risk.

Targets: A typical green October lands +10% to +50%. If November also prints, ~200k by year-end becomes feasible—not guaranteed, but within historical bounds.

Alts: Usually lag BTC early, then follow on late-Oct / Nov strength. Size accordingly.

Why Pumptober Wrecks Traders

Timing Illusion

A month has ~30 days. Historically, the expansion comes mid/late October, not Day 1. In 2023, we saw an initial pop, a two-week flush (28k → 26k), then the run. In 2021, we got an early pop—but that’s the exception, not the base case.Leverage + Impatience

Traders front-run Oct 1 with high leverage, get chopped or liquidated in the early range, then miss the actual move.Sentiment Whiplash

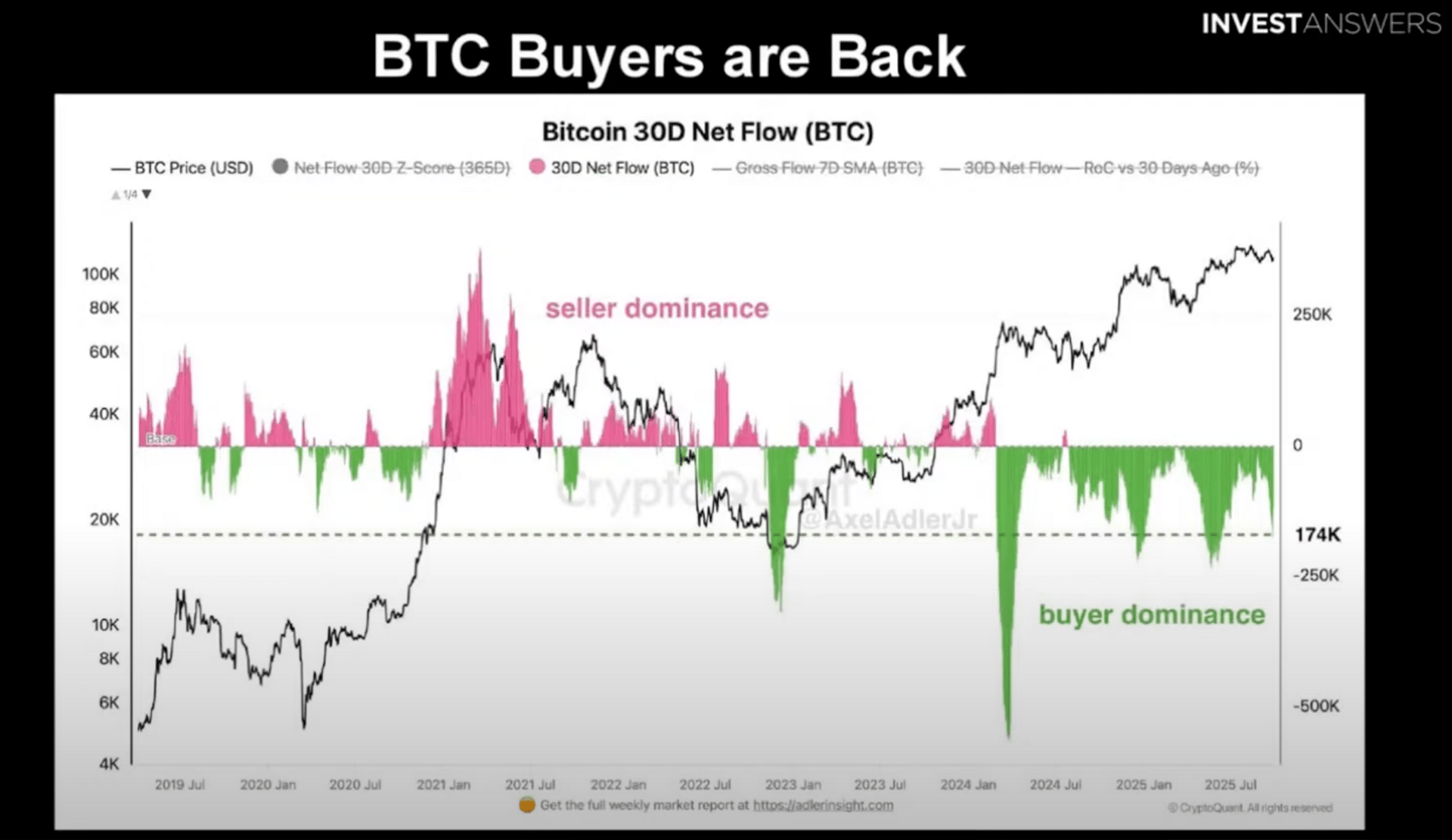

A routine –10% dip (e.g., 124k → 108k last week) sent fear gauges into the 30s. That panic often precedes the next leg up, not a new bear.

The October Map (3 Scenarios)

1) Base Case: “Chop → Breakout”

Weeks 1–2: Range, fakeouts, liquidation hunts.

Weeks 2–4: Breakout attempt(s) and trend continuation.

How to trade it:Ladder in on red days; don’t all-in green candles.

Keep core spot plus a modest swing long; add only on strength (break/close above prior range).

Protect with a hard invalidation (see below).

2) Fast-Track: “Early Pop” (rarer, like 2021)

Week 1: Impulsive breakout that never looks back.

How to trade it:Use momentum triggers (e.g., day close above range high) to add.

Trail stops. Don’t fight strength with shorts.

3) Fakeout/Flush: “Pump → Dump → Real Move” (like 2023)

Week 1: Quick pop, then ~2 weeks lower.

How to trade it:Pre-place bids in the high-confluence support zone (see levels below).

Watch funding/sentiment wash out → scale in, then ride the later October recovery.

Levels & Invalidation

Key support zone: 108k–110k (recent flush low cluster).

Major invalidation: 104k (weekly “bear flip”/trend break). If weekly closes below, de-risk.

Near resistance: Recent supply around 124k. A strong daily/weekly close above suggests trend continuation.

Discipline rule: If weekly closes beneath 104k, accept the signal, reduce risk, and wait for the system to flip back. No heroics.

Positioning Framework (Pick One & Stick to It)

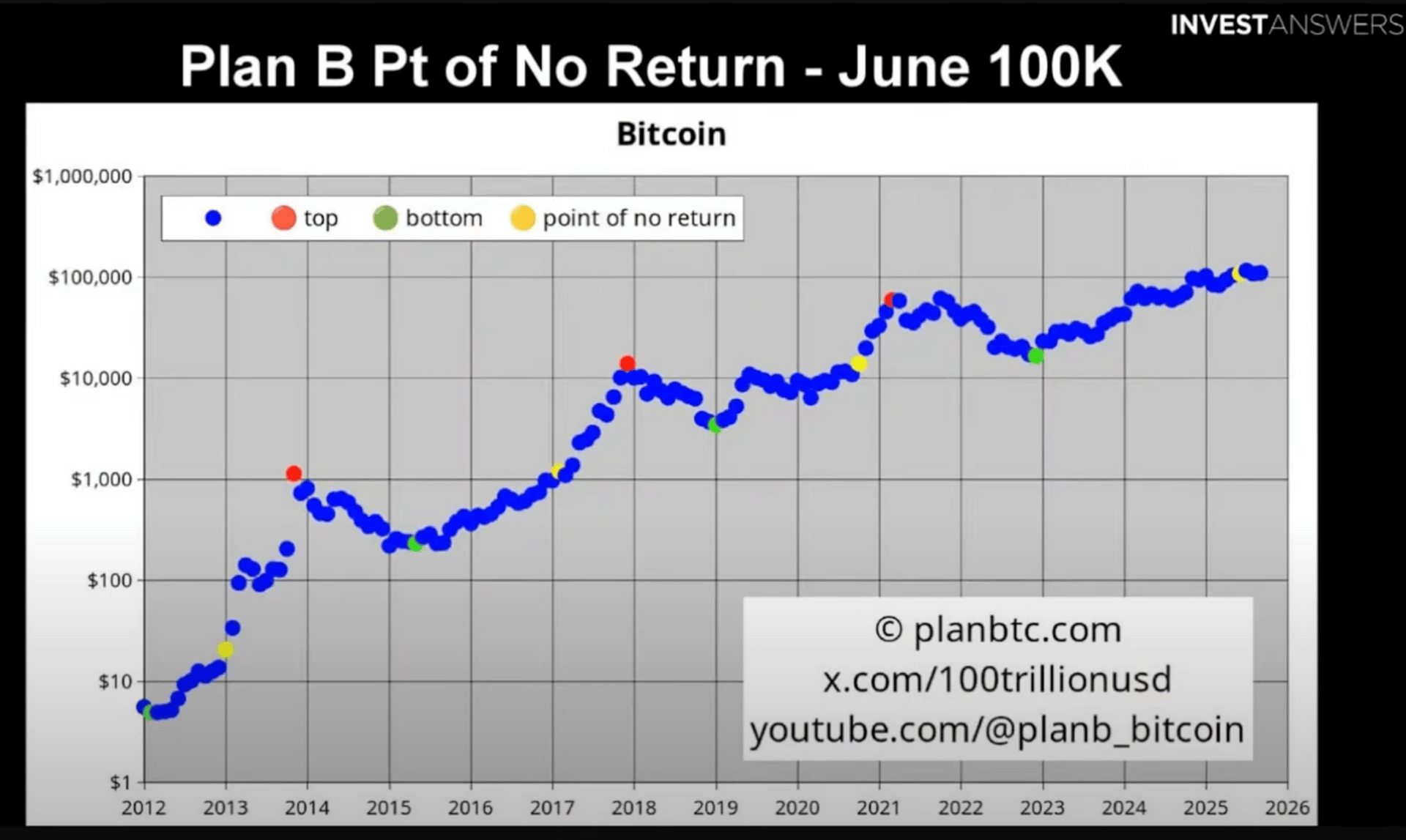

According to Plan B - the point of no Return is at 100k.. Will we never see bitcoin bellow 100k ever again?

A) Core + Adds (Swing/Investor)

Core spot position sized for volatility you can stomach.

Add on strength: Only when daily/weekly closes reclaim resistance (e.g., >124k).

Trim into vertical moves (scale out 10–25% at a time).

Re-buy dips to prior breakout levels if trend remains up.

B) Bracketed Range Trader (Short-Term)

Place stink bids at 108–110k with stops just below your invalidation.

OCO orders: profit targets staged at resistance (121–124k, then higher).

If stopped, don’t revenge trade. Wait for fresh structure.

C) System-Only (No Predictions)

Trade the weekly trend system (“money line”):

Long while weekly is bullish.

Flat/Hedge on a weekly bear flip (<104k).

No gut feelings. No exceptions.

Sizing, Leverage & Risk

Leverage: Keep it modest (2–5x max) or avoid entirely. Uptober ranges hunt liquidations.

Risk per idea: 0.5–1.5% account risk per trade is plenty in crypto.

Stops: Pre-commit to your invalidation before entering. Move stops only to lock gains, never to “hope.”

Altcoin Timing (Don’t Front-Run)

BTC leads. Alts usually lag in early October, then accelerate late October → November if BTC confirms.

Allocate in tranches:

1/3 now (if charts are constructive),

1/3 on BTC breakout confirmation,

1/3 on clear alt breadth expansion (multiple majors breaking out together).

Cut underperformers quickly; keep relative strength.

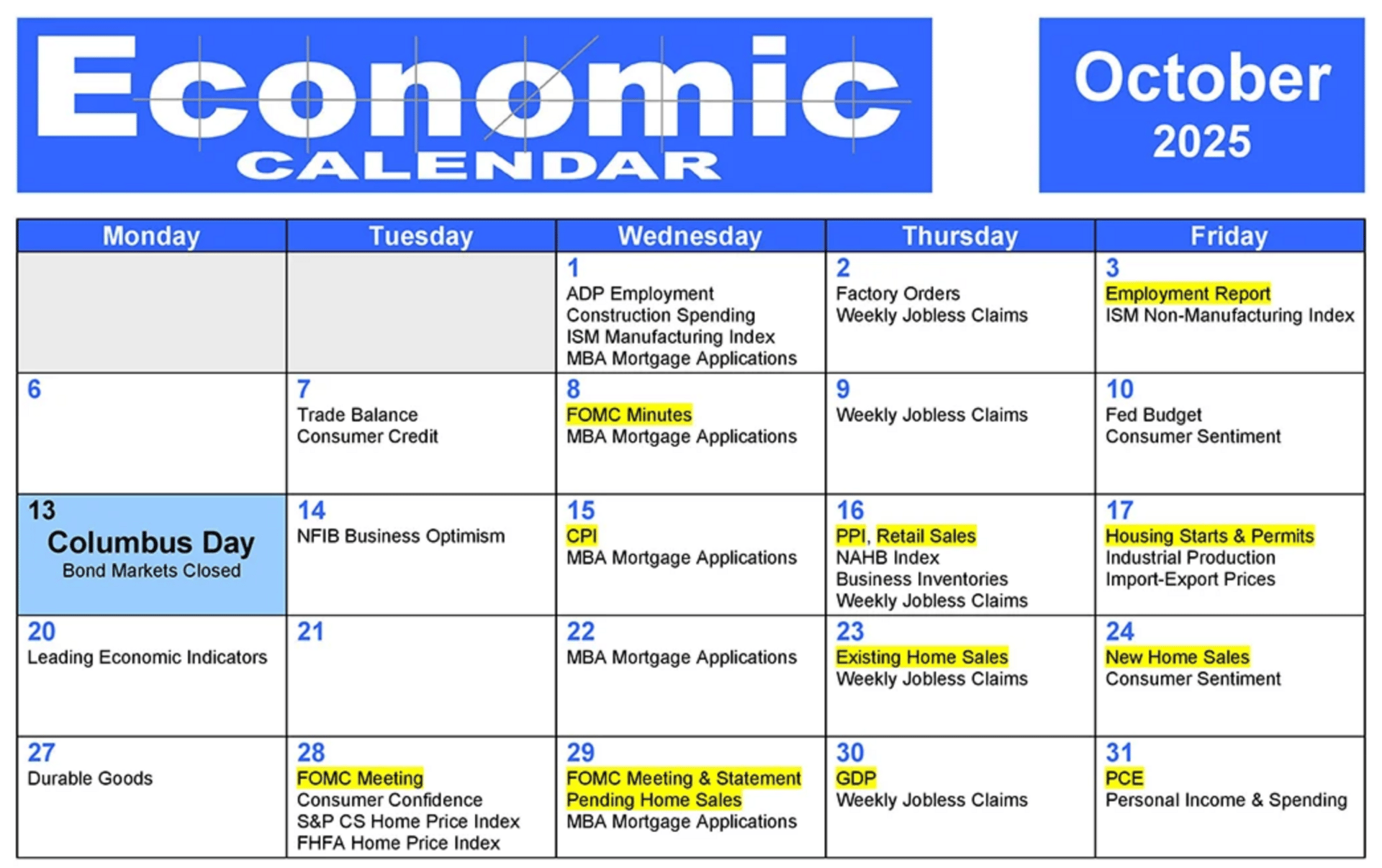

Event & Sentiment Triggers to Watch

Macro policy meetings: Don’t oversize into the announcement candle. Let the first 15–60 minutes play out.

Funding & OI spikes: If funding rips while price stalls → risk of a squeeze down first.

Sentiment extremes: Fear <35 on routine dips often = opportunity in uptrends.

Weekly close: The single most important candle for trend health.

Probabilistic Targets (Not Promises)

If September closes green (it is), October historically skews green too. Past green Octobers ranged +10% to +50%. If November also prints (as in several prior cycles), reaching the high-100ks by year-end becomes plausible. It’s not guaranteed—your invalidation governs your risk, not a target.

Final Word

October’s edge is real—but the timing often isn’t Day 1. Survive the first half; harvest the second. Keep leverage sane, let the weekly trend lead, and be the trader who still has ammo when Pumptober actually arrives.

Stay sharp. Manage risk. Let the market pay you for patience.Pumptober Playbook: How to Trade Bitcoin’s Best Month Without Getting Wrecked

October (“Uptober” / “Pumptober”) has a strong track record—especially in the final year of the four-year cycle. But most traders still get chopped up. Why? Impatience, over-leverage, and ignoring how October usually unfolds.

Here’s a crisp game plan to capture the move without blowing up in the first two weeks.

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply