- Unhosted Newsletter

- Posts

- Unhosted Weekly: Crypto MarketOverview #42

Unhosted Weekly: Crypto MarketOverview #42

Glimpses of ALT season 💰

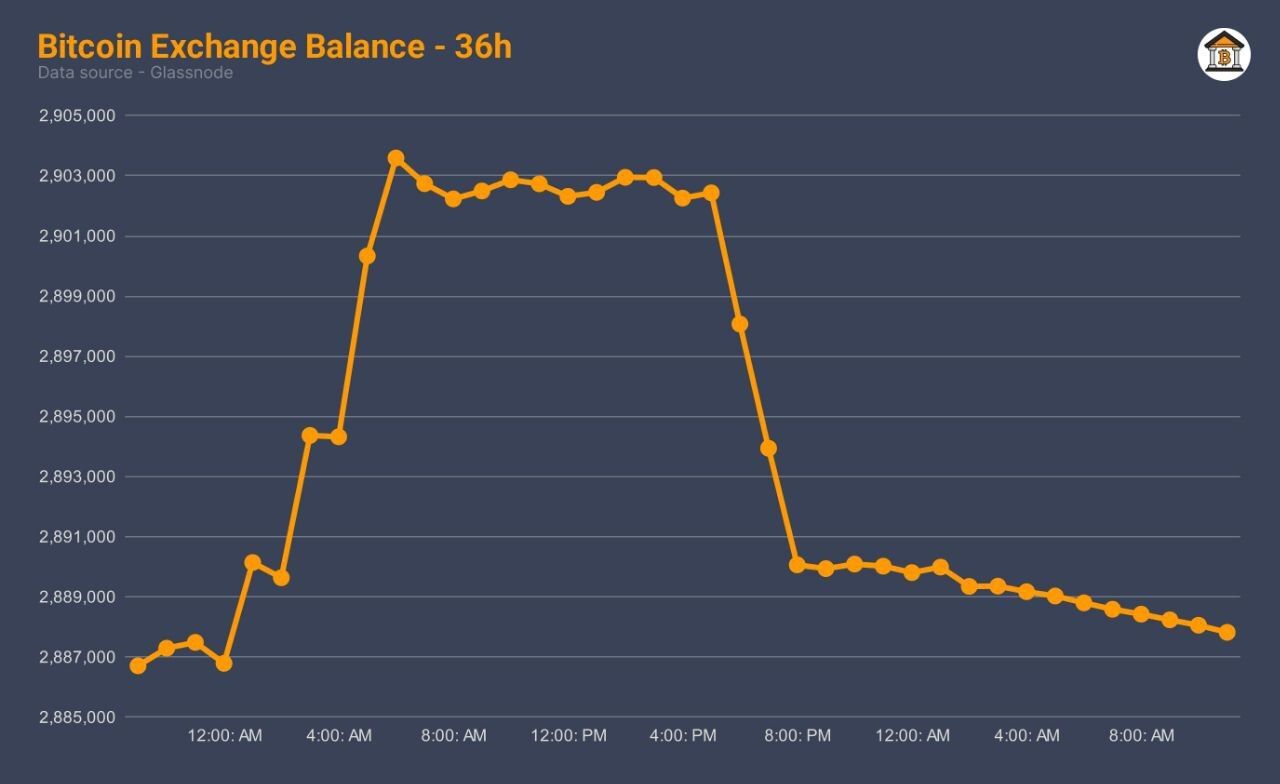

📤 The market has reduced the exchange balance by 14,908 bitcoins in the last 24 hours, leaving 2,887,826 BTC available

🔸 CEA Industries and 10X Capital with the support of YZi Labs announced a private placement of shares for $500 million, aiming to create the world's largest public company with a BNB treasury

💸 Sequans acquired 755 bitcoins for $88.5 million

In total, they bought 3072 BTC for $358.5 million at an average price of $116,690 per coin

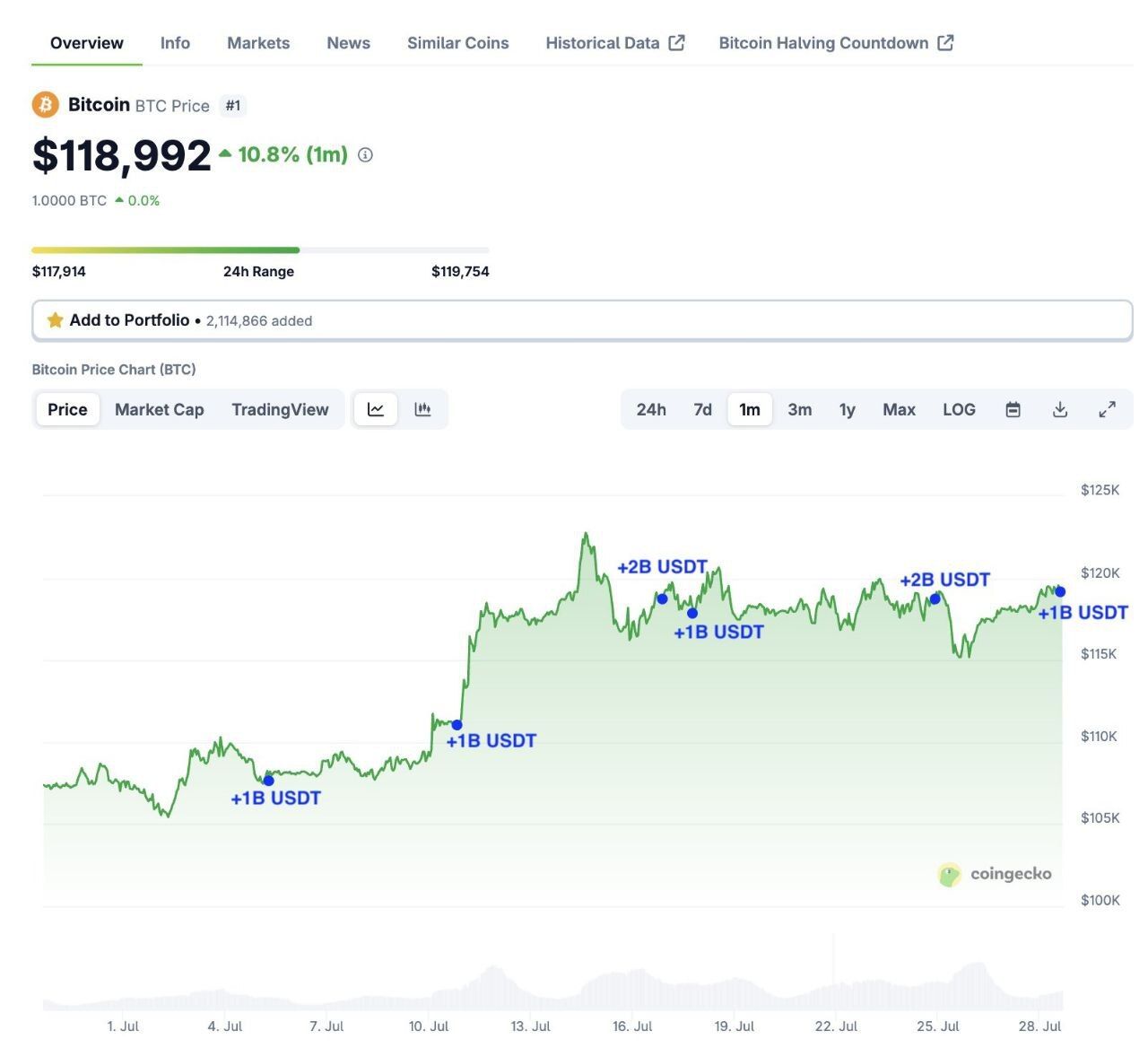

🖨 Today's billion USDT printed by Tether became the eighth billion in the last 25 days

Tron accounts for $2 billion of this issuance, another $6 billion was issued for Ethereum

During this period, BTC price rose by 16.5%

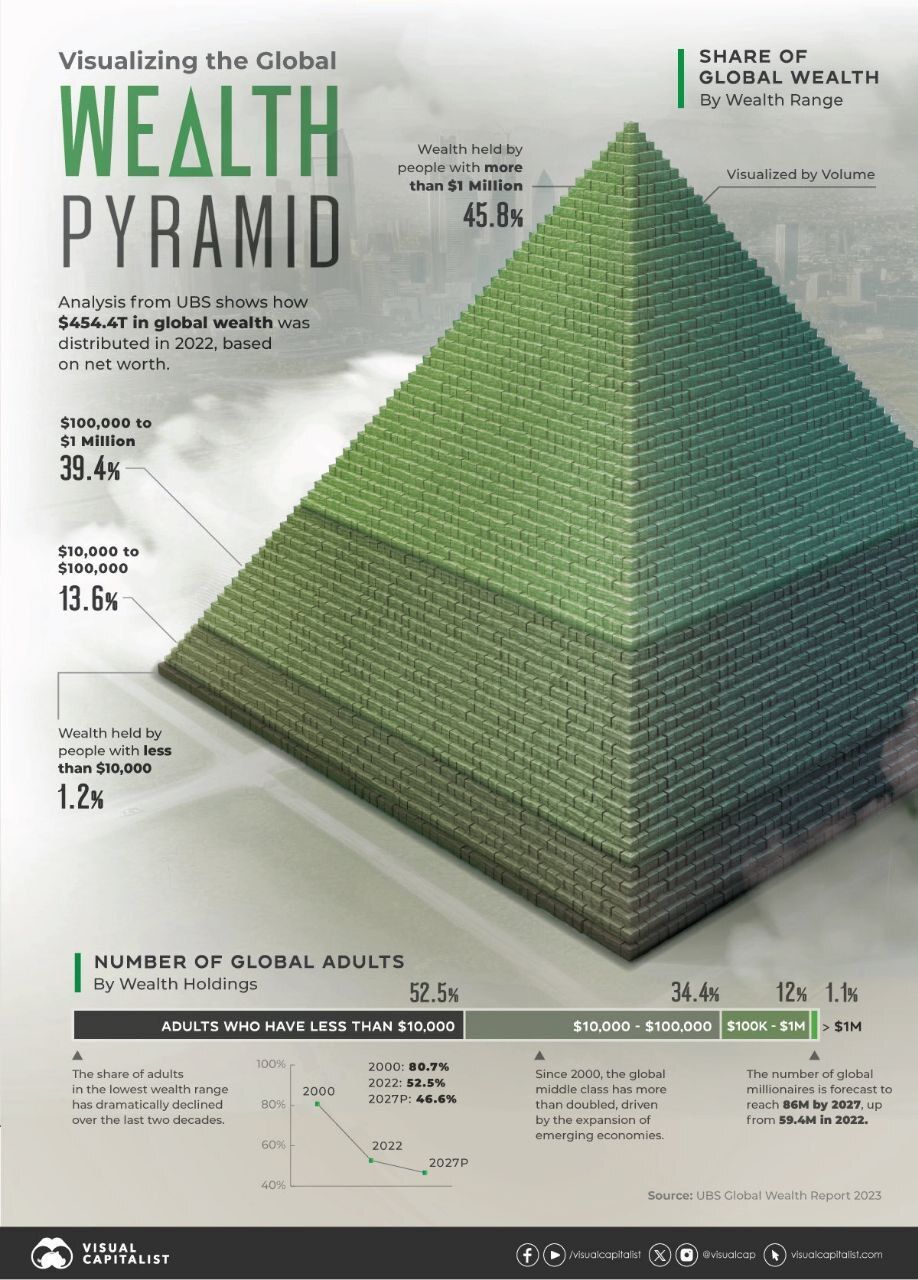

🧮 How much could one Bitcoin cost, depending on the redistribution of global wealth

The whole world today is worth $454 trillion. Thus, Bitcoin today occupies a share of 0.5% ($2.35 trillion)

1% → $228,000 per BTC - 2% → $457,000 per BTC → 5% → $1.14 million per BTC

📉 PUMP is again worth less than a billion dollars

From “ETH Is Dead” to “ETH Is Winning”—Key Moves to Make Right Now

A trader‑to‑trader recap of six frenetic weeks, distilled into what matters next and the trades that fit.

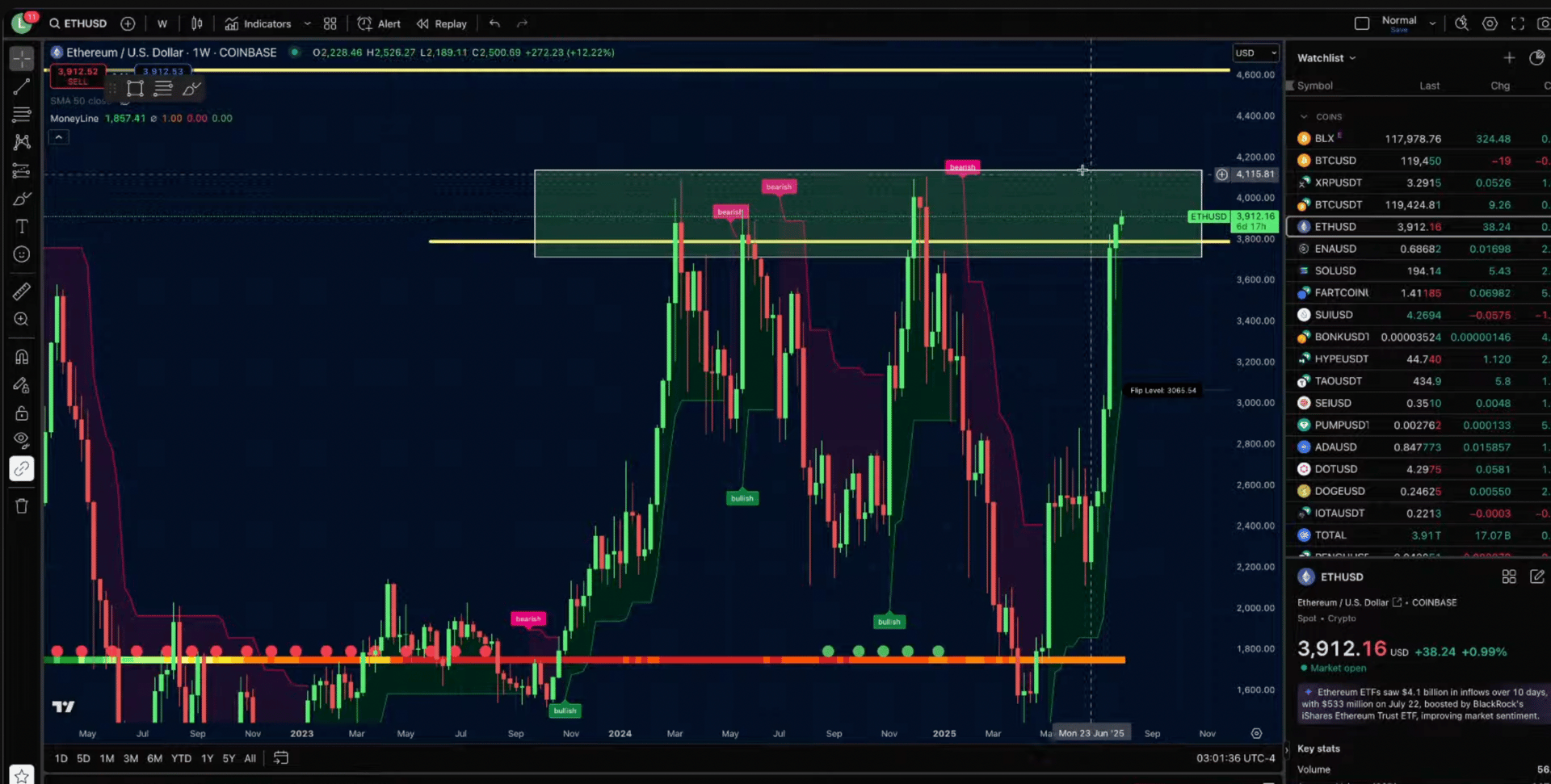

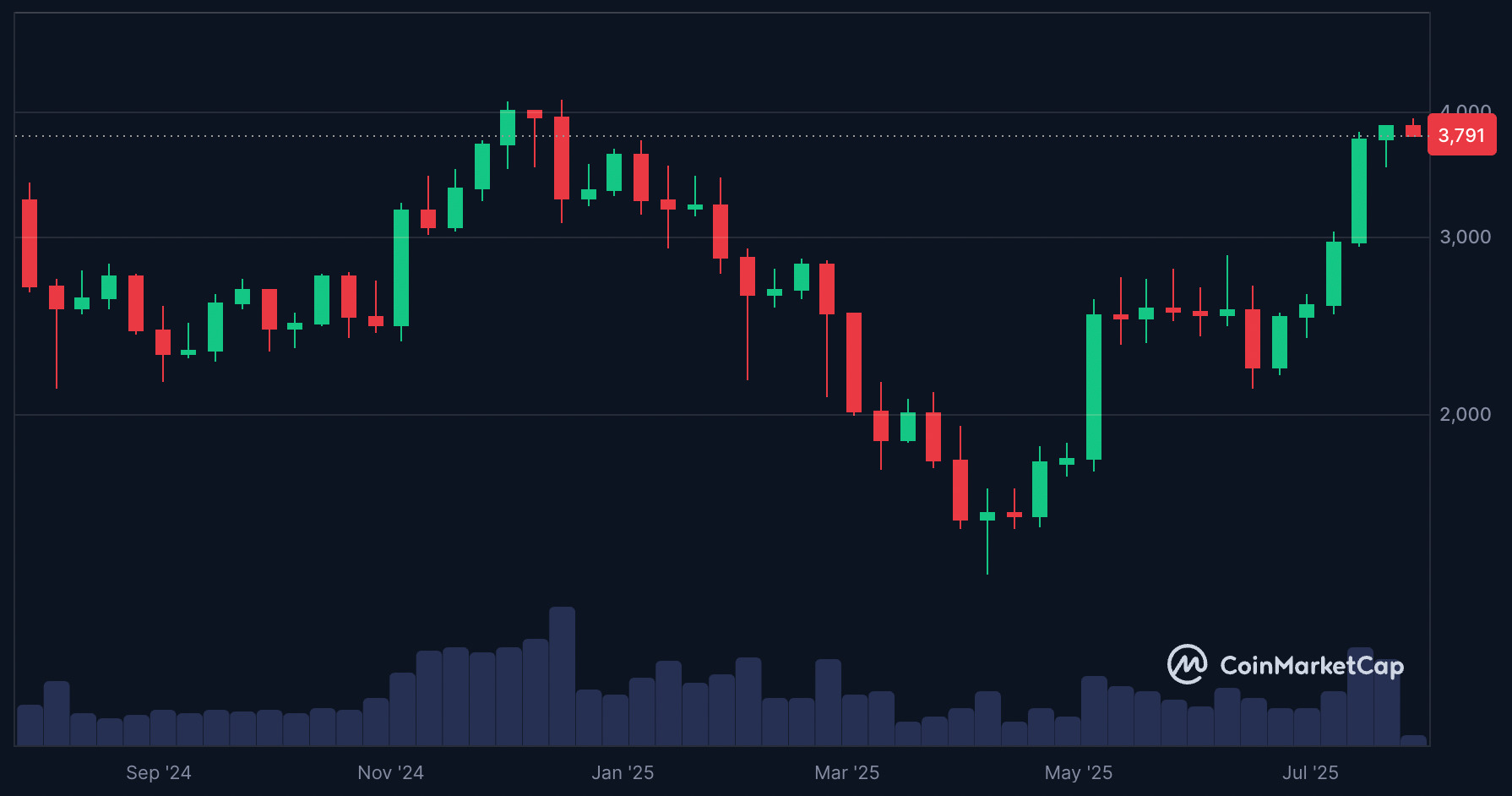

1. ETH’s Surprise Comeback: Why the Ratio Matters More Than the USD Price

What happened: While BTC moved sideways, ETH ripped ~21 % in a single week—its first decisive out‑performance since 2021. The ETH/BTC ratio bounced nearly 2× off its cycle low.

Actionable takeaway

Signal | Why it Matters | What to Do |

|---|---|---|

ETH/BTC > 0.06 weekly close | Confirms ETH leadership &—historically—marks the hand‑off to “large‑cap alt” season. | Rotate 15‑25 % of BTC profits into ETH or ETH‑beta L1 majors (SOL, AVAX) using staggered limit orders. |

ETH gas > 50 gwei for ≥ 3 days | Shows real demand (DeFi, memecoins, NFTs) rather than ETF hype. | Stake/lsETH to earn real yield while you wait; front‑run Layer‑2 airdrops by bridging small test amounts. |

ETH futures basis ≥ +15 % annualized | Leverage is chasing; blow‑off risk rises. | Sell ¼ of new ETH stack into strength; add 30‑day 0.05 downside puts funded by OTM covered calls. |

2. The Exit Blueprint—Because Round‑Tripping Sucks

Once ETH breaks it

s USD all‑time high, sell 5 % of the bag each day until flat.

A more systematic variant:

Pre‑set trailing stops on 40 % of your ETH (e.g., 18 % below ATH).

Automate DCA‑out: 2 % daily into USDC once weekly RSI > 82.

Redirect the proceeds into 6–8‑week T‑Bills (5 %+) so idle cash earns.

3. ETH = Wall Street’s Token, SOL = Silicon Valley’s—Play Both

The new narrative: TradFi treasuries are mothballing ETH; builders & degen retail still prefer Solana.

Theme | Near‑Term Catalyst | How to Position |

|---|---|---|

ETH “neutral settlement layer” | ETH ETF approval volume + corporate treasury buys (Tom Lee target $10 k) | Own ETH, stkETH & L2 governance tokens (OP, ARB) on weakness. |

SOL “decentralised Macau” | Fire‑Dancer testnet + hyper‐liquid memecoin flow | Accumulate SOL on < $160 dips; farm new Sol‑memes early but size small. |

4. Treasury‑Stock Hype: Friend or Future Rug?

MicroStrategy copy‑cats are popping up everywhere. Remember: a premium to NAV is optionality for them, not for you.

Red‑flag checklist before touching any “Treasury Co.”

Premium > 30 %? → Pass.

Locked insiders unlock inside six months? → Pass.

No transparent BTC/ETH custody attestations? → Pass.

Safer angle: Sell covered calls on $MSTR or high‑premium peers; use income to DCA hard spot.

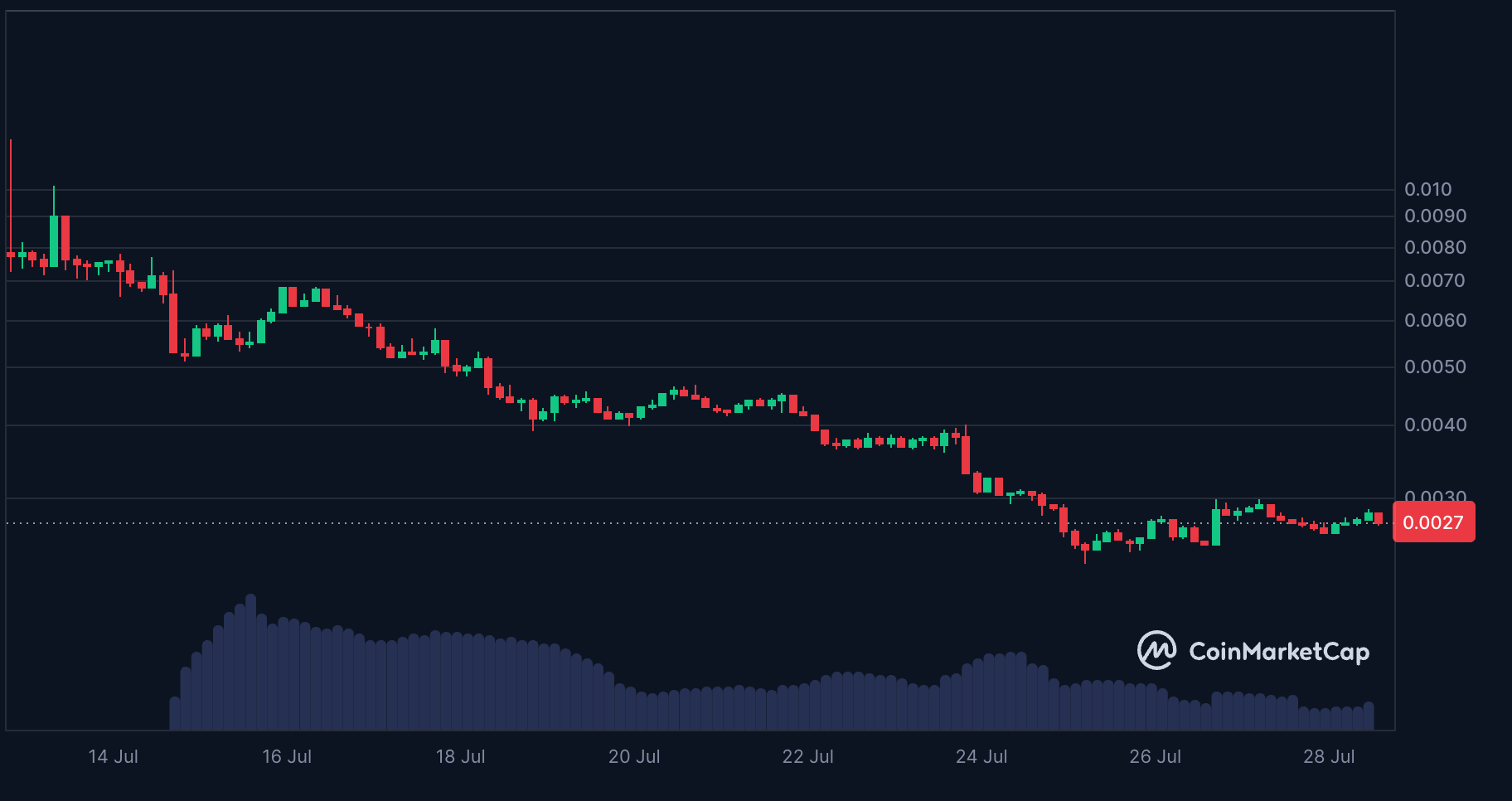

5. Pump.Fun ICO Autopsy—Why Price Dumped & When it Could 2×

Setup: $4 bn raised at $0.04; instant 25 % pop; buybacks started at $0.07 then cooled.

Why it bled back to $0.024

All megachecks got instant liquidity—funds clipped 30‑50 % and de‑risked.

Retail expected a “free 5×”; sold when flat.

Buyback wallet paused = no marginal bid.

How to trade it now

Support appears right bellow ICO price around 0.02 —team can’t let it break lower psychologically so for riskier traders soon could be a good time to LONG.

Track the on‑chain buy‑back wallet: when balance ticks up, front‑run it with tight stops.

Target: first sustained close > $0.040 = path to $0.10 – 0.12 (10 bn FDV) on momentum.

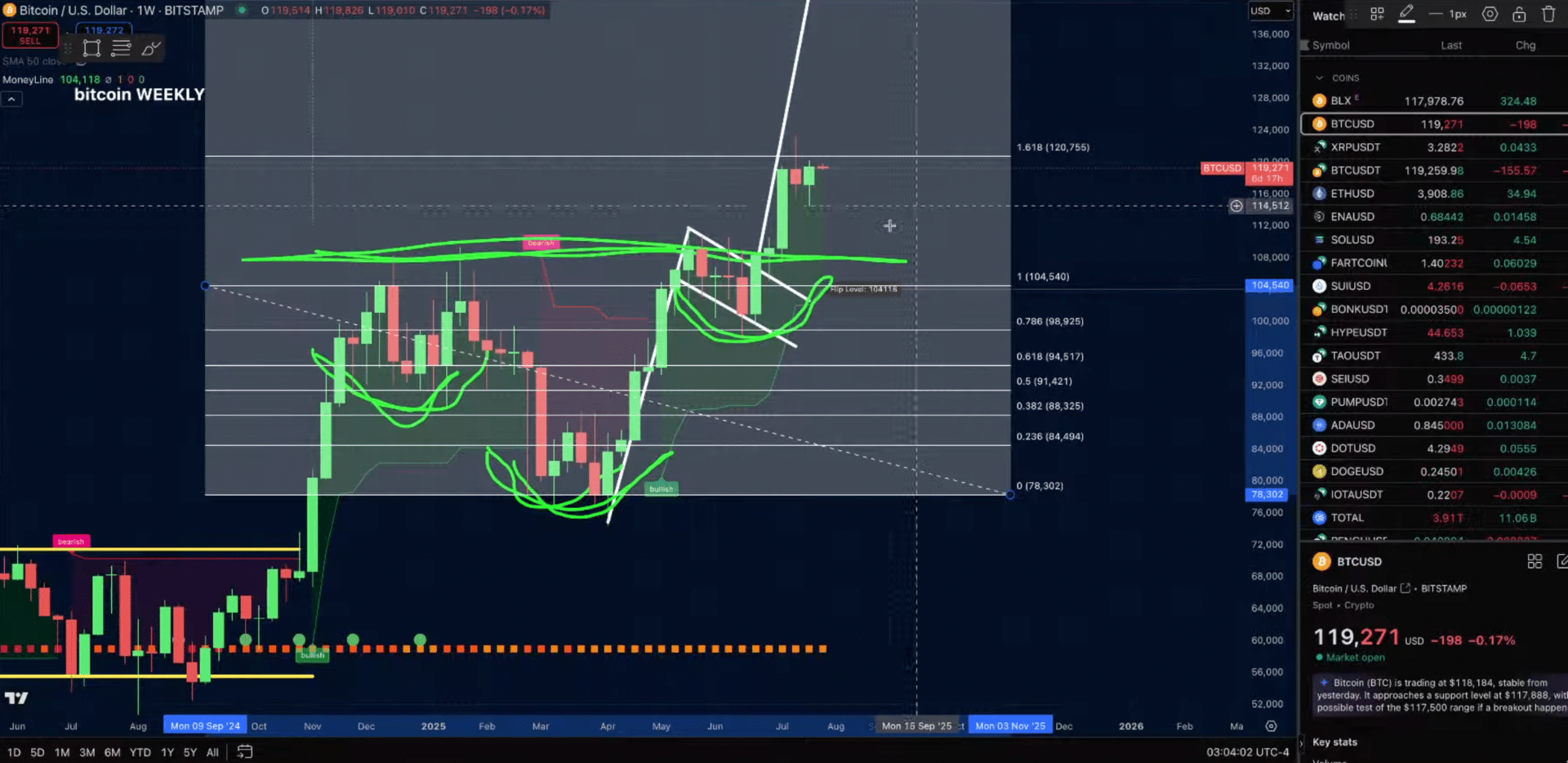

6. Core Bitcoin Stack—Why 25‑40 % in “Boarish” BTC Still Wins

Even the ETH bulls agree: the simplest asymmetric trade today is still holding a non‑trivial BTC core.

Execution tips

Auto‑buy every Friday via strike‑price orders 3 % below spot—catch shake‑outs.

Lend BTC on institutional desks only if collateralized ≥ 120 %, rate ≥ 6 %.

Never pledge the core stack as margin: if you want leverage, use perps separately.

7. Wild‑Card Watchlist

AI‑Backed Stables – tax‑advantaged GPU yields funnelled into on‑chain money markets (early ticker: $FP).

Proof‑of‑Logits Chains – mining blocks by serving AI inference (keep an eye on $Bittensor fork rumours).

Reg‑Lite ETF Jurisdictions – tiny exchanges listing 2× XRP, DOGE or SOL ETFs can front‑run US approval—liquidity bumps follow.

Bottom Line

Momentum, fiscal tail‑winds and raw attention favour higher first, answers later. Rotate methodically (BTC → ETH → large caps), harvest into strength, and—above all—pre‑script exit rules today so euphoria doesn’t write them for you tomorrow.

Want to get the real alpha? Subscribe to our pro newsletter —> here

Reply