- Unhosted Newsletter

- Posts

- Unhosted Weekly #66 - January 12th

Unhosted Weekly #66 - January 12th

Upside down, still holding ⚙️

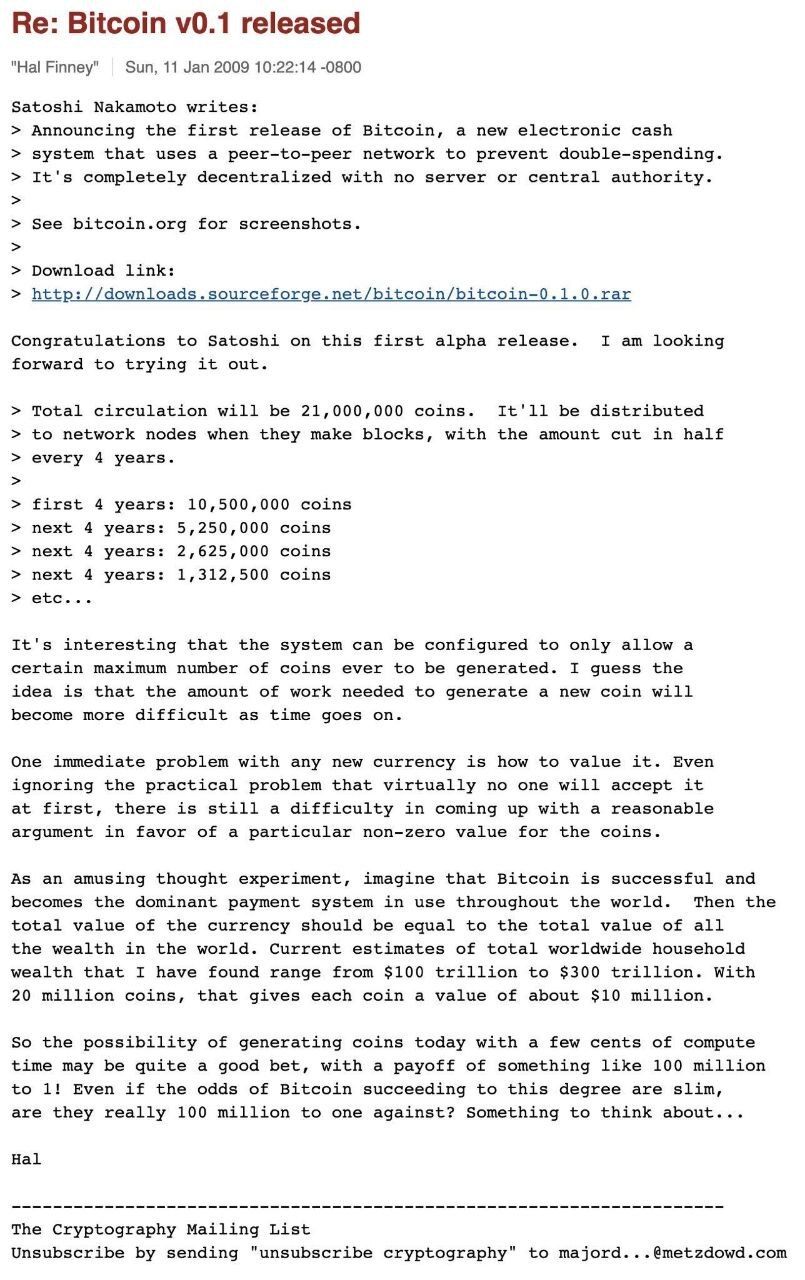

🟠 17 years ago Hal Finney said 1 BTC could hit $10M

🕵️♂️ Dubai’s regulator just slammed the door on privacy tokens

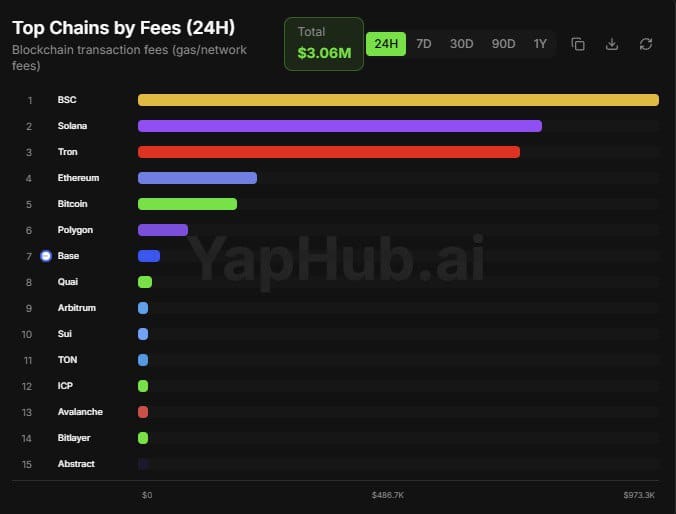

💰BSC just leapfrogged SOL in 24h fees

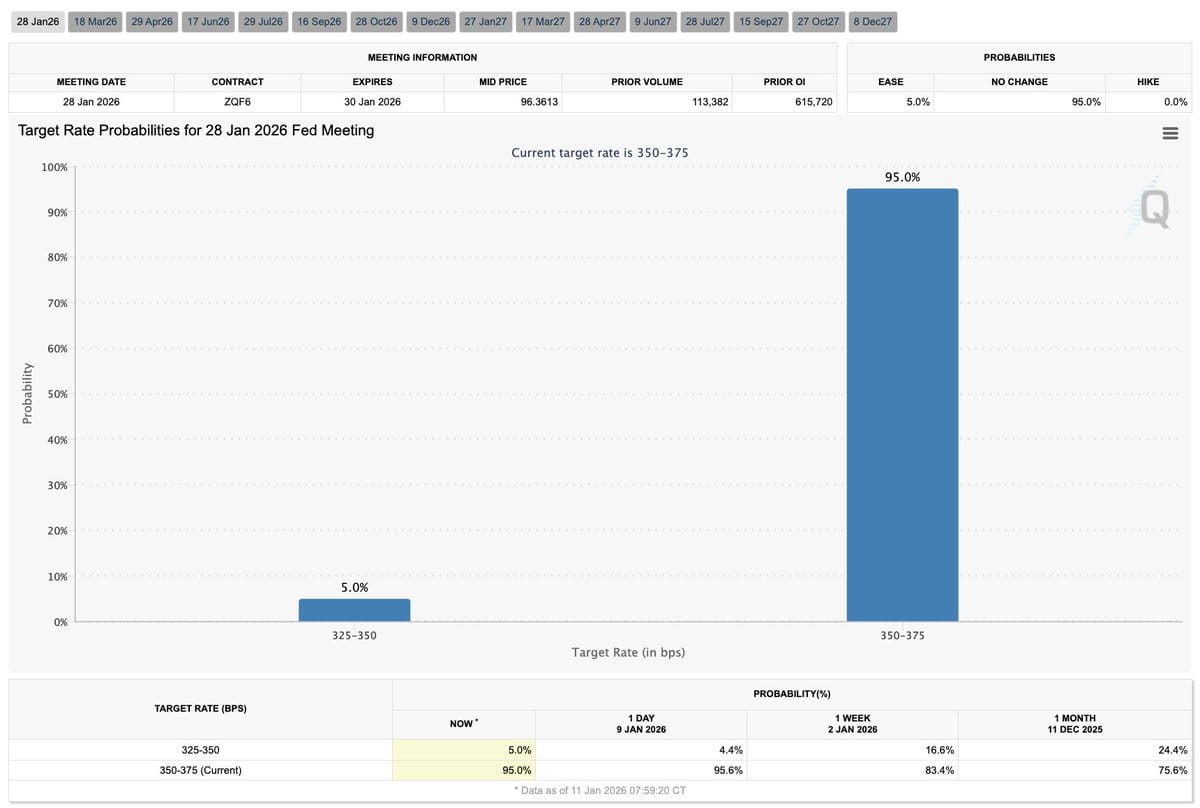

❄️ Only a 5% chance of a rate cut right now

🧠 Vitalik is pushing for stronger, truly decentralized stablecoins

Bitcoin hovering around $90K, and the range is getting crowded

Bitcoin is still grinding sideways around the low $90Ks. Sideways can last longer than anyone wants, but it does not last forever. When a range goes on for months, the eventual move tends to be sharp because positioning gets lazy and liquidity clusters build up.

This week, two real-world catalysts are lining up that can punch the market out of its comfort zone.

Holy Powell Gets Subpoenaed 🧨🏦

The U.S. just stepped into a new kind of macro circus: Federal Reserve Chair Jerome Powell says the Justice Department served the Fed with grand jury subpoenas and threatened a criminal indictment tied to his June testimony about the Fed’s building renovation project. Powell says the renovation angle is a pretext and frames the move as political pressure over interest-rate policy.

Why this matters for markets 🧠📉

1) The “price of money” is getting politicized

Central bank independence is basically a credibility layer for the currency. When that layer looks shakier, markets start demanding a risk premium. That premium shows up through volatility, hedging flows, and a stronger bid for “nonpolitical” assets (read: stuff that does not require trusting a committee).

2) Gold loves institutional chaos 🥇🔥

Reports on the day linked the escalation to stronger demand for gold and broader concern about Fed independence. (Trustnet)

3) Bitcoin’s identity test is back 🟠🧪

Bitcoin has two personalities:

“Digital gold” when trust in institutions wobbles

“High-beta tech” when liquidity and risk appetite drive everything

Todays news points at the institutions wobbles..

Catalyst #1 (Jan 14): Supreme Court opinions day, Trump tariff case in the blast radius

The U.S. Supreme Court is expected to issue opinions on Wednesday, Jan 14, 2026, and the “emergency tariffs” case is one of the big ones markets are watching. The Court has not said which cases will be decided that day, so it’s still a suspense box.

Why traders care (even if they pretend they don’t):

A ruling that strikes down the tariffs can trigger a messy refund process. Estimates floating around are huge, with reporting that $133.5B+ of tariffs are at risk depending on what the Court does and what happens next procedurally.

Treasury Secretary Scott Bessent has said Treasury can cover potential refunds, with Reuters noting the scale discussed as high as roughly $150B in some scenarios.

Macro mechanics that matter for risk assets: if uncertainty spikes, rates and dollar dynamics can move fast, and that tends to spill into BTC via liquidity and risk appetite channels. Reuters also flags the risk of volatility around this decision window.

Prediction markets have been pricing low odds for the tariffs being upheld (mid 20s to around 30% depending on the moment and venue).

Catalyst #2 (Jan 15): Senate market structure bill markup and vote

On Thursday, Jan 15, the Senate is scheduled to move forward with a crypto market structure markup and committee vote, widely framed around the CLARITY Act effort.

Why it matters:

Market structure is the boring plumbing that decides who regulates what and how tokens get classified. If the U.S. gets clearer rules, it reduces the odds of policy whiplash and helps institutions operate with fewer “career risk” excuses.

It is also political. Multiple outlets are highlighting that the calendar is tight heading into the 2026 election cycle and midterms, which can compress the window for big bills.

This is the kind of thing that can change sentiment without immediately changing price. Price still needs buyers to overpower sellers.

What the chart watchers keep circling back to

1) Trend beats narrative

Even “great news” can flop in a downtrend, while nonsense pumps in an uptrend. That’s not philosophy, it’s how flows work.

2) Watch magnets, not hopes

The transcript leans heavily on the 200-week moving average concept as a long-term gravity point. Whether that level is reached or front-run, the point is simple: major participants watch the same long-horizon references.

3) Short-term levels people obsess over

CME gaps and nearby liquidity pockets become targets during choppy regimes. They don’t predict the future, but they do explain why price “randomly” tags levels that feel arbitrary. Tight squeeze in between 90-92k..

Positioning and “who’s doing what” (with a reality check)

There’s a lot of talk about institutions accumulating and a potential supply squeeze narrative. That story exists, but price action has to confirm it. Relief Rally is looking more likely in case you want to do a quick trade but dont get suprised if betcoin gets denied at a 100k level since we are in a downtrend!

Reports have circulated about large banks increasing exposure via spot Bitcoin ETFs, including claims around Wells Fargo disclosures. Treat this as “interesting context,” not a holy signal.

Quick watchlist for this week

Jan 14: Supreme Court opinions day, tariff ruling watch, volatility risk elevated.

Jan 15: Senate crypto market structure markup and vote.

BTC range behavior: whether price stays trapped near $90K or starts expanding with follow-through.

Want to get the real alpha? Subscribe to our pro newsletter -> here

📍Unhosted AI Weekly: Up Only Charts, Down Bad Attention

🤖 AI Tokens - $28.9B Sector, Thinking Hard but Not Running Yet

AI market cap sits around $28.9B (+0.6% 24h) with volume near $2.9B. Translation: capital is parked, not chasing. Speculation is selective, not euphoric.

What’s moving

Story 🧠 ripping higher on narrative juice. Big daily and weekly gains, classic “new shiny AI thing” behavior. Fun momentum, fragile conviction.

Render 🎨 still grinding. Strong weekly trend, short term pullback. Infra names keep getting patience capital.

DeepNode 🧩 drifting lower. Attention fading, needs either product news or liquidity to wake it up.

Big picture

AI is acting like late stage accumulation. Money prefers infrastructure and real usage over buzzwords. No mania, no panic. Just builders and bored traders sharing the same room.

🦾 Robotics Tokens - $980M Sector, Cooling Fans On

Robotics market cap around $980M (-3% 24h) with $142M volume. According to many 2026 is the year of robotics. Let’s see if this accumulation levels find the demand needed to send it higher. All eyes are still on bitcoin breaking the bearish trend, until most attempts will be short lived.

Token read

Virtuals Protocol 🛰️ still the poster child. Large cap for the sector, but bleeding short term. Narrative leader, price leader not guaranteed.

Geodnet 📡 quietly strong on the weekly. Looks like real demand sneaking in, not just a candle cosplay.

Auki 🛠️ sliding. Liquidity thin, patience thinner.

Neuron 🧠 popping on low volume. Cute bounce, dangerous hold.

NATIX 🚗 continuing the slow bleed. This is a long game token acting like a short attention market.

Big picture

Robotics is still early, still niche, still illiquid. The idea is powerful. The market is not convinced yet. Bots trade it. Humans hesitate.

🧠 Final Take

AI has mindshare and capital parked with intent. Robotics has vision but lacks urgency. If AI is the brain, robotics is still learning to walk without falling over.

Playbook

AI: favor infra and usage. Expect chop.

Robotics: trade volatility, don’t marry the thesis yet.

Both: size small, respect liquidity, narratives don’t pay slippage.

Smart money is patient. Everyone else is refreshing charts.

🛠️ Sentiment Split - Crowd Picks New Heroes, Old Bags Cry

🟢 Good Sentiment - “Hope Is a Hell of a Drug”

Retail is back in risk-on mode, shopping for narratives and dopamine hits. The loudest chatter is clustering around Trove Markets (12.8K), WHALEGURU (11.2K), MultichainZ (11.0K), XMR (10.6K), and good old BTC (9.3K) proving it never really leaves the room.

L1 and infra names like XRP, SEI, SUI, ASTR, and Miden are getting steady love, while smaller plays like Flipster, BLUP, Inference Labs, and TermMax smell like early-rotation experiments. This isn’t pure mania - it’s selective optimism with a gambling problem.

🔴 Bad Sentiment - “Group Therapy in Progress”

On the other side, the cope is loud. Kontigo (-6.0K) leads the misery leaderboard, followed by Coinbase (-4.0K) reminding everyone that public equities feel pain too. BLAST, DUPE, HT, and TORN are all catching heat, while memes like SHIB and brands like CRO take emotional damage.

NFT-adjacent names Moonbirds, MX, META, and RIVER PTS round out the red zone - classic post-hype fatigue with no catalyst in sight.

👉 TL;DR

Green side is chasing infra, privacy, and “smart money” cosplay. Red side is full of yesterday’s narratives getting rotated out without mercy. Sentiment is split, not euphoric - which usually means volatility over direction.

Play it straight: ride strength with tight exits, fade the hate only if there’s a real catalyst, and remember sentiment flips faster than your PnL. The market doesn’t care who you believed in.

🛰️ Agent Market Check - $1.23T Sector, Price Mooning, Attention Bleeding

Agent market cap just ripped to $1.23T (+17.3% 24h) while Smart Engagement slid to 2.9K (-5.0%). Classic divergence. Capital is rushing in faster than people can tweet about it. Price action loud, conversation tired. That combo usually means rotation, not conviction.

Dominance snapshot:

BNB Chain and Polygon are doing cartoon numbers, mostly base effects and accounting optics. Other chains are getting left behind, down -22.9%, which tells you this move is concentrated, not broad. Money is picky right now.

📊 Leaders by Attention (24h):

🟢 FARTCOIN (8.33%, +2.26)

Still absurd, still winning. Meme gravity beats fundamentals when liquidity is bored. As long as attention sticks, it trades. When it doesn’t, it dies fast.

🟢 ELSA AI (7.48%, -0.79)

Still top-tier mindshare but slipping. The crowd likes the brand, not adding fresh conviction. Needs a product moment or it bleeds slowly.

🟢 WARP (6.4%, -1.77)

Solid presence, weak follow-through. People are watching, not buying. Feels like a setup waiting for a catalyst.

🟢 FET (3.77%, +2.77)

Real infrastructure, real bid. One of the few names where attention and price aren’t fighting each other. Quiet strength.

🟢 CGPT (2.63%, +0.52)

Grinding higher without hype. Not exciting, which is usually bullish in this market.

🔻 Losers by Attention:

🔴 VIRTUAL (3.77%, -2.41)

Attention evaporating. Narrative cooled, no new hooks. Market already moved on.

🔴 OPUS (2.54%, -2.42)

Classic post-hype decay. Still visible, just not wanted.

🔴 BNKR (1.35%, -2.18)

Former darling losing oxygen. Without fresh flow, wallets don’t save you.

🔴 REKT (2.28%, -1.13)

Name checks out. Attention leak continues.

👉 TL;DR:

Agent sector is pumping on capital rotation, not renewed belief. Price up, chatter down is a warning label, not a green light. FET and CGPT look like actual accumulation. FARTCOIN is still the casino table everyone crowds around. Everything else is fighting entropy.

Playbook: trade strength, fade silence, size down on vibes. When engagement comes back, that’s when trends get real.

Reply