- Unhosted Newsletter

- Posts

- Unhosted Weekly: Crypto MarketOverview #40

Unhosted Weekly: Crypto MarketOverview #40

The Orange Standard 🍊

🚀 BTC just poked its head above $123 K!

💵 Strategy’s Bitcoin stash just blasted past the $70 B milestone for the very first time!

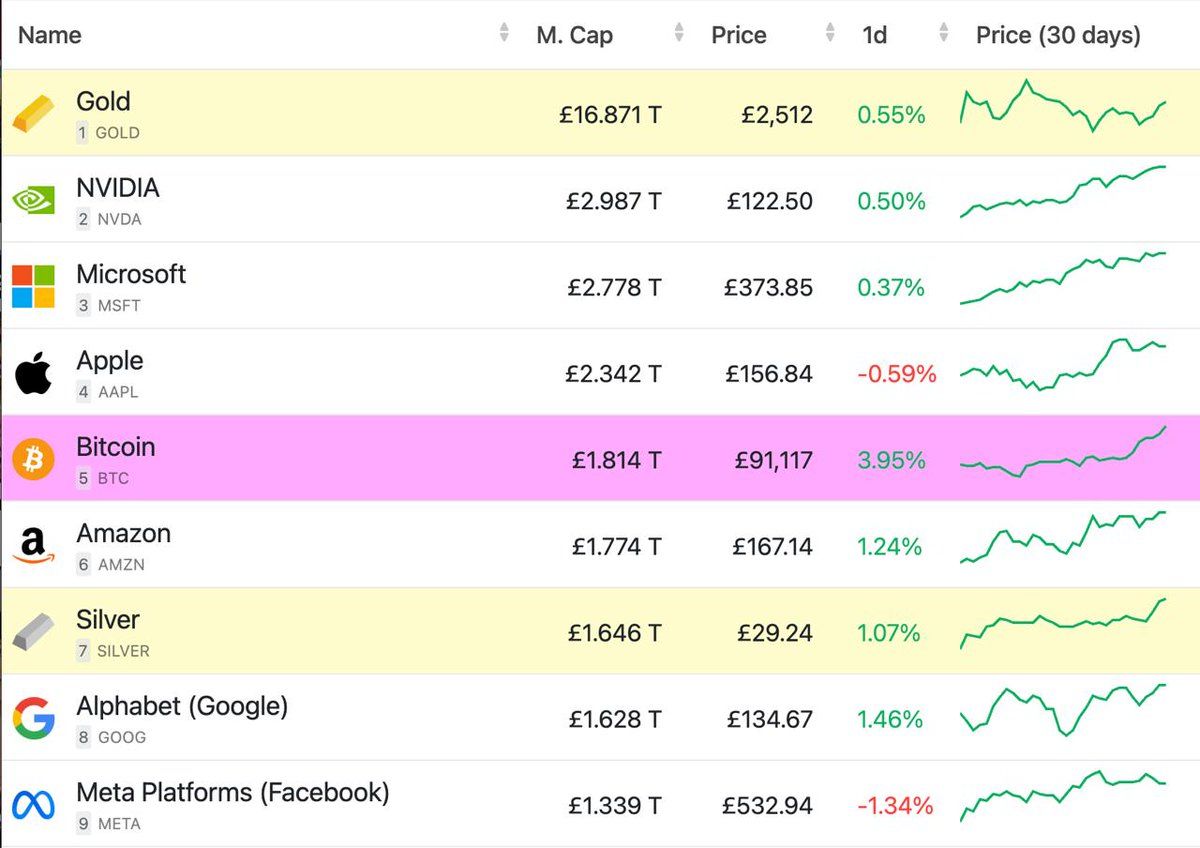

🏆 Bitcoin is now the 5th-largest asset in the world, surpassing Amazon, Silver, and Google.

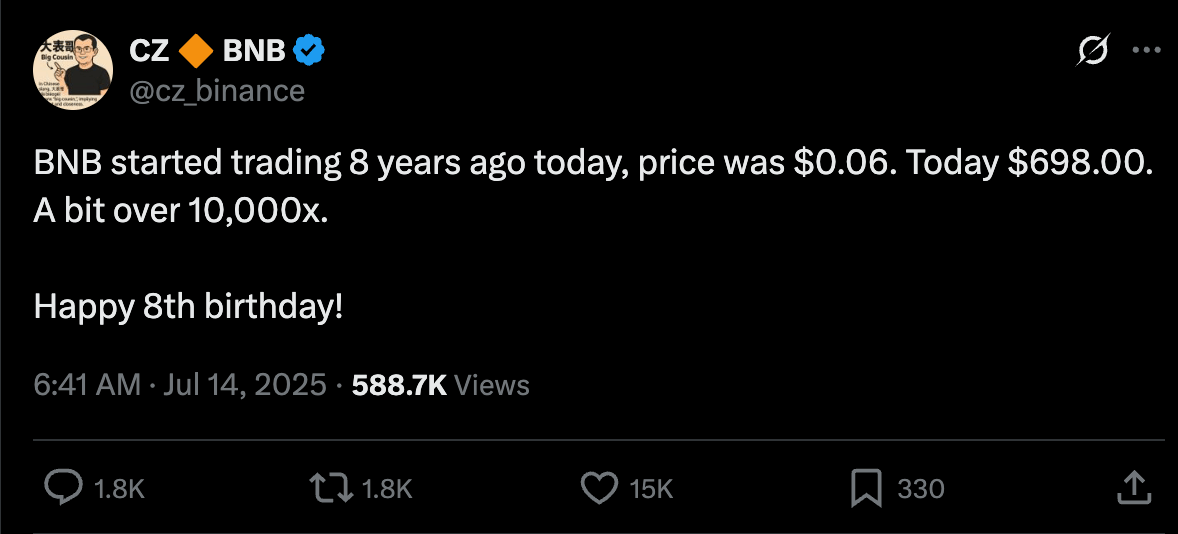

🎉 Today is BNB's birthday!

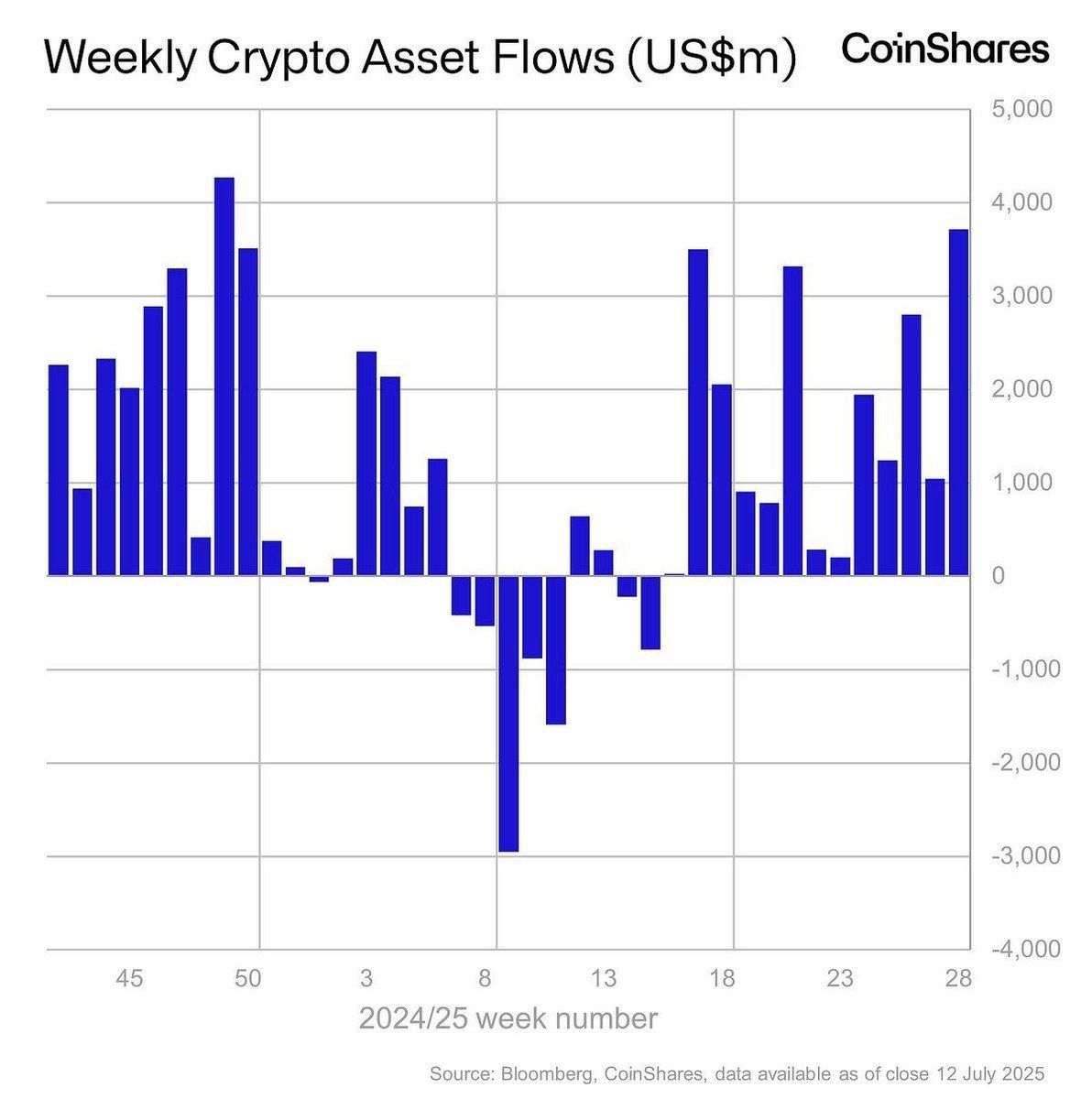

💸 Digital asset investment products see $3.7B in weekly inflows, the second-largest on record.

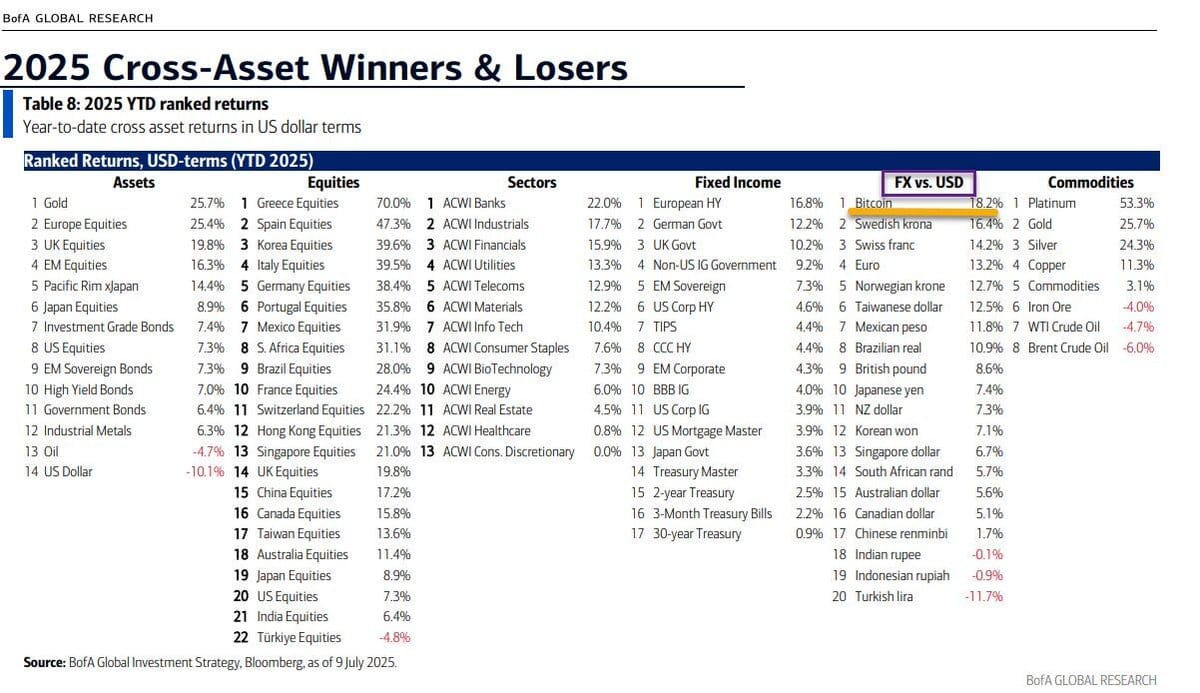

🔗 Bank of America lists Bitcoin as the best-performing currency of 2025.

Crypto Market Pulse – July 2025

From textbook break-outs to a looming $5 trn liquidity wave, the board is lighting up. Here’s how to position before the next leg.

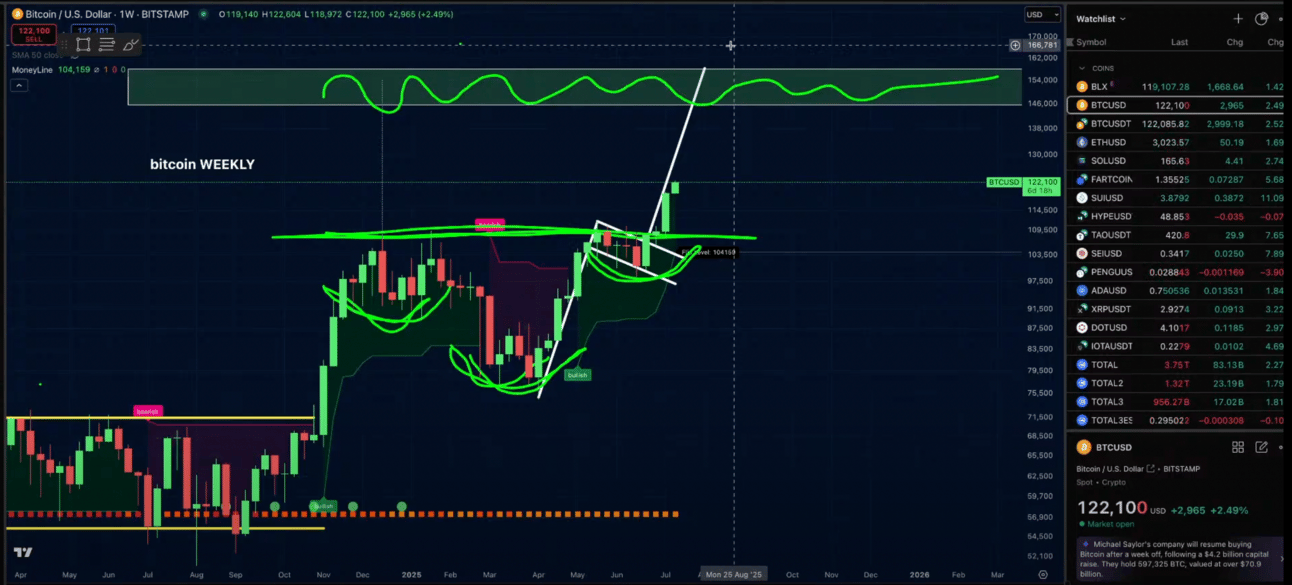

1. Bitcoin: Welcome to Price-Discovery Mode

Technical trigger | Why it matters | Positioning cue |

|---|---|---|

Weekly all-time-high close | Seven-month coil finally released. | Swing longs remain valid while $120 k holds. |

Bull-flag break | Text-book continuation structure. | Core target $150 k (measured move ≈ 25 %). |

Inverse head-and-shoulders | Confirms multi-month accumulation. | Secondary target $146–152 k. |

2.618 Fib extension | Few obstacles between $120 k → $150 k. | Trail stops just below $119 k; add on dips into former resistance. |

Actionable alpha

Size-down leverage above $148–152 k – first serious profit-taking zone.

Replace laddered limit sells with OCOs (order-cancels-other) to avoid getting wicked out of an accelerating parabola.

Hold a small cash buffer; post-breakout volatility is a feature, not a bug.

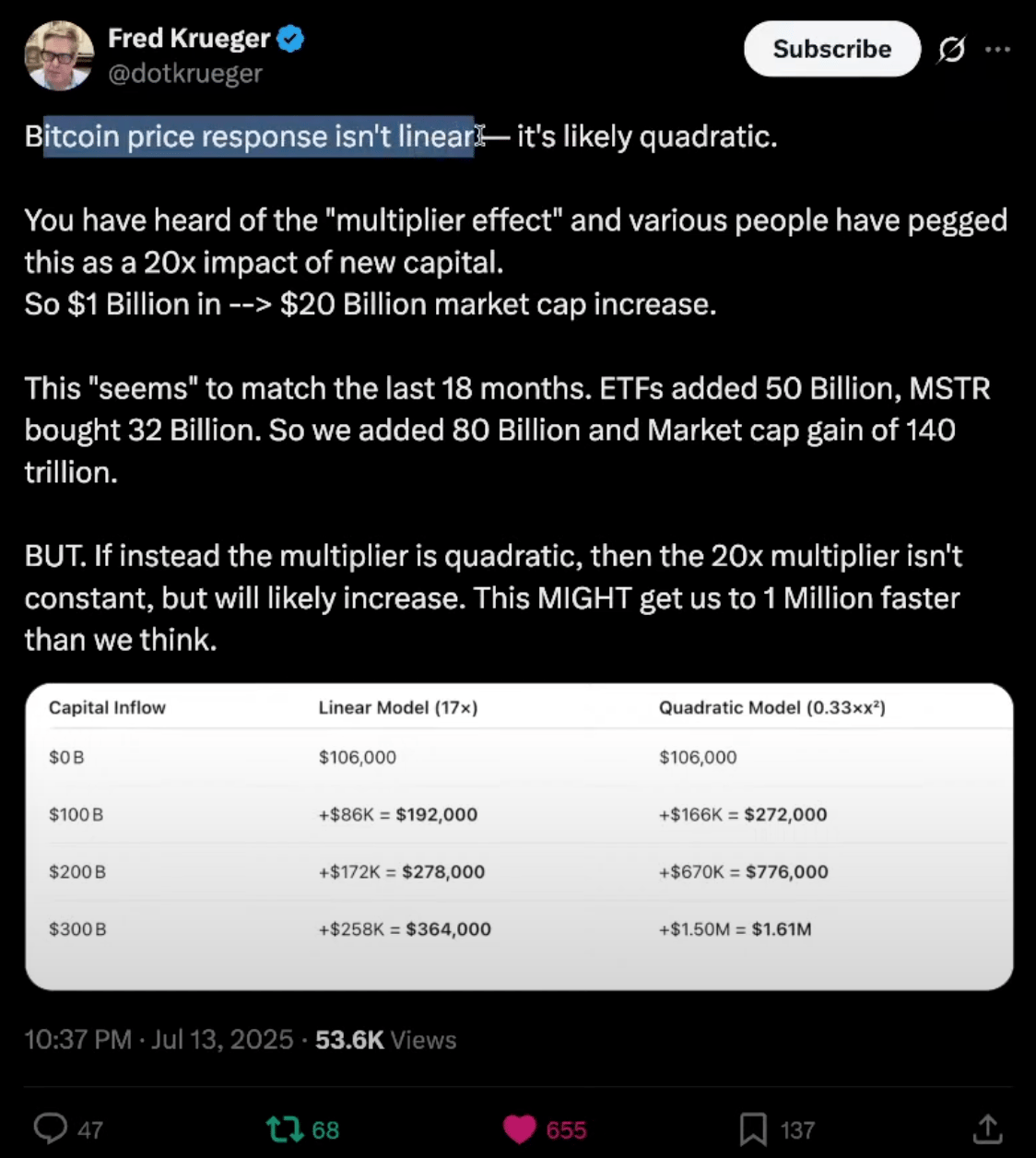

2. Macro Switch-On: “Big Beautiful Bill” = Big Beautiful Liquidity

$5 trn fresh debt: largest single expansion since the COVID bazooka.

Net effect: M2 climbs to new highs; real yields drift lower despite Fed inaction.

OTC desks dry: corporate treasuries (MicroStrategy, MetaPlanet) now lift directly on-exchange, pushing slippage onto screens.

Actionable alpha

When | What to do | Why |

|---|---|---|

Now – Q3 2025 | Run a net-long book across risk assets. | Liquidity leads price; fiscal taps are open. |

Every new Treasury refunding | Check BTC response within 48 h. | Lack of supply = quadratic price effect (à la Fred Krueger). |

If 10-year > 4.75 % | Hedge with short-dated puts. | Sign of funding stress; temporary crypto pullbacks follow. |

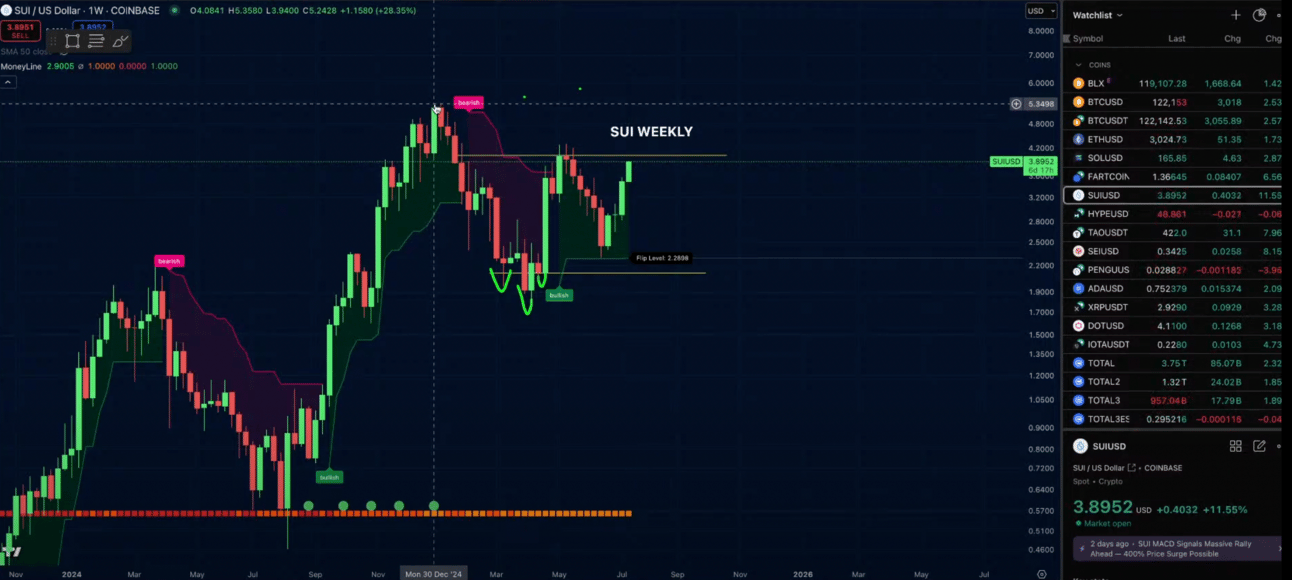

3. Altcoin Rotation: Engines Igniting

Fastest momentum flips

Ticker | Catalyst | Immediate level |

|---|---|---|

HYPE | Breakaway from seven-month range | Tagging price discovery – scale out above 0.0009 BTC |

SUI | Third attempt at $4.00 ceiling | Monitor hourly close > $4.05 for trend continuation |

BONK | Launchpad revenue → buyback & burn | Next supply wall US$0.000055 |

XRP | Weekly money-line flip + stable-coin traction | Fresh weekly long; invalidate < $0.53 |

IOTA | MoveVM main-net + new DeFi suite | Room to 0.000013 BTC (200-WMA) |

ALT season is here - 196 tickers flipped bullish vs USD, 148 vs BTC last week

Portfolio map (suggested weights)

50 % BTC core

20 % ETH (post-ETF inflows)

15 % High-beta majors (SOL, SUI, HYPE)

10 % Narrative trades (IOTA, BONK, PENGU) 5 % Dry powder Rebalance weekly until BTC dominance < 63 %.

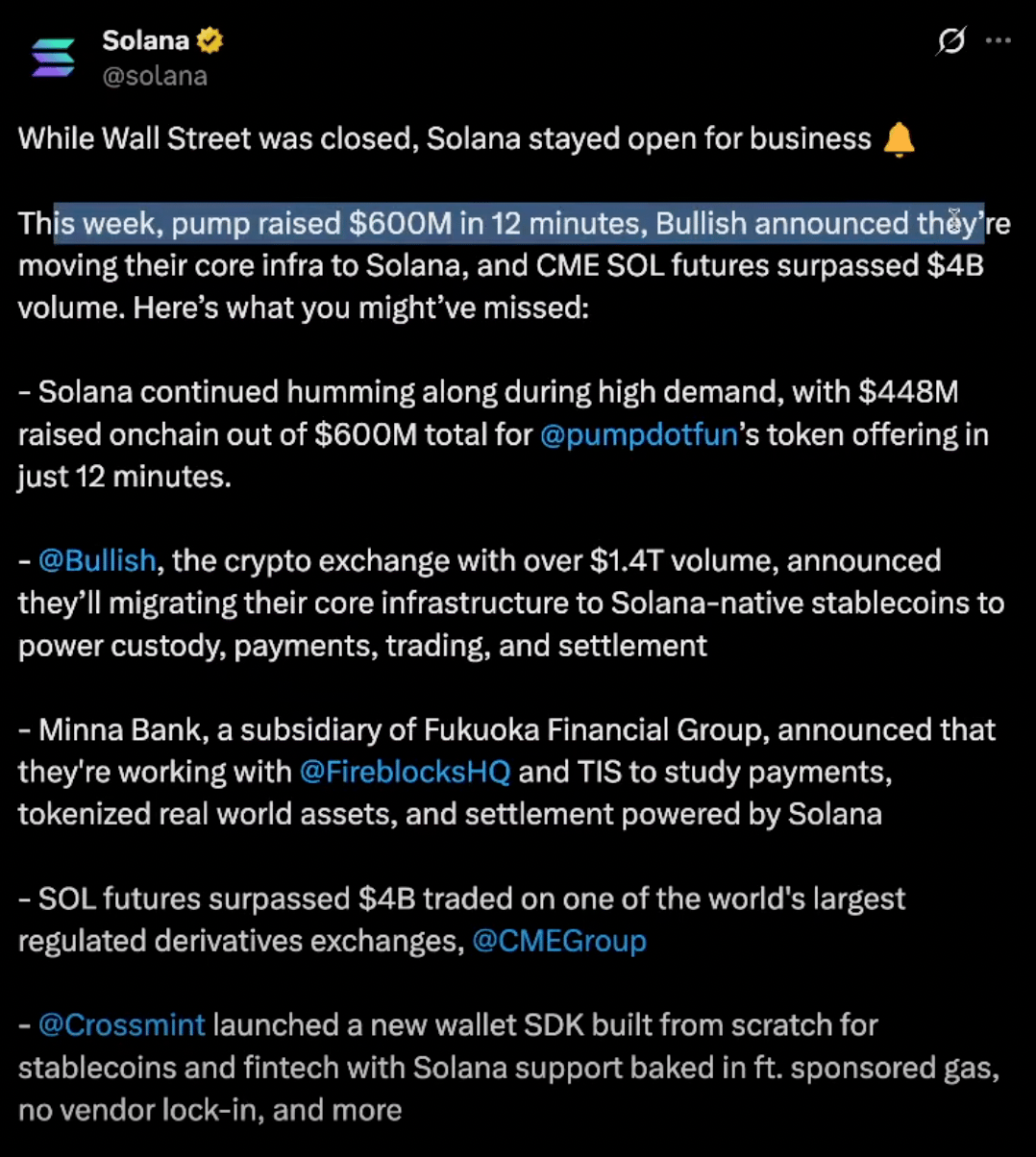

4. Solana Corner: Throughput Meets Real Revenue

Theme | Latest data | Why it matters |

|---|---|---|

Tokenised stocks | 90 % of all on-chain equity volume now routes via SOL. | Institutions interact without CEX custody. |

BONK-Launchpad | 29 k SOL bought for burns (annualised 156 k SOL). | Revenue recycles back to holders – unlike Pump.fun. |

DePIN / GPU cloud | Theta EdgeCloud & Hivemapper both migrate worker payouts to SOL. | Cash-flow protocols anchor treasury demand. |

Key SOL levels

$188: turns weekly trend decisively bullish vs ETH.

$230: window to new ATH; layer on optionality (long dated calls) if broken.

5. Ethereum Roadmap: Institutional Story vs. Builder Reality

EF “Scalable L1” blog: commits to more blob-space, statelessness and quantum-safe signatures—but still centred on L2 roll-ups.

Kathy Wood calls it “the right move”; TradFi loves the narrative.

Builder push-back: Monad & other Move-based chains courting EVM devs with base-layer throughput (no separate sequencers).

Actionable alpha

Trade the narrative: overweight ETH until spot-ETF inflows plateau.

Build on chains where users live: SOL, SUI, upcoming Monad; simpler UX wins the cycle.

For ETH gas exposure, accumulate blob-heavy L2 sequencer tokens only on dips; they’ll underperform once base-layer fees stay low.

6. Policy & Regulation Watch

Jurisdiction | What’s cooking | Hedge |

|---|---|---|

EU / ECB | Floating idea of redirecting retail savings into “strategic projects”. | Keep > 50 % stack in self-custody, outside EU banks. |

UK | BoE warns against bank-issued stable-coins. | Diversify into on-chain USD stables (USDC, USDT, PayPal USD). |

Switzerland | Green party wants 50 % wealth tax on > CHF 50 m. | Consider multi-sig with foreign co-signers; residency flexibility. |

7. Key Levels & Calendar

Asset | Breakout level | Pull-back buy zone | Catalyst to watch |

|---|---|---|---|

BTC | $128 k 4-h close | $119–121 k | U.S. CPI – 19 Jun |

ETH | $3 650 | $3 300 | Spot-ETF flows (weekly) |

SOL | $188 | $157–162 | Firedancer Dev-Net Q3 |

SUI | $4.05 | $3.55 | Tencent partnership rumours |

XRP | Weekly close above $3 | $2.75 | Ripple stable-coin TVL milestones |

9. TL;DR Action List

Stay long BTC until weekly closes < $120 k.

Rotate 30 % of performance capital into majors flipping vs BTC (SOL, SUI, XRP).

Deploy grid-bots on high-range, high-narrative alts (e.g., COOKIE, FORT).

Keep 5 % cash—hyper-volatile breakouts still offer flash-fill bargains.

Monitor policy headlines; self-custody and jurisdictional optionality are no longer optional.

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply