- Unhosted Newsletter

- Posts

- Unhosted Weekly: Crypto MarketOverview #41

Unhosted Weekly: Crypto MarketOverview #41

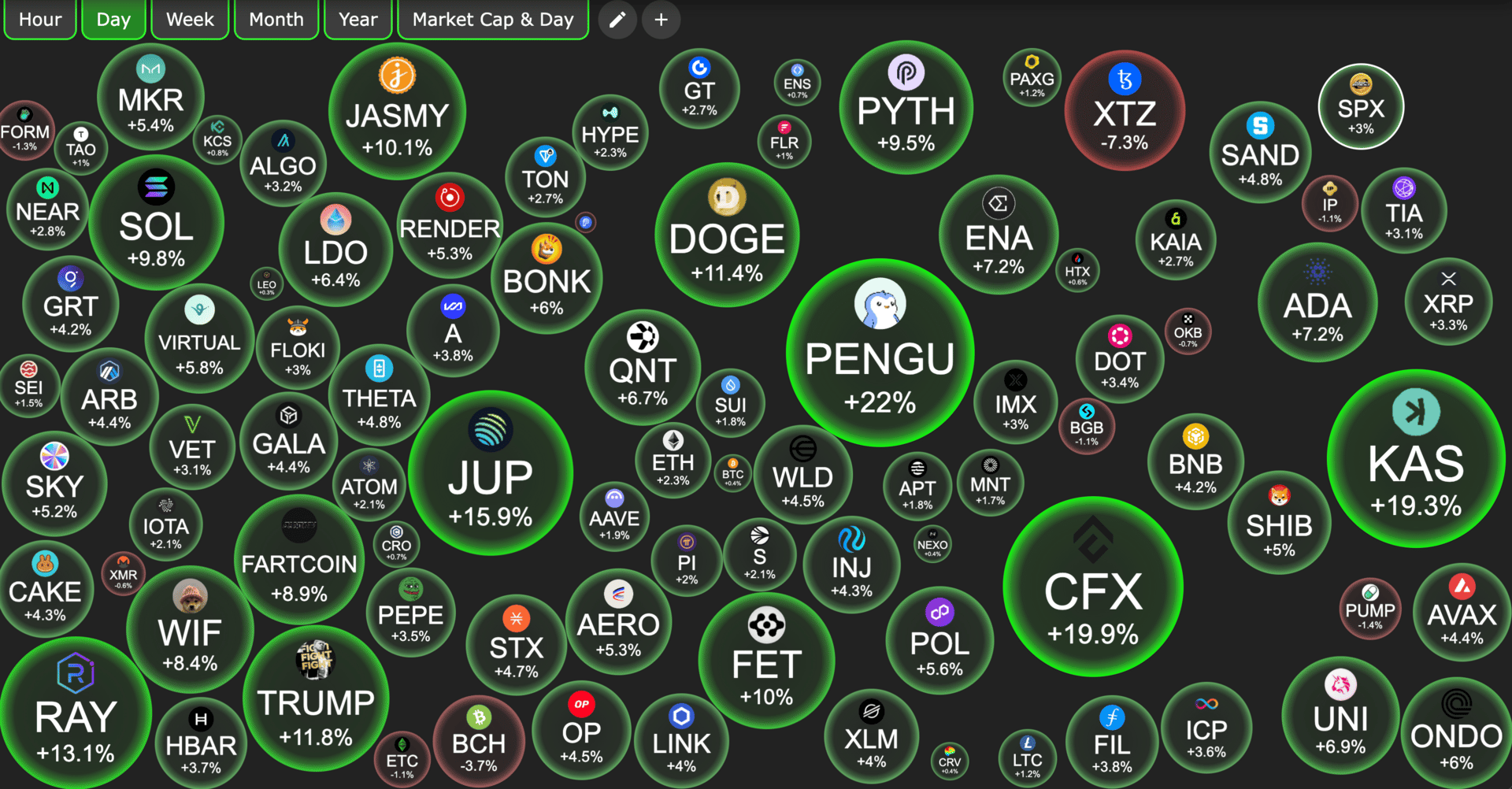

Dominance Collapsing - BTC Hoarding Continues 💰

🇺🇸 Trump Media holds $2B in $BTC and Bitcoin-linked assets — that’s ⅔ of its $3B liquid bag.

🐧 $PENGU just flipped $TRUMP to become the #2 memecoin on @Solana by market cap.

📈 Strategy just boosted its BTC stack again!

🔥 Ethereum is riding a wave — just broke through the $3,800 range with consistent daily gains and surging ETF inflows.

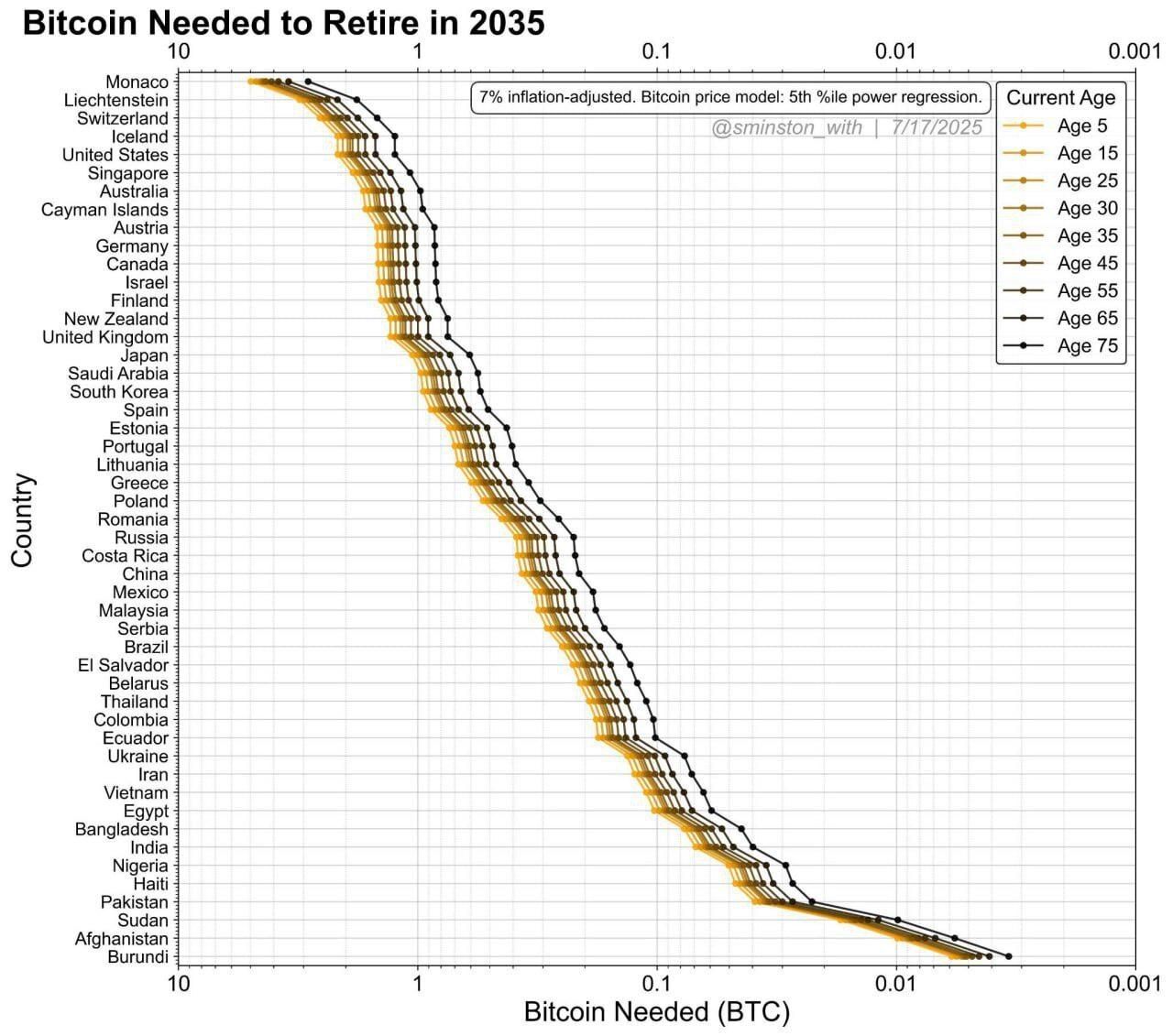

🌍 How much BTC to retire by 2035?

Market Note – 15 July 2025

A 12‑minute read on the week’s most tradeable shifts — and exactly how to play them.

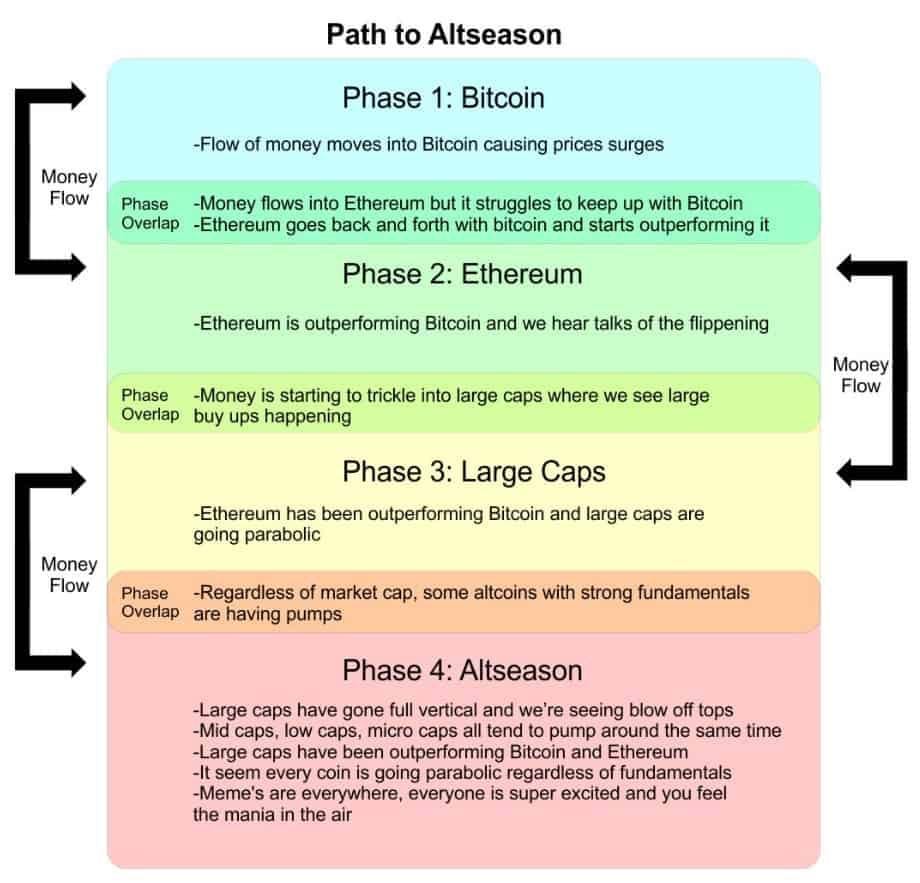

1. Follow the Flow: How (and When) to Rotate From BTC → ETH → Altcoins

Action‑ready playbook for riding the classic crypto money‑flow cycle:

Cycle Phase | What Usually Happens | Concrete Signals to Watch | How to Position |

|---|---|---|---|

1. Bitcoin Season | Fresh fiat pours into BTC first. | • BTC sets higher‑highs on weekly chart. | • DCA into BTC only. |

2. Overlap / ETH Ignition | BTC cools; ETH starts catching bids as traders hunt beta. | • ETH/BTC climbs > 0.06 and holds 2–3 weekly closes. | • Rotate 15‑25 % BTC profits into ETH. |

3. Large‑Cap Alt Season | ETH’s strength bleeds into top‑20 alts. | • Altcoin‑Season Index > 75. | • Harvest ETH gains in tranches; redeploy into liquid large caps. |

4. Mid/Small‑Cap Mania | Retail FOMO arrives; narratives (AI, memecoins, real‑world‑assets) explode. | • Parabolic moves & 30 %+ daily swings. | • Cap exposure to 10 % portfolio spread across < 10 picks. |

5. Euphoria → Exit | Liquidity thins; large wallets distribute. | • Total‑mc / Stable‑coin‑mc ratio > 12. | • Tighten stops; raise cash to 50 %+. |

Tools & Alerts to Automate the Plan

ETH/BTC Ratio – add an alert at 0.06 (phase‑transition) and 0.075 (euphoria).

Altcoin Season Index – > 75 = go heavy large caps; < 25 = stay with BTC.

DefiLlama TVL Heat‑Map – shows where real liquidity is moving.

Google Trends “buy crypto” – a free sentiment spike detector.

TradingView Trailing‑Stop Script – auto‑clips 20–30 % pull‑backs in mania phase.

Risk Rules That Keep You Alive

Keep a non‑negotiable core BTC stack (25–40 %)—never rotate it.

Use position sizing, not conviction, to manage unknowns: 1–2 % per micro‑cap.

Pre‑plan exits: every time a coin 3×’s, withdraw your original stake.

Respect cycle compression—what took 18 months in 2017 now fits inside 6–9 weeks.

Master these rotations and you’re no longer guessing “When alt‑season?”—you’re synchronised to it. Stay nimble, stay systematic, and let the money flow pay you instead of surprising you.

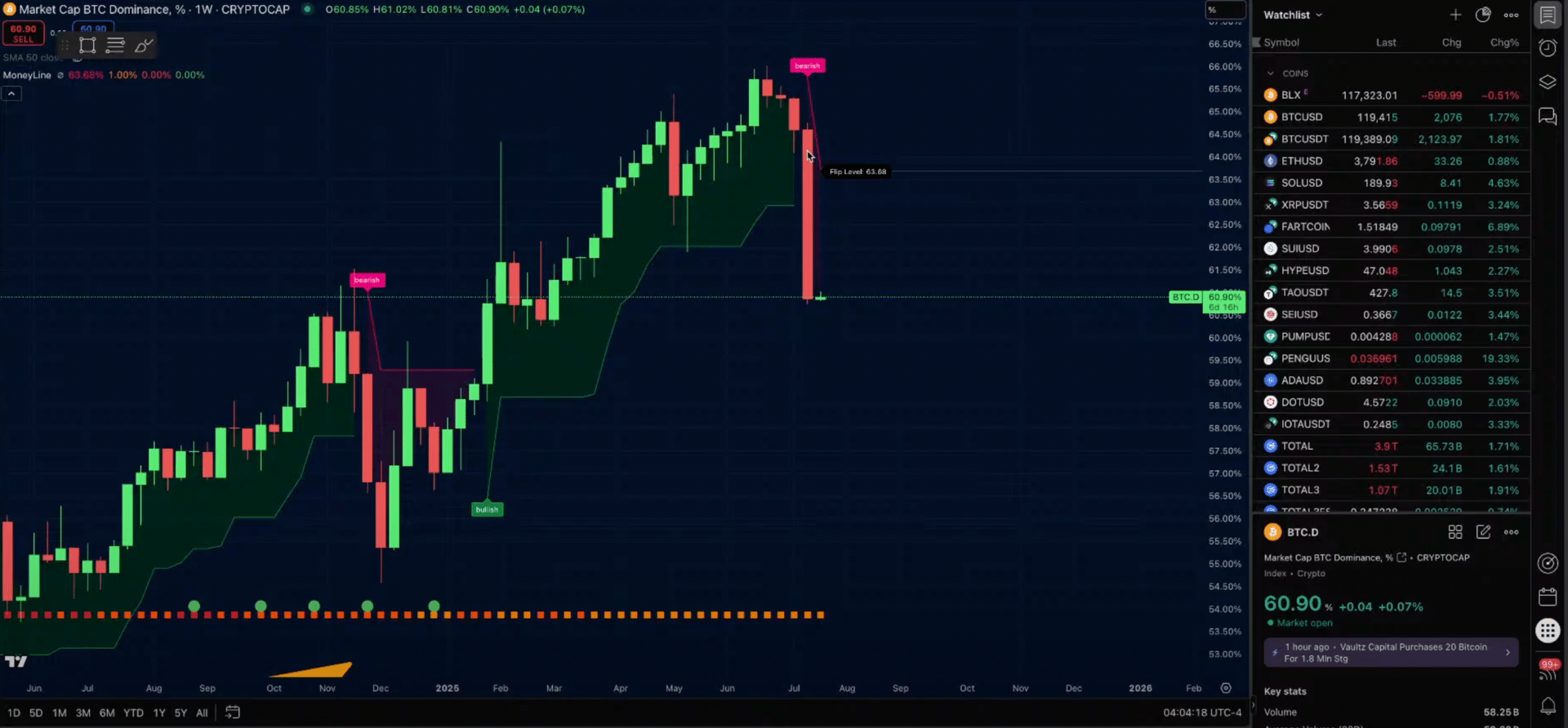

2. The Alt‑Season Trigger – BTC Dominance Cracks

Key prints

Weekly BTC.D close < 63 % 🔻

Two‑Week momentum rolls bearish for first time since Q1‑21.

Playbook

Allocation move | Rationale |

|---|---|

Rotate 25–30 % BTC → high‑beta majors (SOL, DOGE, SUI, XRP) | Capture relative‑strength pop historically worth 2–3× BTC returns. |

Retain core BTC hedge (40 %) | If dominance snap‑backs, you’re still long king coin. |

Tactical long‑only basket in mid‑caps | Weight by on‑chain revenue growth (see §5). |

Dominance stays sub‑63 % → stay aggressive. Weekly close back above 64 % → cut alt exposure by half.

3. Fast‑Moving Names & Trade Set‑Ups

Ticker | Catalyst & Metrics | Entry / Invalid | Targets |

|---|---|---|---|

PENGU | Social‑media coup in Asia; NFT floor + 120 % | 0.036 / invalidate 0.030 | 0.055 → 0.10 |

DOGE | Double‑bottom and 2‑wk money‑line green | 0.17 / inv. 0.149 | 0.24 → 0.40 (dbl‑btm) |

BONK | Launchpad rev‑share burns 89 k SOL | 0.000042 / inv. 0.000036 | 0.000055 → 0.000072 |

SUI | TVL +90 % in 45 d, Bluefin vol. ATH | 3.90 / inv. 3.55 | 4.80 → 6.00 |

Tip: Use ATR‑trailing stops (1.5× 14‑day ATR) once first target hit to keep runners alive.

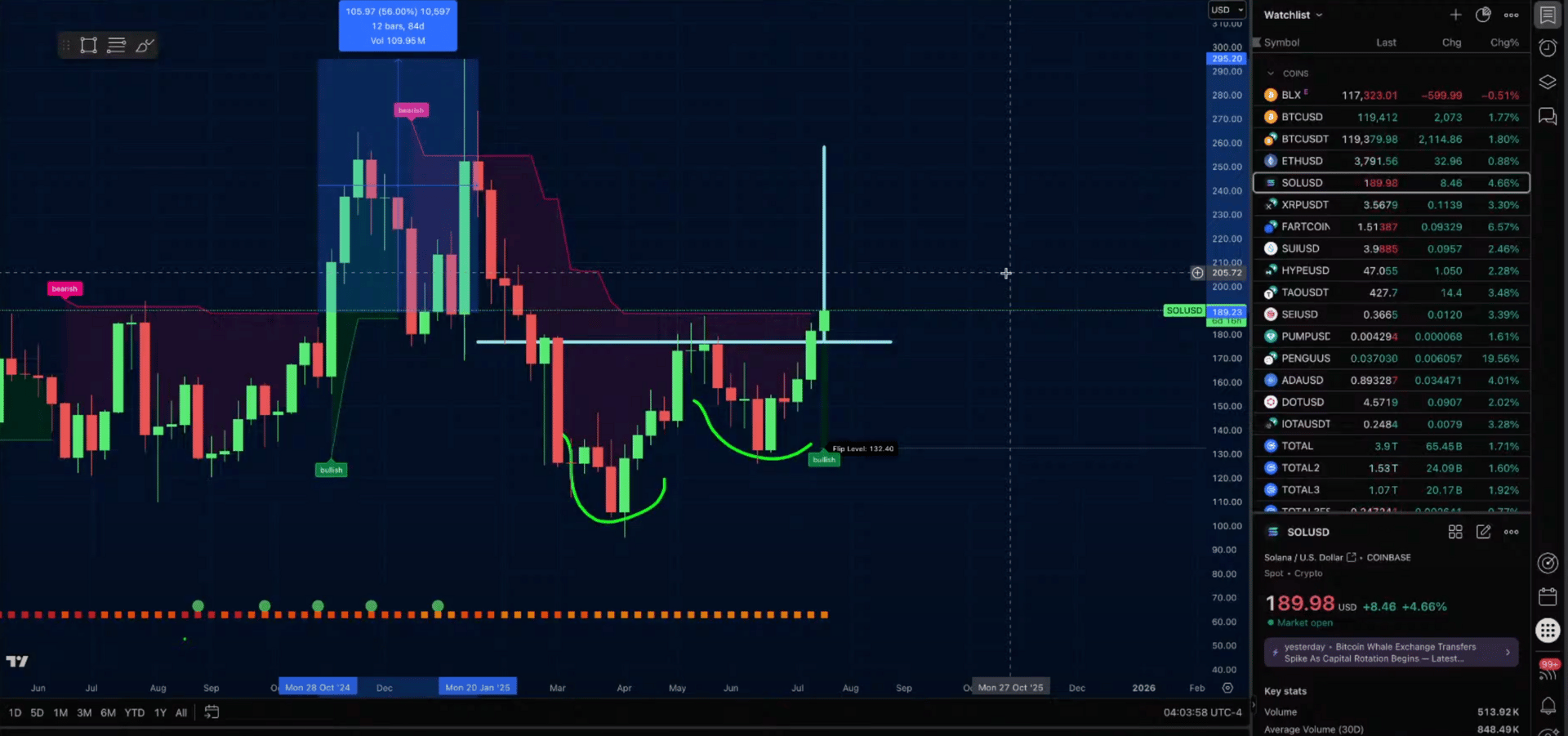

4. Solana Steals the Show — How to Ride It

Technical picture

Metric | Status | Comment |

|---|---|---|

Weekly money‑line | Bullish flip @ $180 | First since Aug‑23; needs weekly close > $180. |

Double‑bottom target | $260 | Classic breadth‑thrust break. |

On‑chain active wallets | 70 M (⤴ 330 % YoY) | Confirms narrative traction. |

Execution map

Break‑out add‑on

Spot tranche @ weekly close > $180.

Stop (weekly) < $162.

Dip‑buy zone

$165–170 → staggered ladder of bids (20 % portfolio each).

Watch 12‑hr money‑line to time reloads.

Targets & scale‑outs

T1 $230 (prior supply).

T2 $260 (dbl‑bottom measured‑move).

T3 $315–330 (fib/ATH anchoring).

Derivative kicker

30‑day SOL IV remains < 90 %. Sell 0.20‑ΔPuts (150 / 155) to finance 0.30‑ΔCalls (250 / 275). Structure nets flat premium, limited downside, unlimited upside through summer.

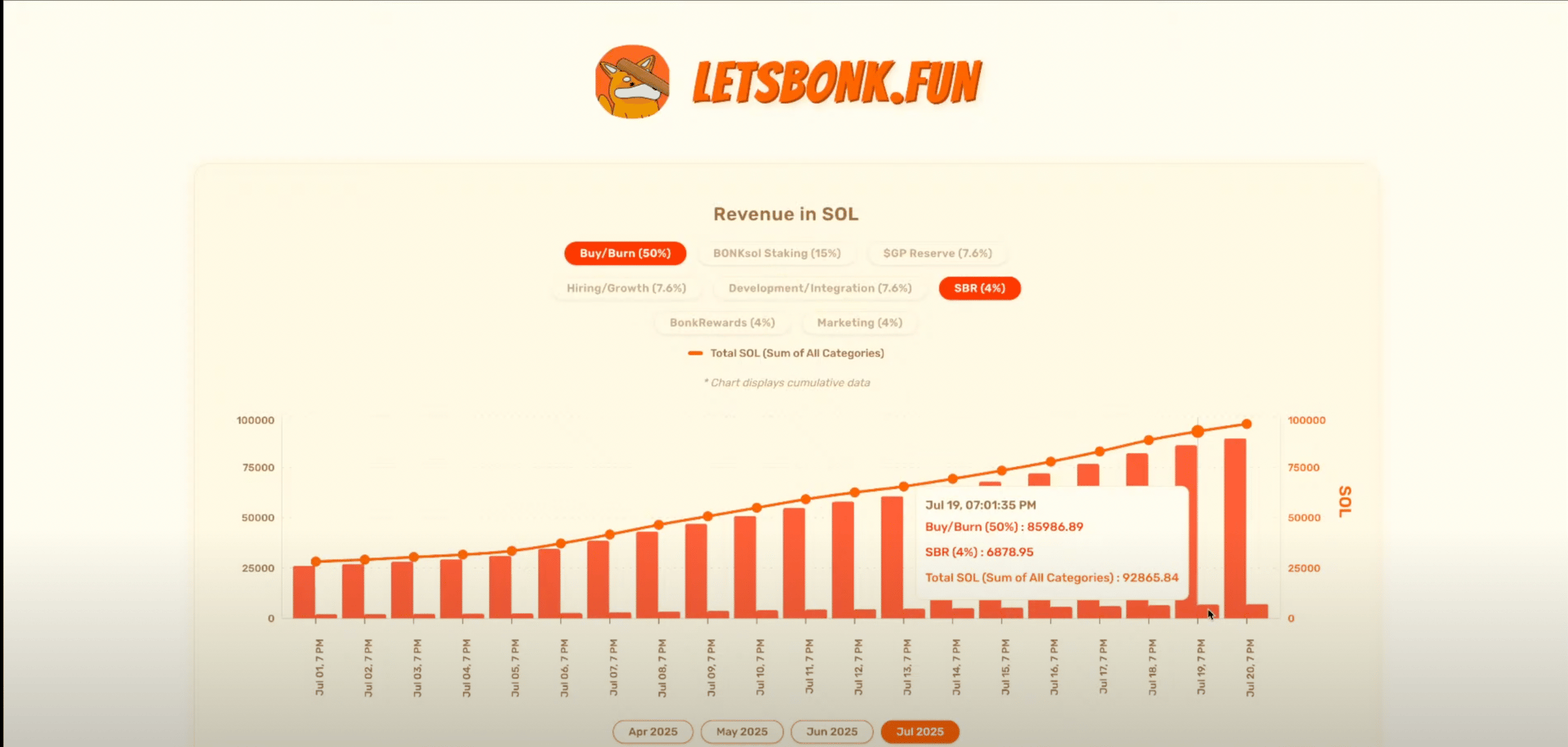

5. BONK – The “Revenue‑Burn” Meta in Action

Why it matters

Unlike most meme tokens, BONK has a hard‑coded cash engine: every SOL paid to the launch‑pad (BonkBot + BONKpad) is funnelled into market‑buys and irreversible token burns. You are effectively long a shrinking float.

Last 30 days | Figure | Trend |

|---|---|---|

Fees collected | 89 k SOL ($15.2 M) | ⤴ +74 % MoM |

SOL used to buy‑back BONK | 100 % | Policy vote locked till ’27 |

Supply burned YTD | 13.1 % | Deflation rate accelerating |

Set‑ups

Strategy | Details | Risk control |

|---|---|---|

Spot swing | Buy on fee‑spike Mondays (launch‑pad day), sell 30 % at next weekly burn tweet. | Hard stop 9 % below entry. |

Grid‑bot | 0.000036–0.000055 range, 40 grids, 3 × leverage. | Use 50 % of intended capital; bot auto‑DCA’s dips. |

Yield loop | Stake BONK/USDC LP on Raydium (38 % APR) → farm rewards → auto‑convert to BONK. | Impermanent loss; hedge 50 % notional with short BONK‑PERP if price gaps > 25 % weekly. |

Alpha kicker: Track revenue.bonk.fun dashboards; whenever daily SOL inflow > 4 k, BONK has historically rallied an average 17 % over the next 48 h.

PS Bluefin, Jito GMX and pumfun also can be put in the same bucket of protol buybacks.

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply