- Unhosted Newsletter

- Posts

- Unhosted Weekly #52 - October 6th

Unhosted Weekly #52 - October 6th

Runway to $150K ✈️

👑 $BTC just locked in its highest weekly close ever — new chapter, same king

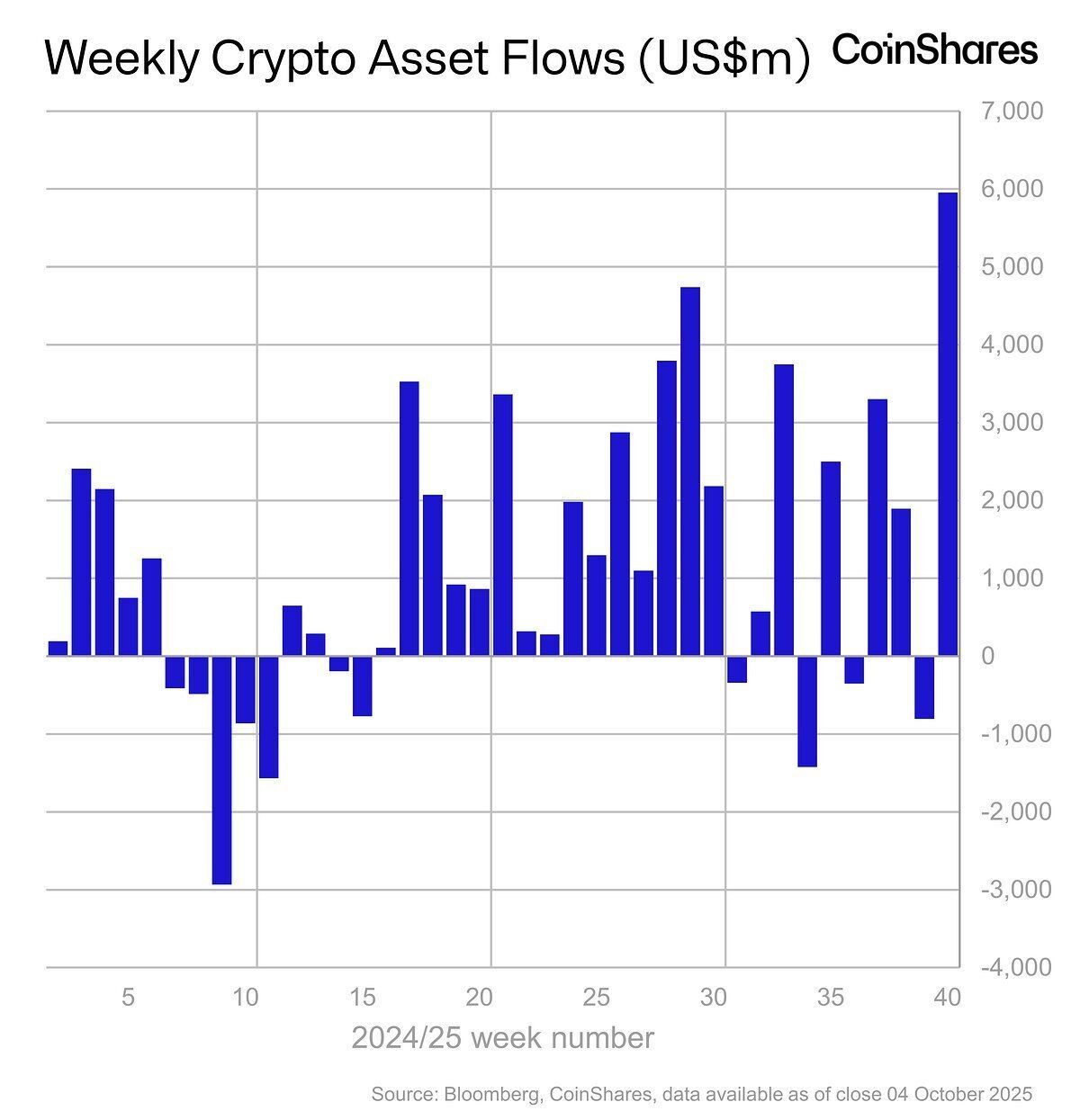

🚀 Digital asset funds pulled in a record-breaking $5.95B last week — biggest inflow ever

⚡️Grayscale just dropped the first spot staking ETPs for $ETH and $SOL in the US — staking goes mainstream

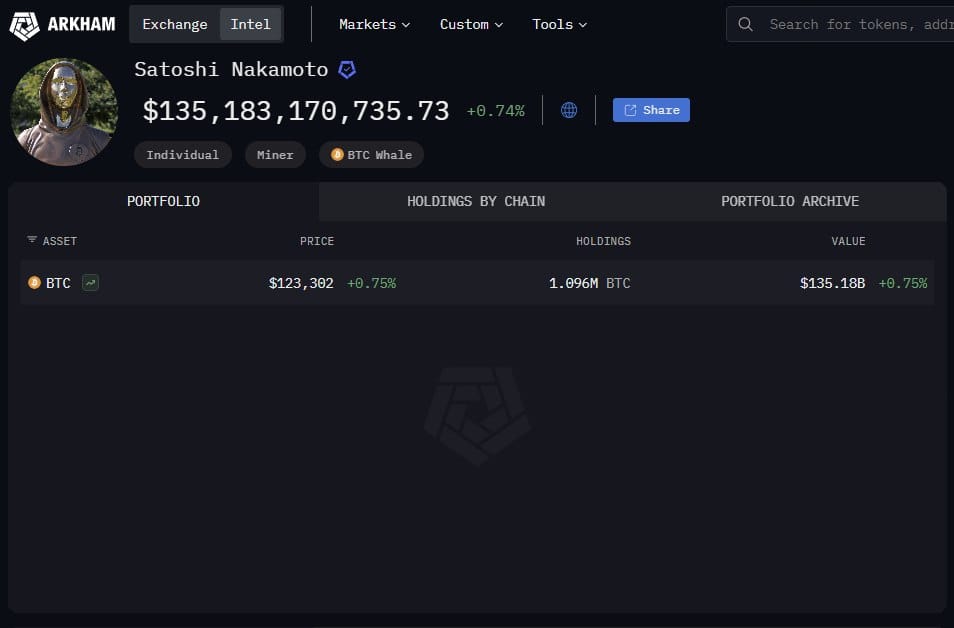

🧙♂️Satoshi’s wallet just topped $135B — making the ghost of Bitcoin the 9th richest person on Earth

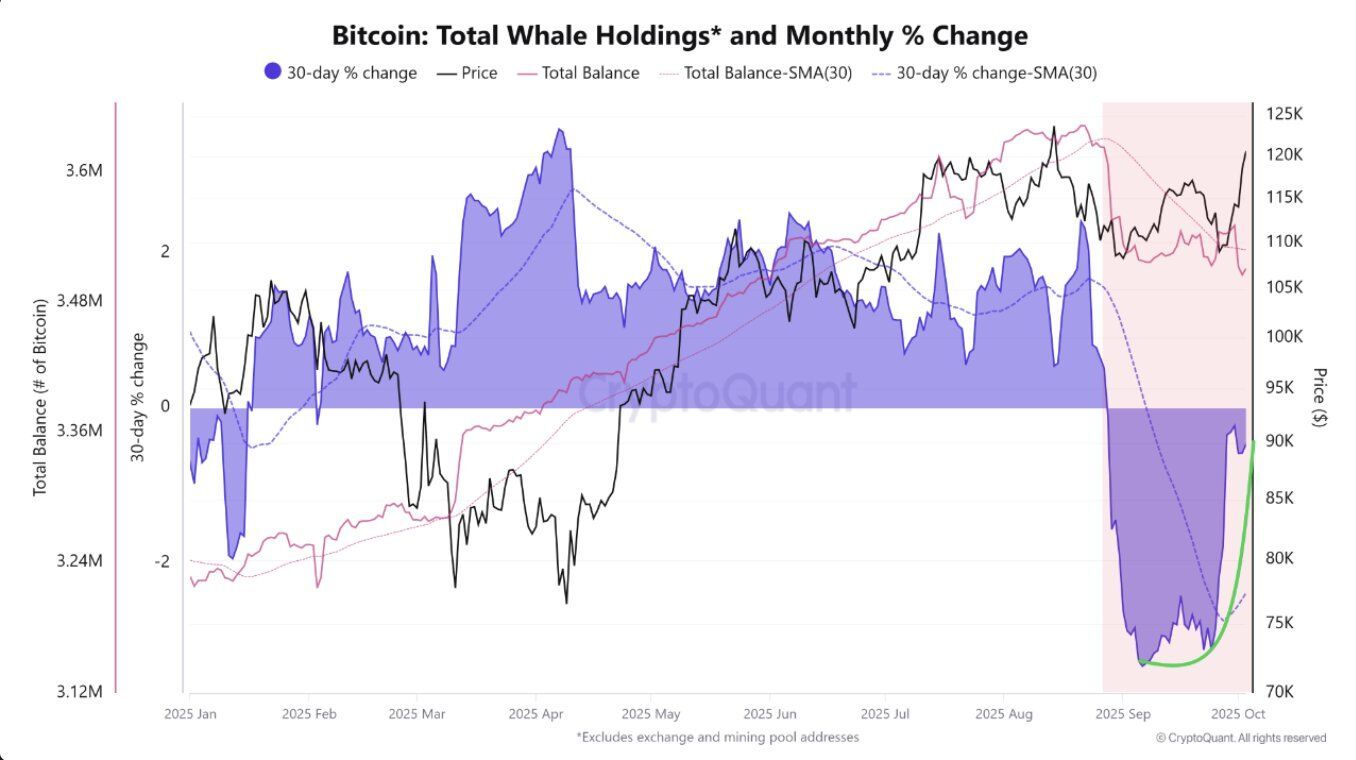

🐋 Whale sell pressure is cooling off — signs point to a re-accumulation phase starting up, per CryptoQuant

🚀 Bitcoin’s Weekly All-Time High: What Comes Next

Bitcoin just printed its highest weekly close in history — the candle everyone’s been waiting for finally landed, and it’s green enough to make a leprechaun jealous.

Price briefly pushed into new-all-time-high territory before cooling off slightly into the close, confirming one thing: the consolidation that’s been cooking since July has officially blown the lid off.

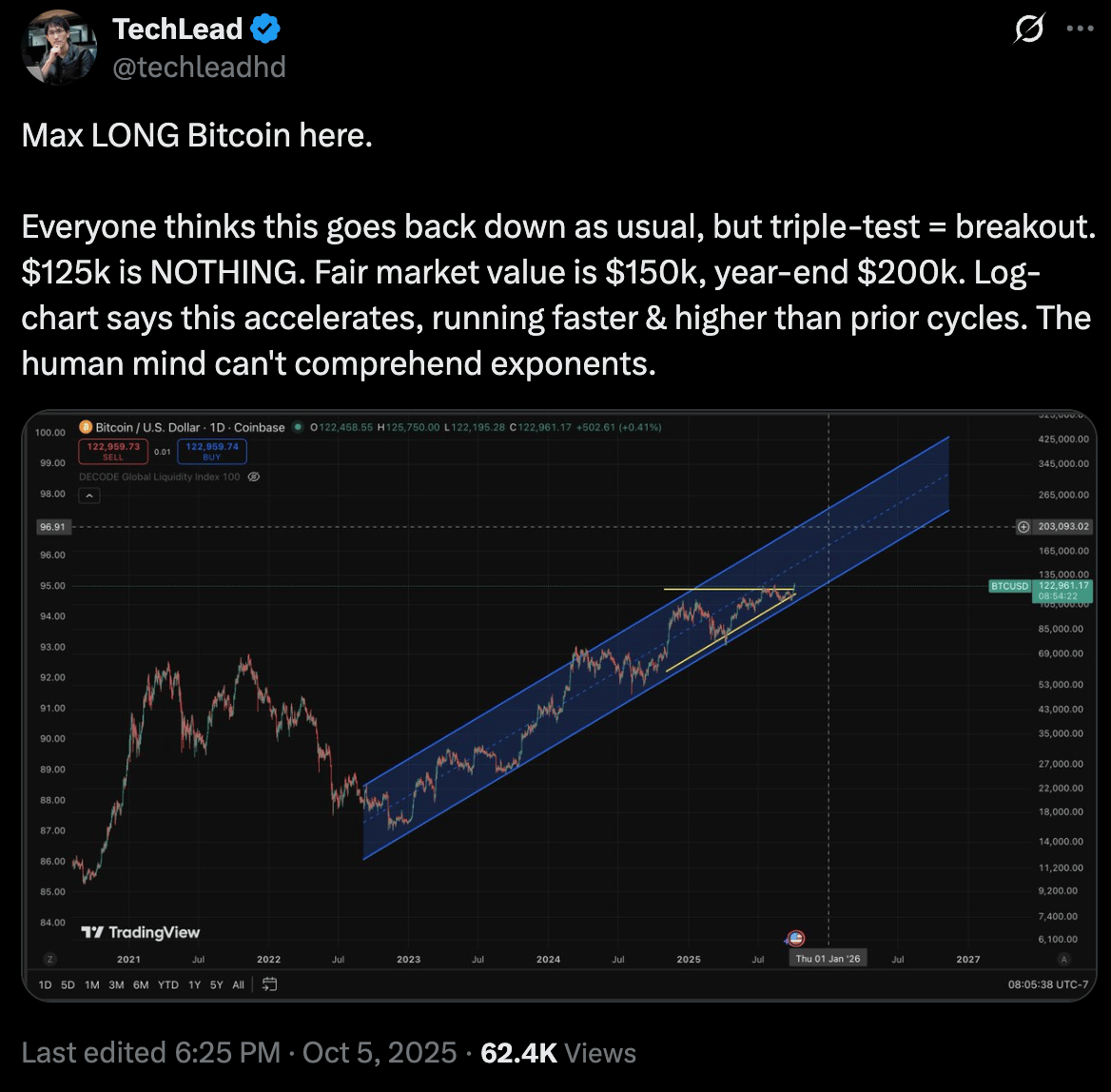

🔥 Pressure Cooker = Breakout Zone

Months of sideways chop built up enough energy to light a rocket. Once that kind of compression breaks, it rarely ends with a mild pump.

The next logical target? $150K.

Not pulled from thin air — it’s where multiple technical targets converge:

🧠 Inverse Head & Shoulders projection

📏 Fibonacci extensions

📊 Prior breakout symmetry

We might top at $140K or overshoot to $160K, but the math clusters around $150K. Beyond that, the market’s due for what could be a short, violent correction before the next phase of the cycle.

⚙️ The Strategy That Actually Works

Forget “gut feeling” trading. The only way to survive this phase is mechanical discipline.

The rules are simple:

Follow the trend indicator (the “money line”).

Stay bullish while it’s green.

Exit only when it flips bearish — not before, not after.

That’s how you catch the trend and skip the noise. Most retail traders will flip bullish too late and panic-sell too early. You don’t want to be them.

🧩 Macro Setup: The Perfect Storm

Even if Bitcoin cools off short-term, the macro backdrop is still pure rocket fuel:

🇺🇸 Trump-era money printer — expect a new Fed chair in May and a “stimulus renaissance.”

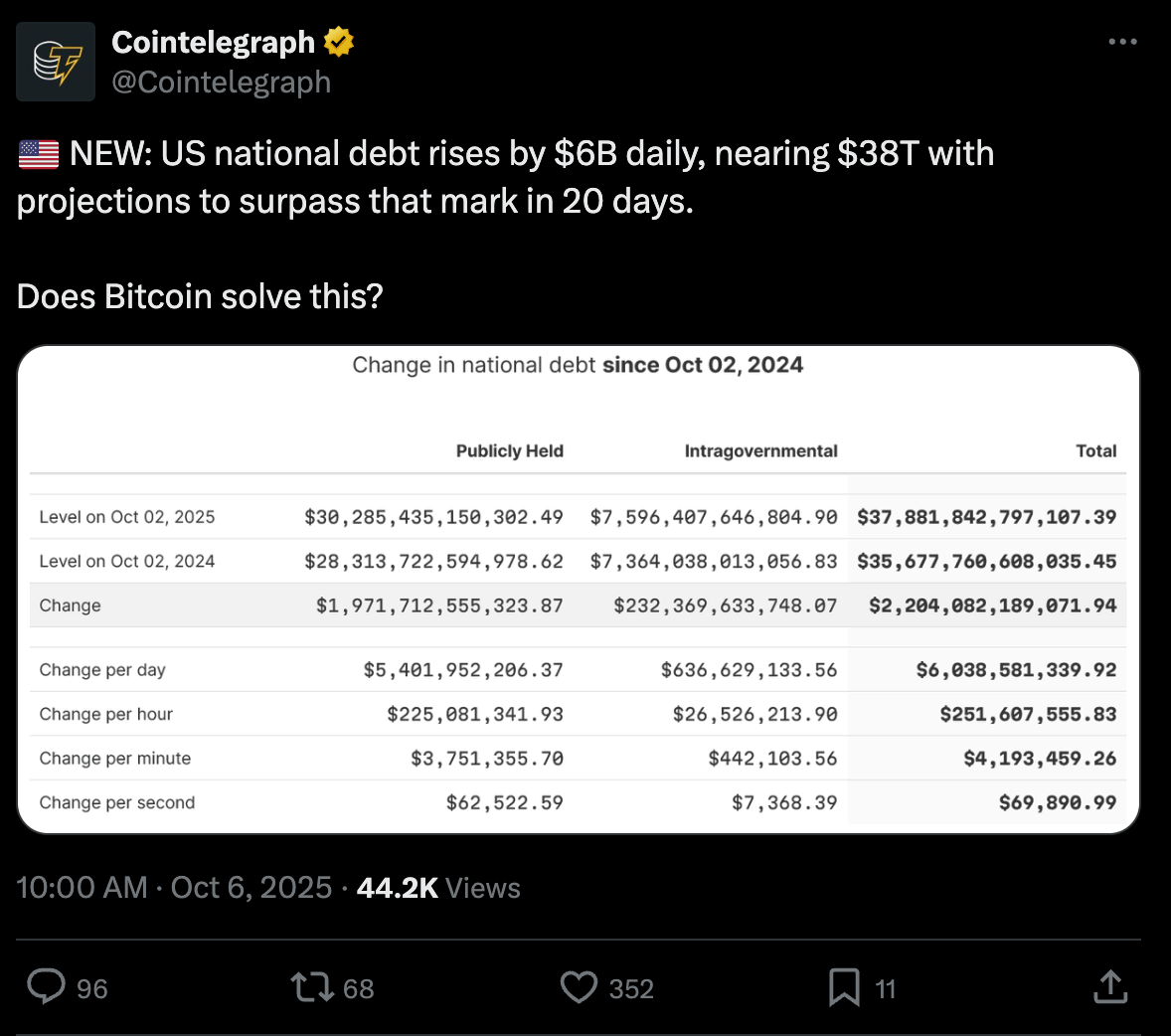

💵 US national debt rising ~$6B per day, crossing $38T this month.

🏦 Rate cuts + fiscal chaos = liquidity flood.

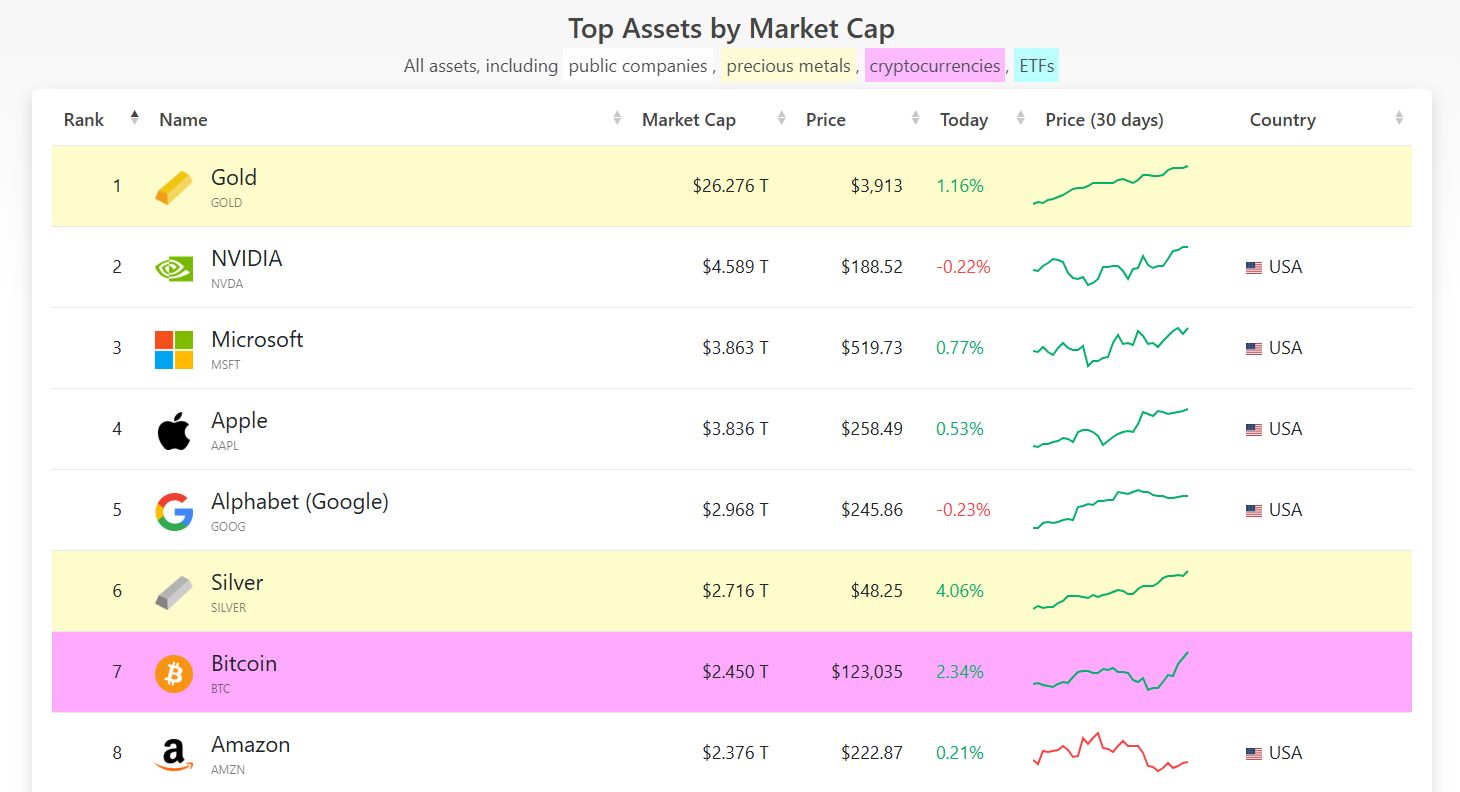

If those conditions line up, we’re talking about a setup that could push Bitcoin beyond $1M before the end of the next administration. Sounds wild — until you remember gold sits at a $26T cap and Bitcoin’s only $2T. That’s a 13x gap. The “flippening” isn’t fantasy, it’s math.

🐋 Market Psychology: The Bearish Turncoats

Watch for this next wave:

People who’ve been screaming “down only” for months will suddenly start buying back in — at $123K+.

That’s the danger zone. Emotional re-entries after invalidation are how you get rekt on the next dump.

Stay rational. The bull is intact until the trend says otherwise. The bear flip will be obvious when it happens — it always is.

🧭 Big Picture: The Run Isn’t Over

Yes, a correction will come. It always does.

But on the macro timeline, we’re still early. Most people don’t own Bitcoin, don’t understand it, and still call it a scam.

That disbelief is your edge.

If the US eventually integrates Bitcoin reserves into its national balance sheet — or even flirts with the idea — the path to $1M+ BTC becomes less speculation and more inevitability.

🧨 TL;DR — What to Do Now

✅ Trend still bullish → ride it.

🧘♂️ Use mechanical exits, not emotions.

🪙 Stack sats or automate DCA.

📉 Prepare to buy hard on the next true bear flip.

💰 Long-term thesis: Bitcoin beats every legacy asset — including gold.

“Don’t predict. React.”

That’s the play. The market will tell you when it’s over — until then, enjoy the chaos, stay liquid, and remember: disbelief is the most bullish indicator on earth.

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply