- Unhosted Newsletter

- Posts

- Unhosted Weekly #61 - December 8th

Unhosted Weekly #61 - December 8th

What Matters, What Moves, What’s Next 💡

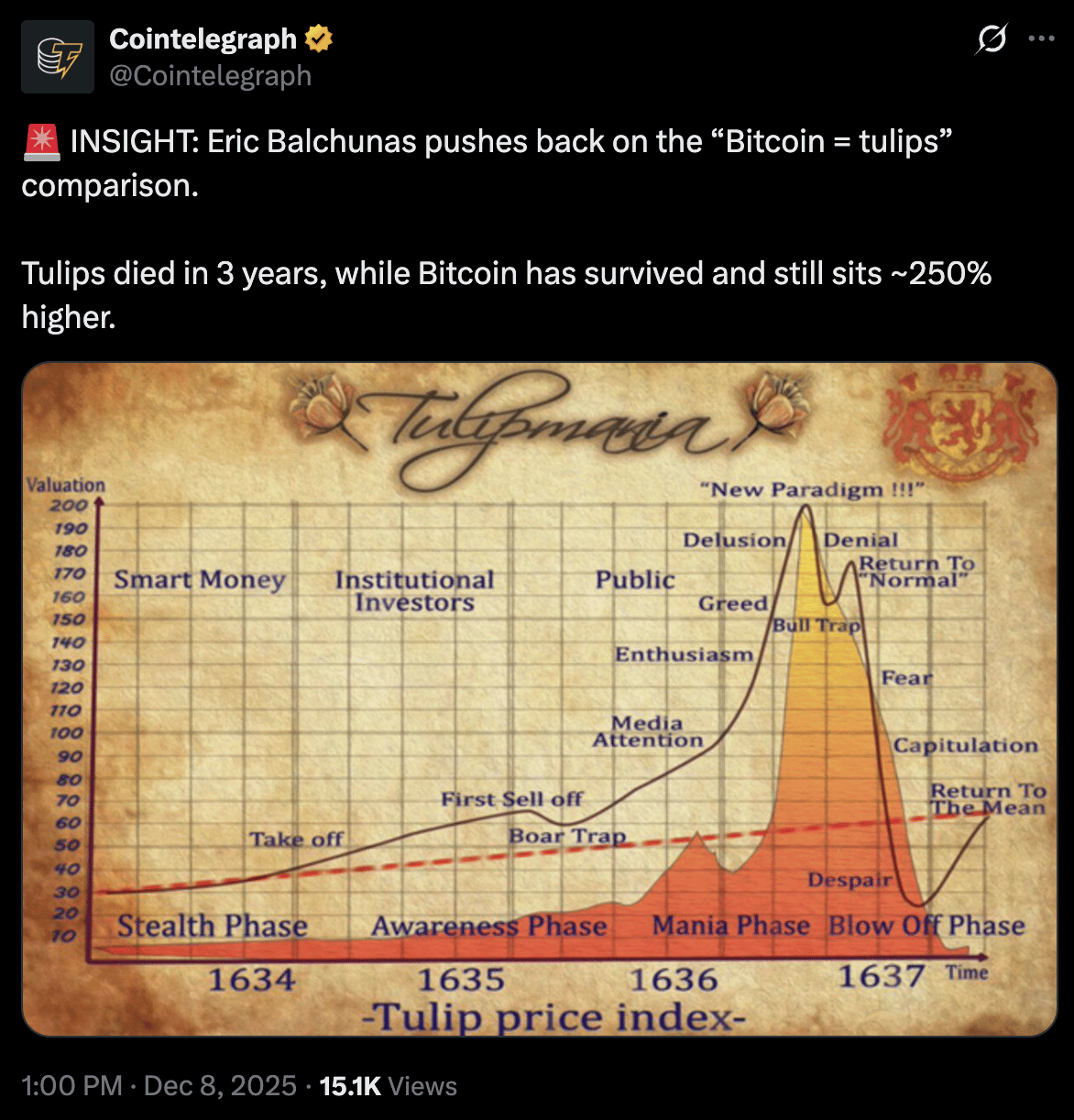

📈Tulips collapsed in 3 years, Bitcoin’s still alive

🏦 Over 4M $BTC now sits in global treasuries

🟧 Big stat: The top 100 public companies now stack 1,059,453 BTC

🐋 Smart whales piled into $426M in $ETH longs

📝 December rate-cut odds climb to 88.4%, per CME data

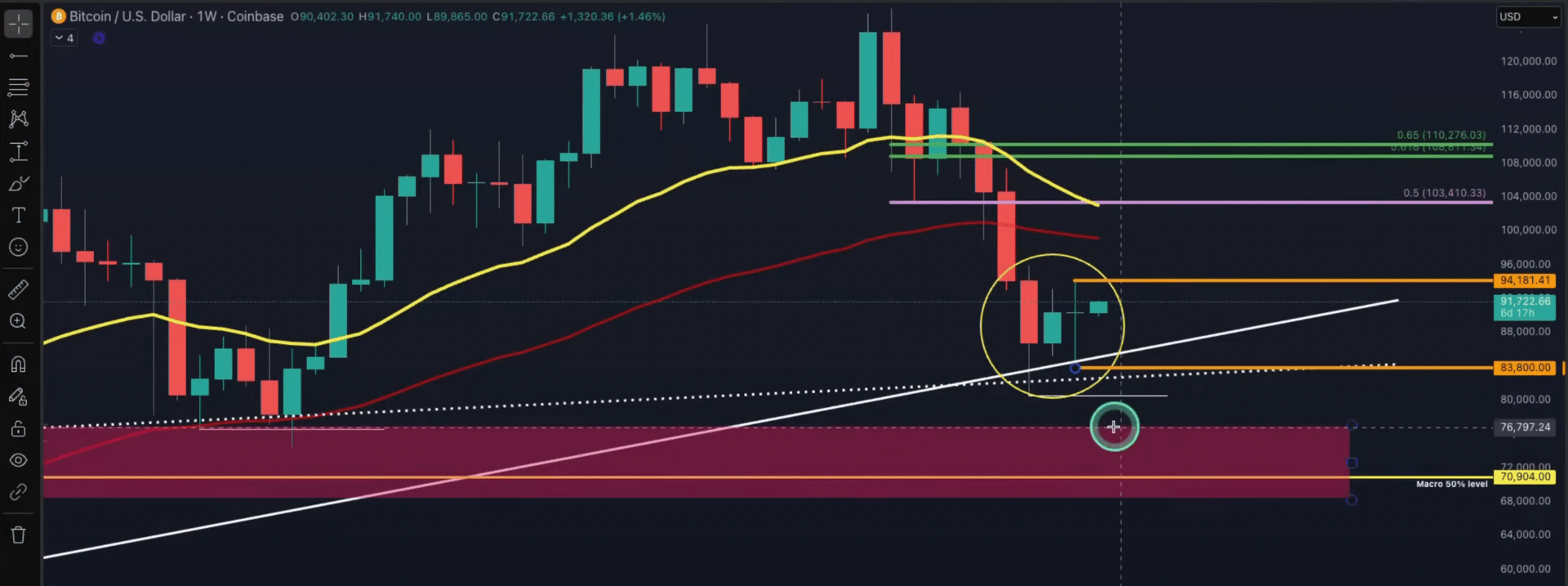

Short-Term Bounce or Lower Lows Ahead? 📉

The current market environment is split between two camps: those preparing to buy a short-term bounce and those waiting for deeper pullbacks. Both sides have a case. Models point to a possible 6–7% upside squeeze, yet higher-time-frame structure still leans cautious.

Top Macro Catalysts to Watch This Week ⚠️

Two major events will dictate volatility:

1. Federal Reserve – Rate Cut Decision (Wednesday)

A rate cut is priced at ~90% probability. Markets usually drift upward into Fed events, but any relief rally tends to face resistance once the announcement hits.

2. Bank of Japan – Rate Hike (Next Week)

A potential BoJ hike could tighten global liquidity and spark risk-off moves. This event may align with local lows forming across BTC and equities.

Actionable insight:

Set alerts for the Fed decision and BoJ policy window. Short-term trades may thrive into Wednesday but expect volatility spikes immediately after.

Short-Term Bounce vs High-Time-Frame Risk 🟠

Bitcoin can squeeze into the $97k golden pocket before facing resistance. This level aligns with:

Falling daily EMAs

High-volume node

Local bearish order block

Near-term scenario:

→ Rally into $97k

→ Heavy resistance

→ Potential rejection into December lows

Bigger picture:

BTC remains below the weekly 21 EMA. Historically this signals relief rallies rather than trend reversals.

Actionable insights:

Fade aggressive upside moves into $96.5k–$97.5k.

Watch for a low sweep near support; a reclaim of that level becomes a strong mid-term long.

Avoid oversized positions until weekly structure improves.

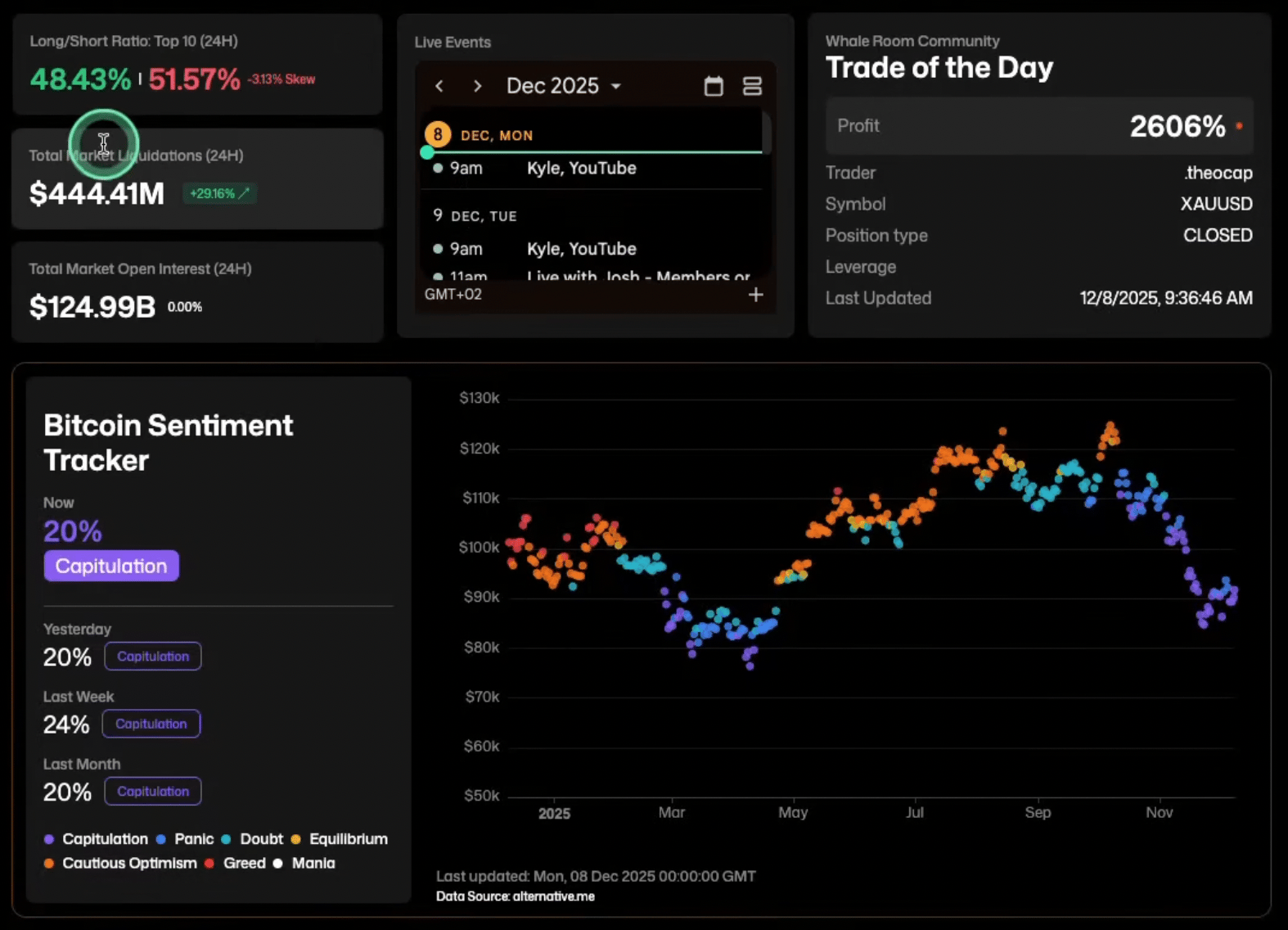

Volatility Outlook: Compression Before Expansion 🔄

Multiple indicators show extreme volatility contraction, suggesting a large move is imminent:

Bollinger Band Percentile collapsing

Exchange volume breaking below key thresholds

Long/short skew near neutral

Liquidity pockets thin on both sides

Actionable insight:

Prepare for range expansion. Mark the previous week’s high/low and use sweeps as triggers for breakout or mean-reversion trades.

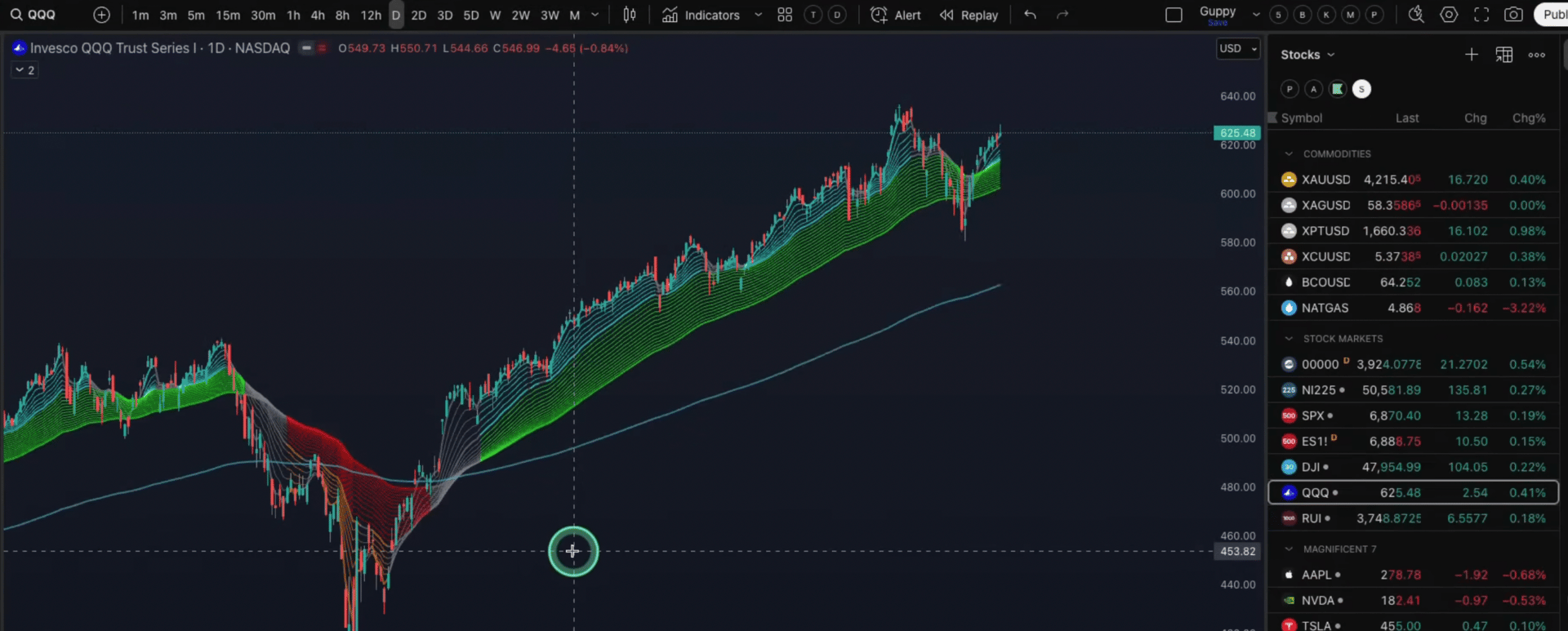

Traditional Markets: The Only Bright Spot 🌍

US equities remain the strongest risk-on indicator:

S&P 500 consolidating at all-time highs

Dow Jones, NASDAQ, Russell 1000 all pushing toward price discovery

Big tech holding trend (Google, Apple, Amazon strong; Meta showing early profit-taking)

Commodities trending up: Gold, silver, platinum in structured uptrends

This risk backdrop can offer temporary support for Bitcoin, though crypto clearly lags.

Actionable insights:

Traders seeking momentum may find better conditions in gold/silver or equities.

Use EMA ribbon or Super Guppy on daily time frames to time entries within strong trends.

December historically favors commodity continuation moves.

Highlighted Trade Setups 📌

Gold – Multi-Week Swing Setup

Target: ~24% upside

Best entry near 4,129 if tagged

Tight stop (~3.5%) due to clean structure

Breakout expected late December–January

Why it matters:

In a low-conviction crypto environment, gold offers a clearer trend and more reliable rotation.

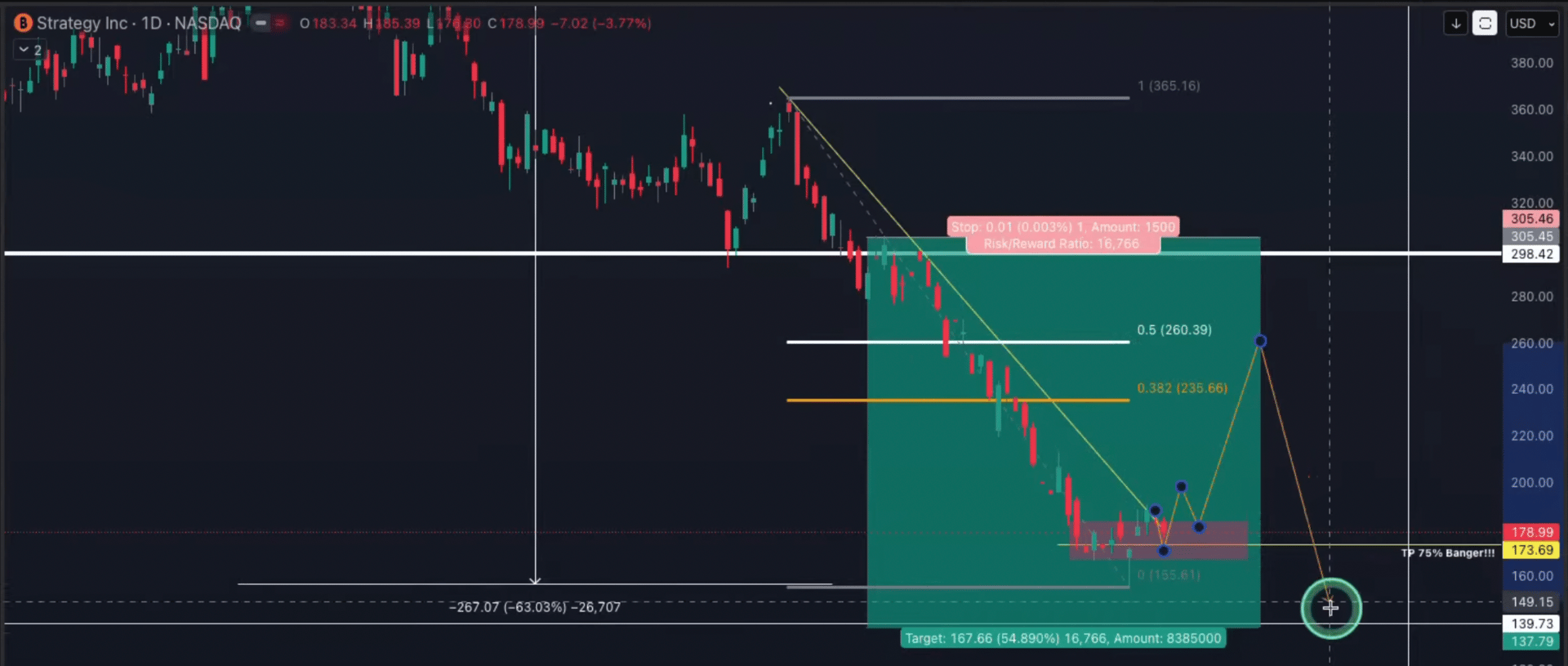

MicroStrategy (MSTR) – Relief Rally Potential

MSTR sits on major support after heavy selling.

Potential upside: 235–260

Previous short profits taken; now entering relief rally territory

A reclaim confirms trend shift

Actionable insight:

Good candidate for short-term bounce trading, but avoid overstaying the move.

Altcoins: Still in a Bleed-Out Cycle 🔻

Most alts continue grinding lower:

SOL: in mid-range, no clear high-conviction level

XRP: closer to support, but still likely to revisit deeper levels

SUI, ADA, SONIC: straight downtrends

TAO: local spikes but still range-bound

Pump.fun (PUMP): only interesting due to key support, not fundamentals

Actionable insight:

Avoid altcoin exposure unless capturing intraday rotations. Focus on extremes: range lows only. Mid-range trades carry poor risk-reward.

Liquidity Map: Nothing to Fuel a Trend 🚫

Liquidation levels are extremely thin:

Only ~$13M in liquidations near $92k

Weekly cluster around $94k

Low retail participation

Weekend volume collapse

This explains the “dead zone” environment: no fuel, no direction.

Actionable insight:

Look for liquidity to build before major news events. That’s often the sign a real move is coming.

Strategy Playbook for the Week 📘

If trading short-term

Aim for upside into $97k

Tight stop once daily EMAs come into play

Treat every pump as a potential fade unless volume expands

If positioning mid-term

Wait for:

→ Sweep of the December low

→ Reclaim of that level

→ Volume returnThis creates the first “real” buy-the-dip setup in weeks

If avoiding crypto chop

Rotate attention to strong-trending assets

→ Gold

→ Silver

→ S&P 500

→ Select tech equities

If dollar-cost averaging

Gradually scale into Bitcoin only

Keep alts off the table during downtrend phases

Final Take 🎯

The market sits in a low-liquidity standoff ahead of explosive catalysts. Both sides are evenly matched — the perfect recipe for a sharp breakout.

Key conclusions:

⚡ Volatility expansion is imminent

📈 Short-term squeeze toward $96K–$97K is likely

🚫 That zone carries heavy rejection risk

💧 Sweep of lows remains the cleanest long setup

🏦 FOMC + BoJ decisions will define direction

📉 High-time-frame trend remains corrective

📊 TradFi markets show stronger structure than crypto

This week rewards patience and precision. The breakout is coming — wait for confirmation.

Want to get the real alpha? Subscribe to our pro newsletter —> here

📍Unhosted AI Weekly: Market, Attention, Momentum

AI & Robotics Market Check – $30.5B Sector, Quiet Rotation Underway 🤖✨

📊 AI Token Movers

The AI market sits at $29.63B (+2.2% daily) with $3.06B volume — slow grind up, buyers showing cautious confidence.

🔵 Chainlink (LINK) → $14.12, +2.3% daily, +15.4% weekly

Still the oracle king. Huge cap, steady uptrend, AI narrative integration keeps it sticky.

🟣 Bittensor (TAO) → $305.03, +8.3% daily, +13.1% weekly

The benchmark AI token. Big bounce, heavy liquidity. When AI rotates, TAO leads.

🟢 NEAR Protocol (NEAR) → $1.78, +5.3% daily, +7.2% weekly

Infra play masquerading as AI. Strong weekly recovery, high-volume conviction.

🔵 Internet Computer (ICP) → $3.55, +3.2% daily, +0.6% weekly

Small daily lift after a rough week. Volume stable, sentiment neutral.

🔴 Render (RNDR) → $1.66, +4.7% daily, +3.6% weekly

Compute narrative alive and well. Consistent accumulation pattern.

🟡 Story (IP) → $2.20, +0.0% daily, -4.1% weekly

Sluggish weekly action. Retail loves the meme, whales aren’t in a hurry.

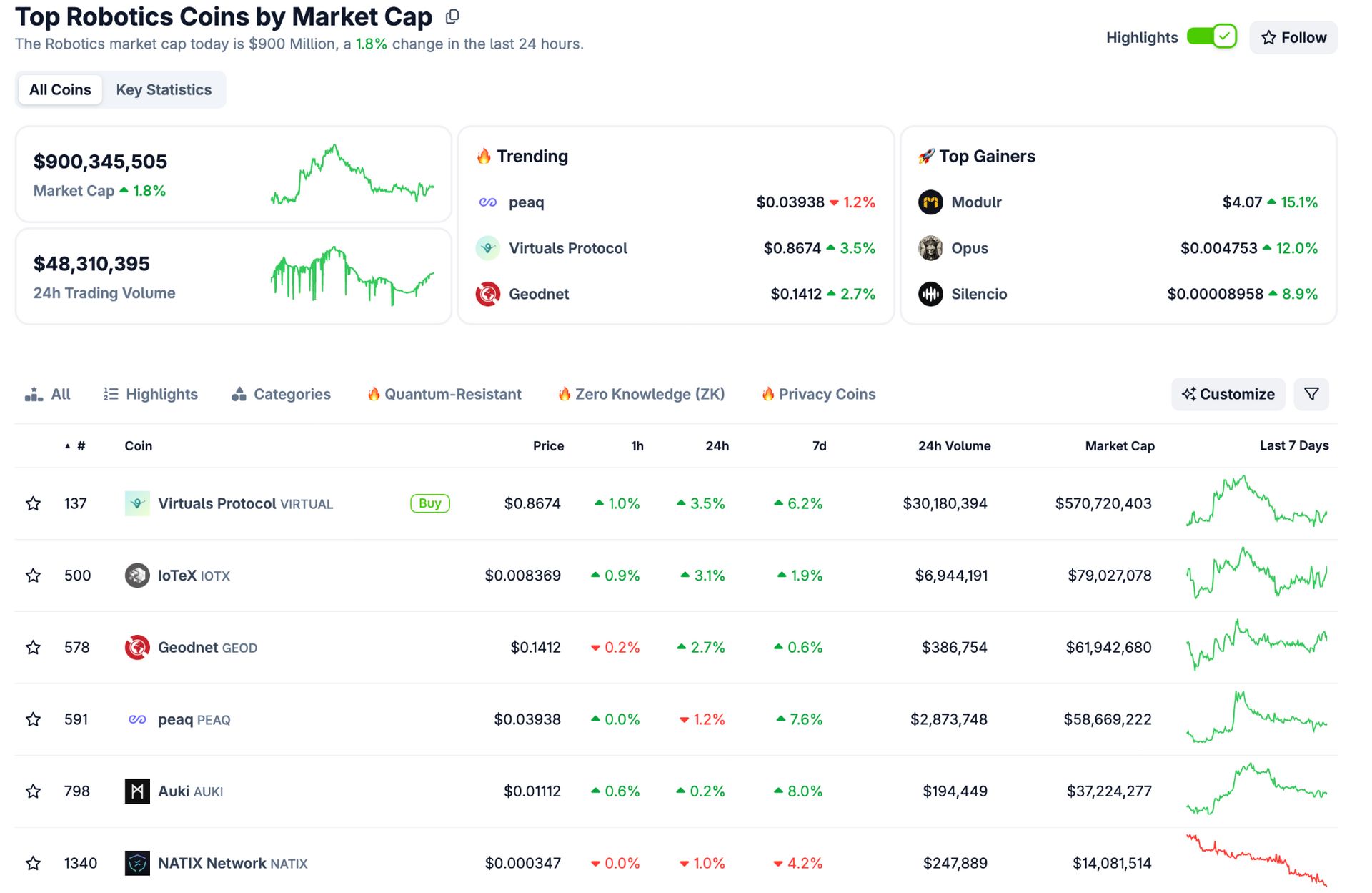

🤖 Robotics Token Movers

Robotics follows with $900M (+1.8% daily) and $48.3M volume — smaller, twitchier, and more momentum-driven. Classic “microcaps wake up last” behavior.

🛰️ Virtuals Protocol (VIRTUAL) → $0.8674, +3.5% daily, +6.2% weekly

Sector leader. Clean uptrend, strong weekly structure, usable token mechanics.

⚙️ IoTeX (IOTX) → $0.00836, +3.1% daily, +1.9% weekly

Slow, steady, reliable. Real-world device angle keeps it relevant.

🛰️ Geodnet (GEOD) → $0.1412, +2.7% daily, +0.6% weekly

Satellite-flavored microcap. Daily strength but low liquidity — handle with care.

🔧 peaq (PEAQ) → $0.03938, -1.2% daily, +7.6% weekly

Slight daily dip but strong weekly bounce. Core DePIN narrative anchor.

🛠️ Auki (AUKI) → $0.01112, +0.2% daily, +8.0% weekly

Thin order books but a strong weekly shift. Momentum play.

📡 NATIX Network (NATIX) → $0.000347, -1.0% daily, -4.2% weekly

Ultra-low float. Weekly bleed suggests rotation away, not toward.

👉 TL;DR

AI sector climbs on volume, robotics follows with smaller but sharper moves.

TAO, LINK, and NEAR remain AI anchors.

VIRTUAL and PEAQ lead robotics while microcaps offer volatility candy.

This isn’t full-send season — it’s rotational accumulation, with traders probing narratives rather than aping them.

💡 Playbook: Ride strong weekly structure, scalp robotics volatility, and avoid low-float traps unless you can stomach a 20% wick in either direction.

Sentiment Split — Degens Pick Their Champions ⚔️

🟢 Good Sentiment

Retail is in “send-it-maybe” mode, rotating toward anything that vaguely looks like momentum:

SEI (24.86K), Zama (9.94K), Pendle (7.68K), BCH (6.54K), Sentient (6.5K), BGB (6.44K), Confidential Labs (12.98K), INJ (8.45K), ETH (7.21K), RLUSD (6.01K), IN (5.87K), Midnight (5.81K), BLUP (12.47K), Base (8.33K), APEX (6.94K), Talus Network (10.96K), Warden (7.99K), MultichainZ (6.72K), Brevis (5.97K), Reya (6.58K), Grvt (5.81K), Coinbase (10.78K), BDX (7.78K), TAO (5.96K), MoreMarkets (5.61K).

A broad sweep of infra, L1s, AI plays, restaking narratives, and whatever Coinbase did today that made normies optimistic again.

🔴 Bad Sentiment

Meanwhile, the pain aisle is fully stocked. Bagholders are tweeting through it:

MERL (-20.26K) leading the suffering, with WIF (-4.59K), SHIB (-4.4K),

ZK (-3.39K), Linea (-3.1K), AI16Z (-3.1K), WLFI (-6.76K), Manta (-3.56K), Dropee (-3.02K), BMEX (-2.98K), PI (-2.75K), BLAST (-2.63K), BSU (-2.77K),

USDT (-5.74K) leaking sentiment like a stablecoin shouldn’t.

Everything from memecoins to L2s to stablecoins is catching strays. Classic rotation: risk-on coins pumped, laggards dumped, and stablecoins mysteriously hated because crypto.

👉 TL;DR

SEI, Zama, Pendle, Base, and INJ dominate the green zone — retail wants momentum and narratives that sound smart.

MERL and WIF take the FUD crown — heavy outflows and loud coping.

Sentiment flips fast.

Green side is dopamine.

Red side is exit liquidity.

Smart money farms volatility. Retail farms hope.

Agent Market Check – $6.16B Sector, Waking Up Again

Agent market cap just climbed to $6.16B (+6.44% 24h) while Smart Engagement inched up to 3.72K (+0.65% 24h). Prices rising, engagement barely moving — classic “smart money rotates, retail oversleeps” setup.

Dominance Snapshot

Base → $2.23B (+4.46% 24h) steady climb, still the center of gravity for agent flows.

Ethereum → $1.59B (+10.87% 24h) strong bounce, reclaiming attention after a slow week.

Other chains → $2.83B (+2.93% 24h) rising, but no clear leader.

Most of the inflow is consolidating on Base and ETH, proving infra agents still run the show.

📊 Leaders by Attention (24h)

🟢 WARP (10.19%, +0.19) High mindshare, clean trend, and showing it’s more than a one-day wonder. Sitting firmly at the top of the attention stack.

🟢 COOKIE (7.92%, +3.07) Explosive inflow. Retail magnet. Every timeline has someone shilling COOKIE today, and the +3.07 bump confirms it’s not imagination.

🟢 UP (2.3%, +1.59) Solid 24h lift. Narrative: “simple, clean, trending.” Market likes momentum it doesn’t need to overthink.

🟢 ETHY (1.67%, +1.26) ETH-adjacent agent with steady upward flow. Not flashy, but dependable.

🟢 OPEN (1.38%, +1.16) Sneaking back into the conversation. Quiet but meaningful rebound in attention.

🟢 ELSA AI (9.27%, +1.07) Still the fan favorite. High baseline mindshare, stable growth — the crowd’s comfort pick.

🔻 Losers by Attention (24h)

🔴 PIPPIN (1.15%, -3.03) Sharp drop. Overfarmed and overexposed — attention rotated out fast.

🔴 INFINIT (1.81%, -2.38) Lost momentum, lost eyes. Likely profit-taking after a hype cycle.

🔴 FARTCOIN (8.81%, -2.03) Heavy meme fatigue. Still large mindshare, but the red tells you degens are securing exits.

🔴 APRO (0%, -1.52) Completely flat in presence but still bleeding. Worst combo.

🔴 SWARMS (0.44%, -1.08) Attention fading. Market signaling “next.”

👉 TL;DR

Agent sector pops to $6.16B, but engagement barely moves — quiet accumulation under the hood.

WARP dominates, COOKIE explodes, ELSA AI holds the throne, and UP/ETHY/OPEN climb the ranks.

FARTCOIN, PIPPIN, and INFINIT take the hit as rotations unwind.

Narrative read:

Memes cooling, utility agents and clean UX plays climbing. Expect Base and ETH-native agents to carry the next leg.

Reply