- Unhosted Newsletter

- Posts

- Unhosted Weekly #64 - December 29th

Unhosted Weekly #64 - December 29th

Pain Over or Just Starting?

🟠 Saylor keeps on Stacking

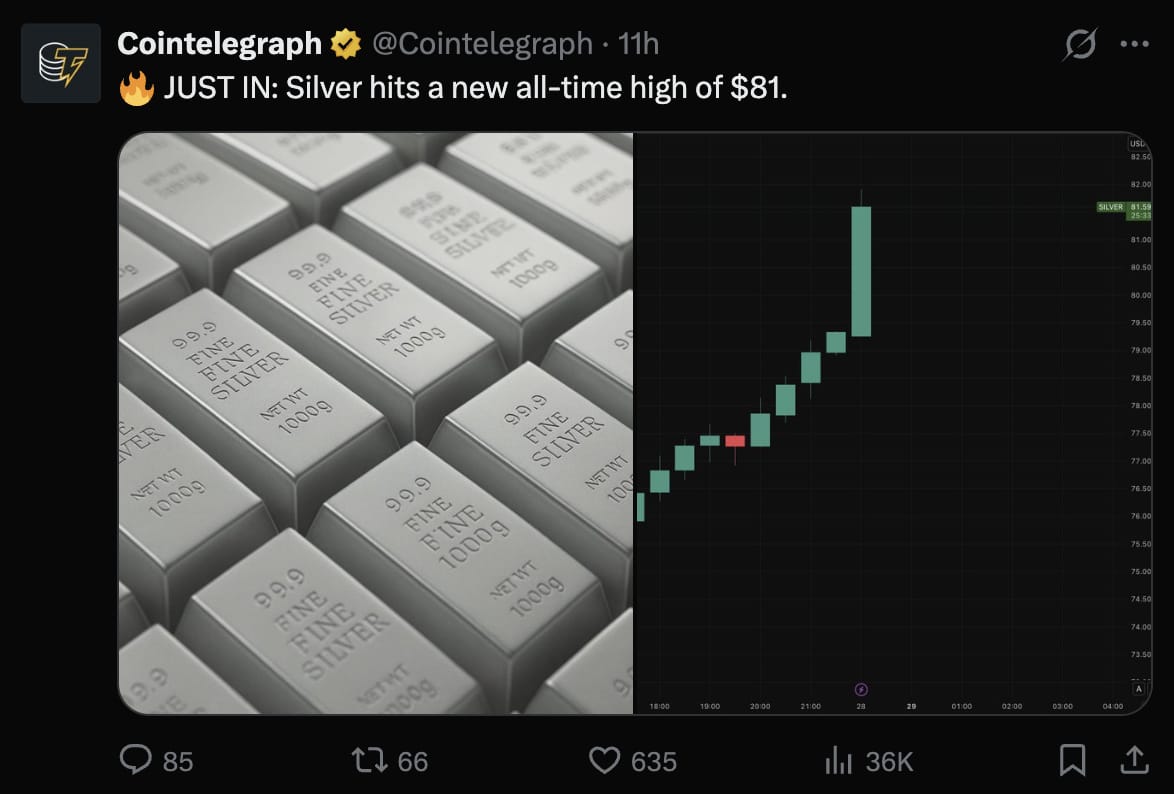

🥈 Silver just printed a fresh all time high at $81

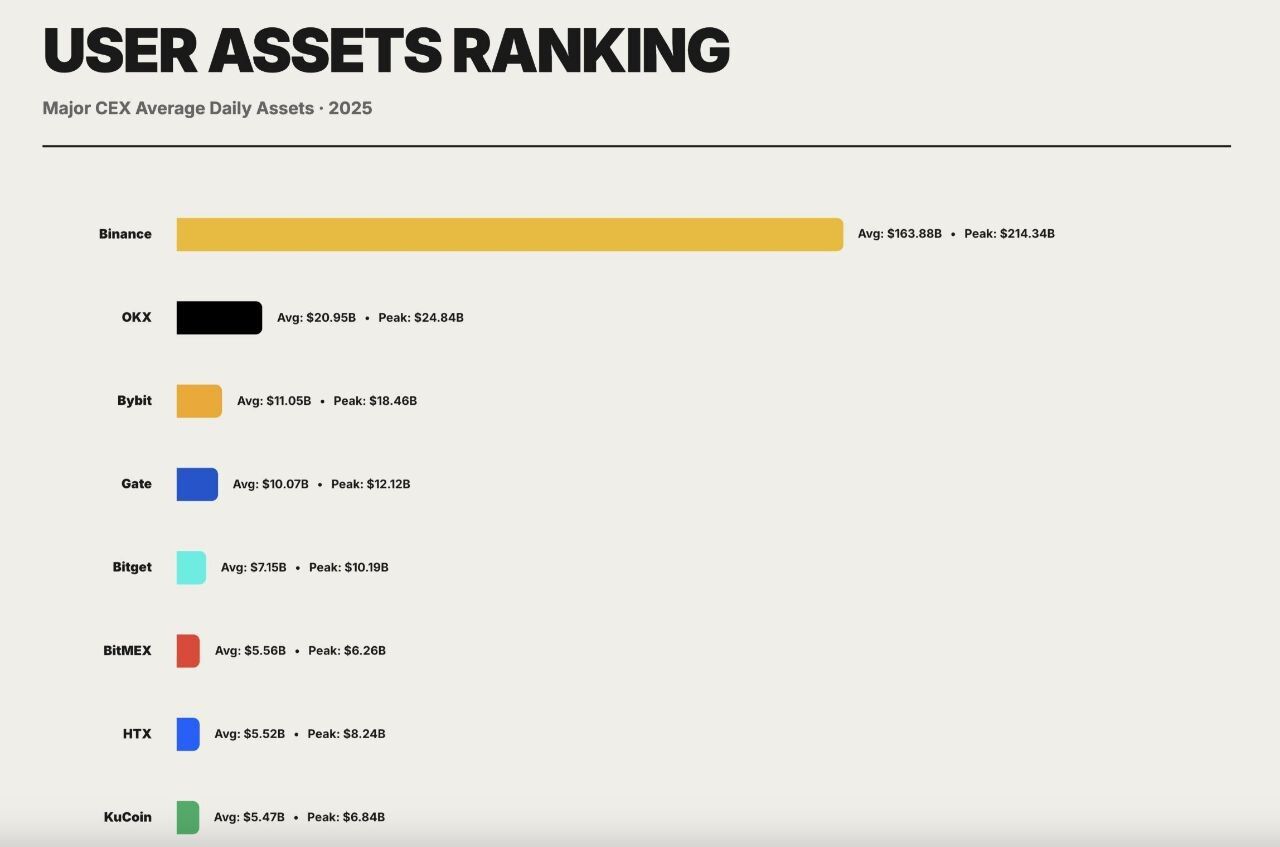

👑 Binance sits miles ahead of every CEX by client assets

🚀 $80B flowed into crypto in 7 hours and we’re back over $3T

💸 Ethereum just set a new builder record

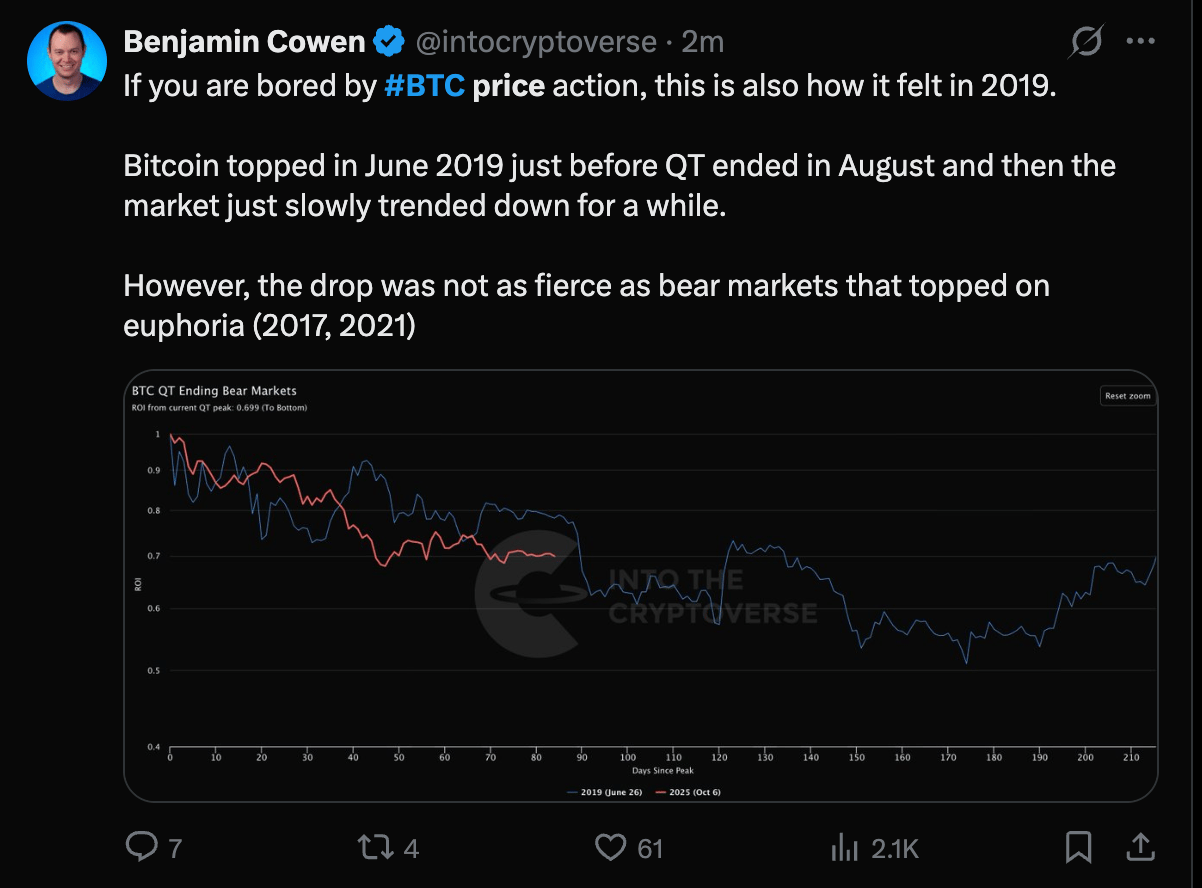

Bitcoin Sideways: Bottom Formation or Just Another Mirage? 🏜️

Bitcoin has spent weeks moving sideways, holding above the 87–88K range. This has sparked a familiar question across the market.

Is this quiet strength a sign of a bottom forming, or simply consolidation before another leg lower?

The confusion is understandable. Each brief push above 90K triggers optimism. Each rejection fuels doubt. Meanwhile, broader markets tell a more revealing story.

Why Sideways Price Action Feels Bullish but Often Isn’t 👀

Many traders interpret sideways movement as strength. The logic is simple. Bears are failing to push price lower, so buyers must be stepping in.

That logic only works in one context. A bullish trend.

When an asset is already in a bearish macro trend, sideways price action more often represents consolidation, not accumulation. In technical terms, this structure is commonly a bear flag, not a base.

Right now, Bitcoin remains below the 50 week moving average. That matters.

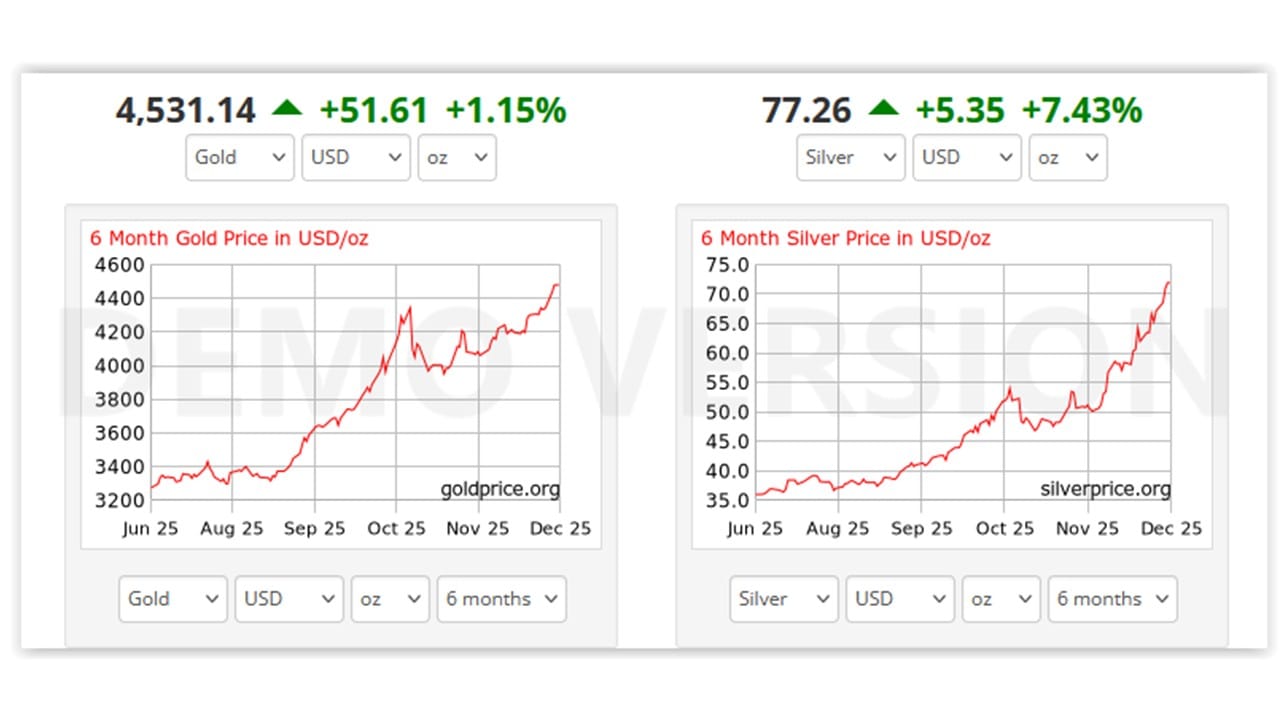

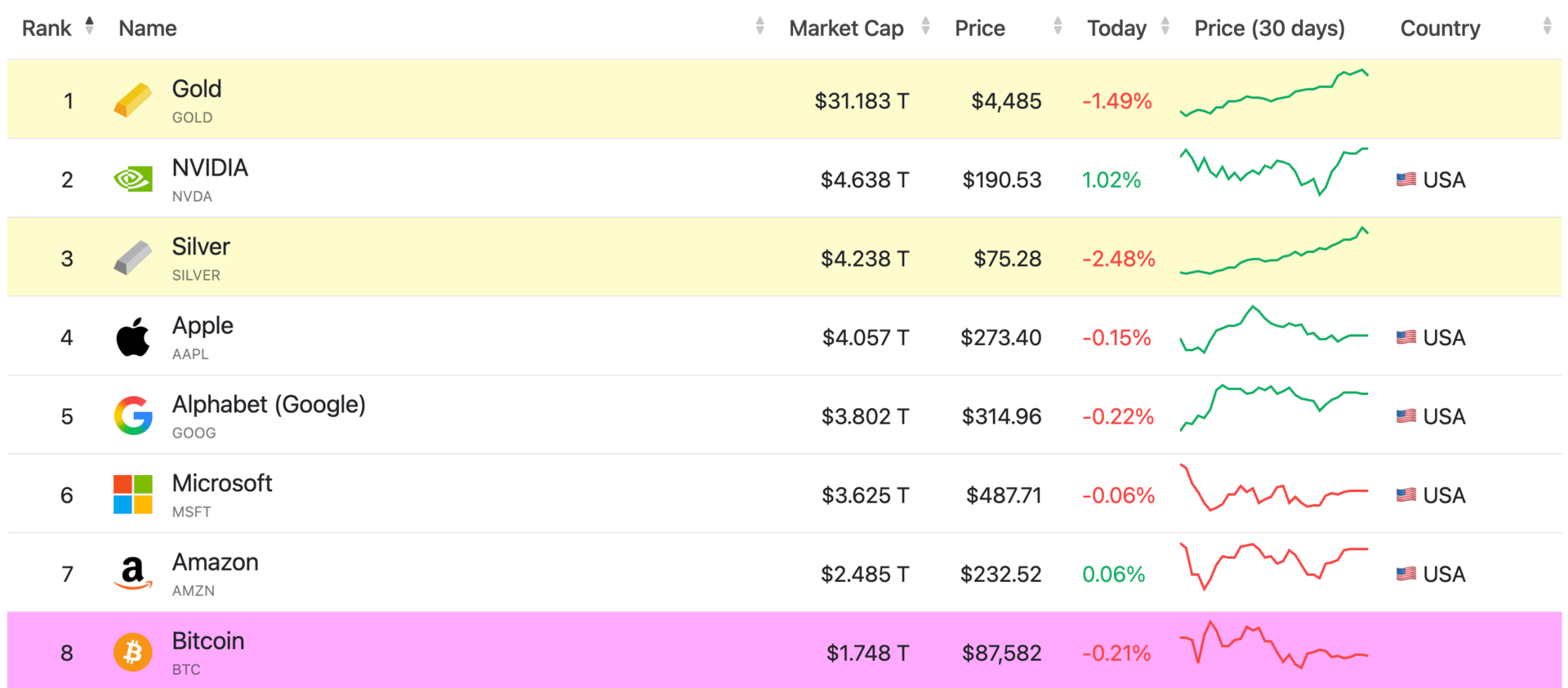

Metals Are in a Bull Market. Bitcoin Is Not. 🥇🪙

One reason Bitcoin sentiment remains conflicted is the strength seen in precious metals.

Gold, silver, platinum, and palladium all entered bull trends months ago. Some of them moved parabolically before pulling back sharply. Those pullbacks did not invalidate the trend. They highlighted a different lesson.

Timing matters.

Buying early in a bull trend is calm and rational. Buying late in a bull trend is emotional and stressful, even if price eventually goes higher.

This is why metals matter to Bitcoin analysis. They show what a real bull trend looks like and how long it can last.

Gold has been bullish for nearly a year. Silver for six months. Platinum and palladium for over half a year.

Bitcoin, by contrast, has been in a bearish trend for roughly one month.

The Primary Scenario: Consolidation Before Lower Prices 📉

The most probable scenario remains continuation toward the 200 week moving average.

The current sideways structure fits cleanly into a broader bear flag pattern. Historically, these patterns resolve in the direction of the larger trend.

The 200 week moving average represents long term fair value. It is where prior cycles have reset excess and where real accumulation tends to occur (currently in the 60k region).

This does not mean price must move in a straight line. Short term rallies are possible. What matters is where weekly closes occur relative to trend levels.

What Would Actually Turn Bitcoin Bullish Again 🔁

Bullishness is not a personality trait. It is a response to market structure.

There are only two conditions that matter:

Sustained weekly closes above the 50 week moving average (104k)

A full trend flip above the key macro resistance near prior highs

Until those conditions are met, rallies are counter trend.

Importantly, these bullish trigger levels are falling over time. That creates a favorable dynamic where re entry prices can approach prior exit levels.

What the Data Says About Smart Money 🧩

ETF flows remain negative on most days. That matters, not because of total assets under management, but because marginal flows determine daily price direction.

At the same time, traders with the highest realized profits are positioned bearishly. The most bullish cohort consists of heavily underwater participants.

This is a classic market dynamic.

Professionals protect capital. Hope clusters at the bottom of the PnL curve.

Final Takeaway: Mirage or Opportunity? 🏜️➡️💎

The current Bitcoin range feels stable, but stability inside a bearish trend is often a mirage.

That does not mean panic is warranted. It means patience is required.

There is a bull market somewhere. This year, it was metals. Crypto will have its turn again, most likely bottom around Q2 and pivot in Q3 of 2026. The opportunity will come when trend, structure, and participation align.

Until then, capital preservation is a position.

Markets reward discipline far more often than conviction.

Bitcoin will make it obvious when it is time.

Want to get the real alpha? Subscribe to our pro newsletter —> here

📍Unhosted AI Weekly: Cooling, Not Collapsing

🤖 Robotics + AI Market Check — Two Lanes, Same Traffic Jam

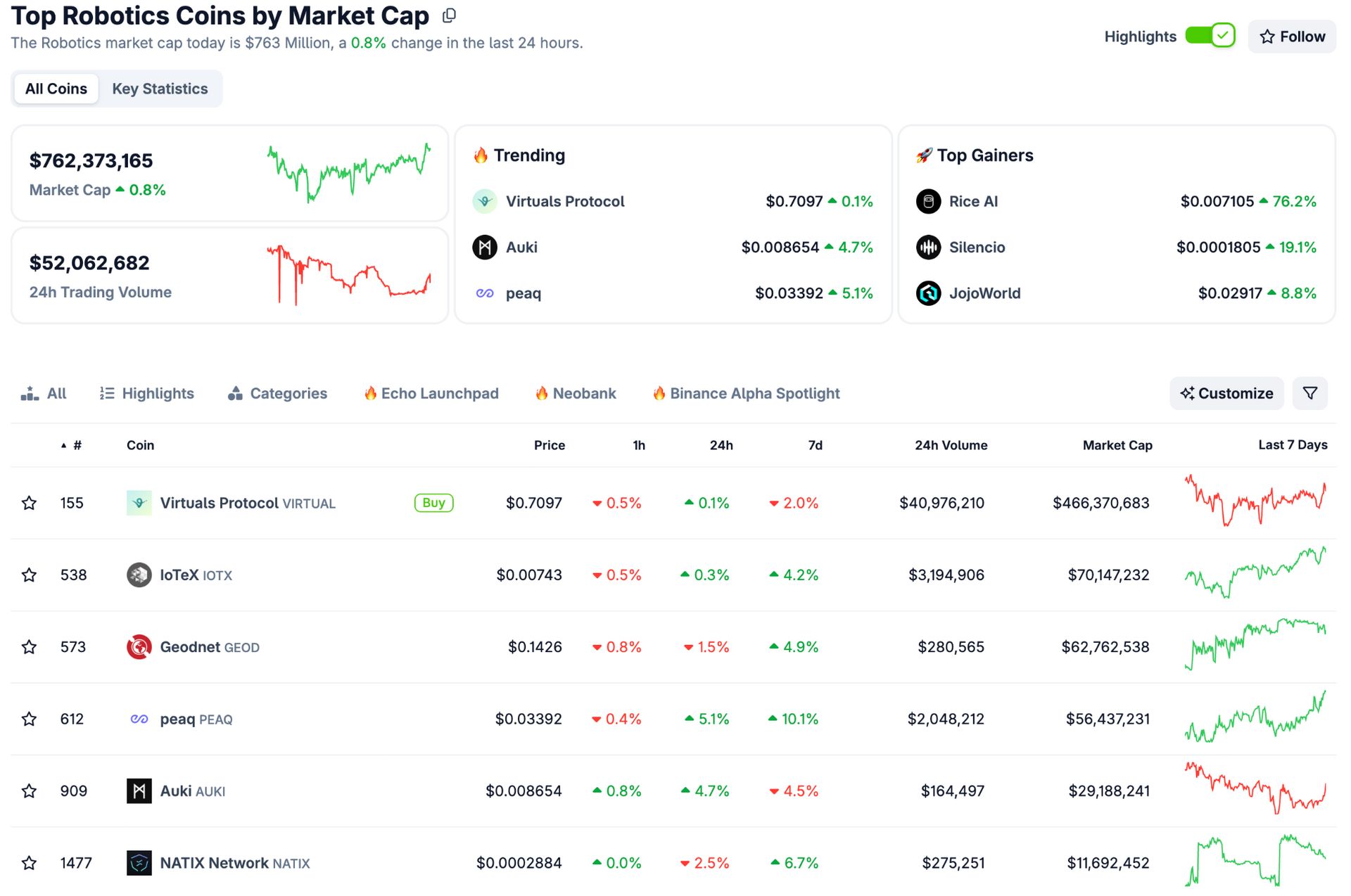

Robotics Sector — ~$763M Market, Quietly Reheating

The robotics cluster crept up to $762–763M market cap (+0.8% 24h) with ~$52M daily volume. Not explosive, but alive. This is rotation money, not mania money.

📊 Robotics Movers:

⚙️ peaq (PEAQ) → ~$0.034, +5.1% daily, +10.1% weekly, ~$56M cap.

Still the spine of the robotics narrative. Real momentum, improving structure. If anything runs when risk appetite returns, it’s this one.

🛠️ Auki (AUKI) → ~$0.0087, +4.7% daily, -4.5% weekly, ~$29M cap.

Classic rebound attempt. Liquidity is thin, chart is tired. Tradable, not trustworthy.

🛰️ Geodnet (GEOD) → ~$0.143, -1.5% daily, +4.9% weekly, ~$63M cap.

Slow grind higher. Less hype, more consistency. Boring is good here.

📡 IoTeX (IOTX) → ~$0.0074, +0.3% daily, +4.2% weekly, ~$70M cap.

Old name, steady bid. Not sexy, but still relevant when infra gets attention.

🔧 NATIX (NATIX) → ~$0.00029, -2.5% daily, +6.7% weekly, ~$11.7M cap.

Low-float chop. Bots love it, humans donate liquidity.

👉 Robotics TL;DR:

No fireworks, but the engine’s warm. PEAQ remains the anchor, GEOD and IOTX grind quietly, AUKI/NATIX are pure speculation. This is rotation prep, not breakout season.

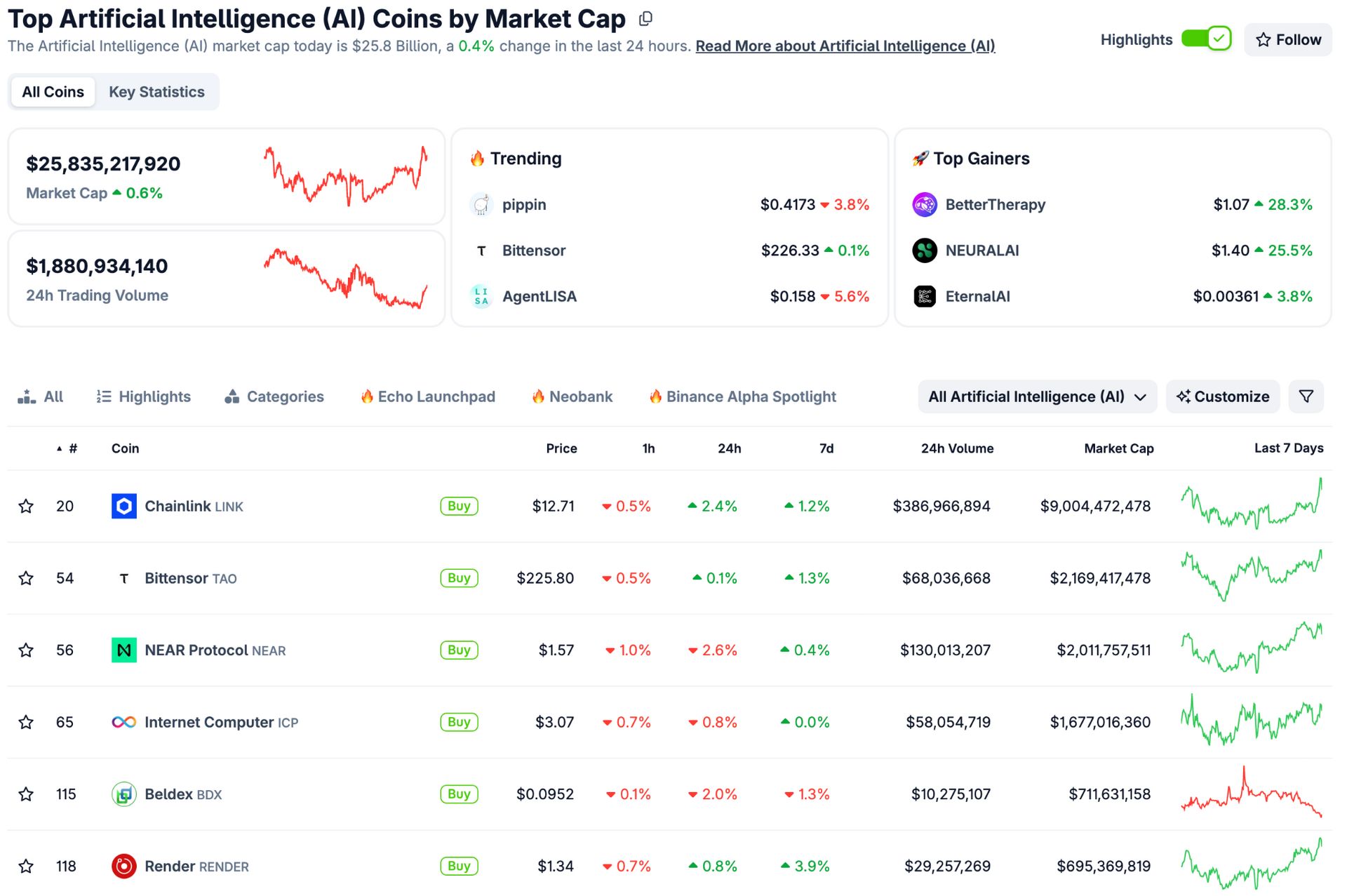

🧠 AI Sector — $25.8B Market, Still Carrying the Narrative

AI sits at ~$25.8B market cap (+0.4–0.6% 24h) with ~$1.9B volume. Bigger, noisier, and far more crowded than robotics.

📊 AI Movers:

🔗 Chainlink (LINK) → ~$12.7, +2.4% daily, ~$9B cap.

Infrastructure king doing infrastructure things. Slow, heavy, dependable.

🧠 Bittensor (TAO) → ~$226, flat daily, ~$2.1B cap.

Still the mindshare monster. No hype spike, but no decay either. That’s strength.

🌐 NEAR → ~$1.57, -2.6% daily, ~$2B cap.

Underperforming short-term, still structurally important. Market’s impatient.

🧬 Internet Computer (ICP) → ~$3.07, -0.8% daily, ~$1.7B cap.

Chop and cope. Strong base, zero urgency from buyers.

🎨 Render (RNDR) → ~$1.34, +3.9% weekly, ~$695M cap.

One of the few AI names still attracting fresh interest. If AI runs again, this gets dragged.

👉 AI TL;DR:

AI remains the default narrative, but gains are selective. LINK + TAO are capital parking lots. RNDR shows signs of life. The rest are waiting for a catalyst that isn’t here yet.

Final Take

Robotics feels like early rotation territory. AI feels like late-cycle consolidation.

If risk appetite returns, robotics probably moves first. If it doesn’t, AI names just bleed slower. Size small. Let PEAQ and TAO tell you when risk is back. Until then, this is chop dressed as opportunity.

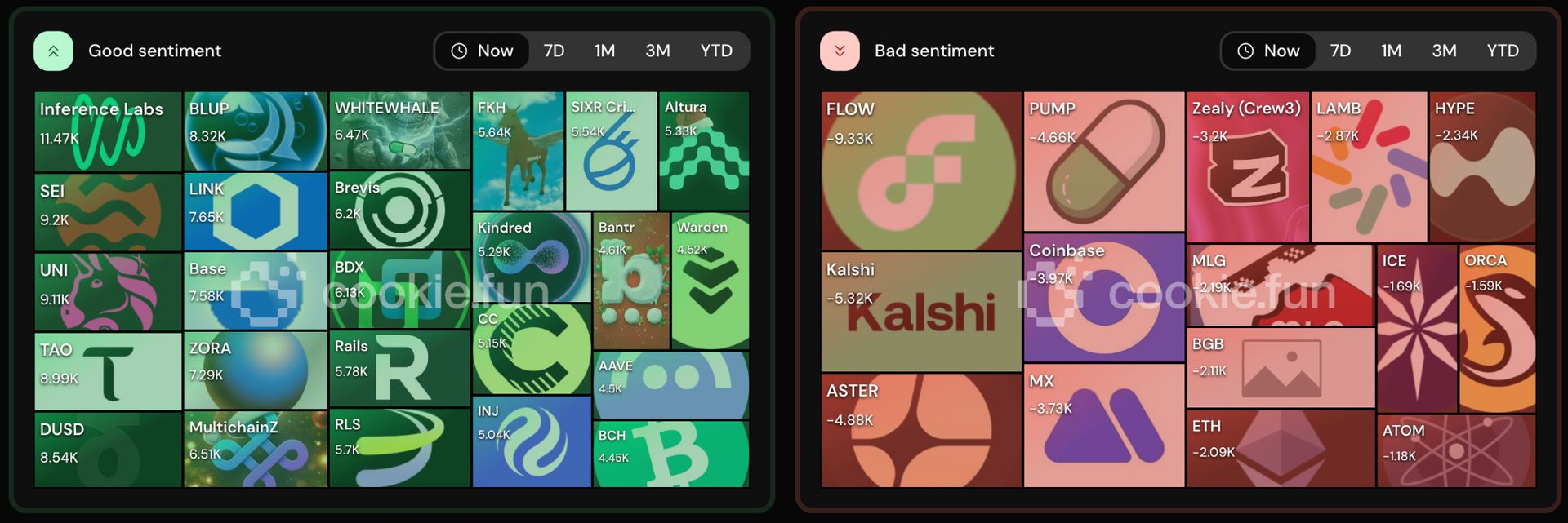

🛠️ Sentiment Split — Crowd Picks Sides, Logic Takes a Smoke Break

🟢 Good Sentiment

Retail’s leaning optimistic again, piling into names that feel productive, composable, or at least convincingly technical. Attention clusters around Inference Labs, BLUP, WhiteWhale, SEI, LINK, UNI, TAO, ZORA, BDX, Base, AAVE, INJ, RLS, MultichainZ, Altura, Kindred, Bantr, Warden, Rails, BCH, DUSD, SIXR, and FKH.

Pattern is clear: infra-adjacent, AI-flavored, or familiar blue-chip DeFi keeps getting the benefit of the doubt. Nothing euphoric, but plenty of “this should be higher eventually” energy.

🔴 Bad Sentiment

Meanwhile, the FUD bin is crowded. FLOW wears the crown of disappointment, followed by PUMP, Zealy, LAMB, HYPE, Kalshi, ASTER, MX, Coinbase, BGB, ETH, MLG, ICE, ORCA, and ATOM.

This is not panic selling, it’s emotional fatigue. Former darlings and utility tokens are getting shrugged off with a quiet “maybe later,” which in crypto usually means “not this cycle.”

👉 TL;DR:

Green side is stacking narratives that sound useful. Red side is full of yesterday’s heroes and underperforming incumbents. Sentiment’s not extreme, just selective. Retail rotates attention fast, conviction slow, and memory even slower. As always, the loudest tiles aren’t the smartest trades, just the most crowded emotions.

🛰️ Agent Market Check – $5.47B Sector, Attention Thinning but Not Dead

Agent market cap sits at $5.47B (+0.7% 24h) while Smart Engagement drops to 2.58K (-3.1%). Same old divergence playbook: price holding up, noise fading. Fewer tweets, fewer dopamine hits, more quiet positioning. This is what cooling looks like, not collapse.

Dominance snapshot

Base → $2.1B (+1.6%) still the main playground.

Solana → $1.37B (-1.16%) bleeding a bit of mindshare.

Other chains → $2.49B (flat) quietly soaking leftovers.

📊 Leaders by Attention (24h)

🟢 ELSA AI (13.31%, +4.1) — back on top. UI-first agents keep winning when markets get boring. Familiar, sticky, low-friction.

🟢 WARP (12.48%, -1.59) — still massive mindshare despite cooling. Attention slipping but remains a core gravity well.

🟢 OPUS (6.91%, +2.43) — infra-flavored AI climbing steadily. Less hype, more curiosity.

🟢 M (4.38%, +2.43) — pure momentum rotation. People clicking first, asking questions later.

🟢 PIPPIN (4.07%, +1.18) — retail-friendly agent energy. Cute, simple, easy to talk about.

🔻 Losers by Attention

🔴 FARTCOIN (6.04%, -4.75) — meme fatigue hitting hard. Same joke, weaker punchline.

🔴 FLOW (1.45%, -3.92) — attention bleeding out fast. Narrative not sticking.

🔴 AIXBT (1.84%, -1.68) — infra angle losing buzz short-term.

🔴 VIRTUAL (2.68%, -1.65) — post-hype drift. Still alive, just not exciting today.

🔴 WARP (again) — even leaders leak attention when the room gets quieter.

👉 TL;DR:

Agents stay green at $5.47B, but engagement keeps sliding. ELSA AI owns the spotlight, OPUS and M are climbing, and memes like FARTCOIN are paying the price. This isn’t a bull leg or a death spiral, it’s a digestion phase. Less shouting, more sorting. Markets are moving from novelty to selectivity. Attention is rationed now. If your agent doesn’t do something useful, it won’t survive the next rotation.

Reply